AIS and MIS Comparison

- Briefly discuss the difference between AIS and MIS.

MIS and AIS are all computer-based information systems that are very helpful for any organizations to keep records correctly and make the right decision for the operations. They are two different main system is an organization.

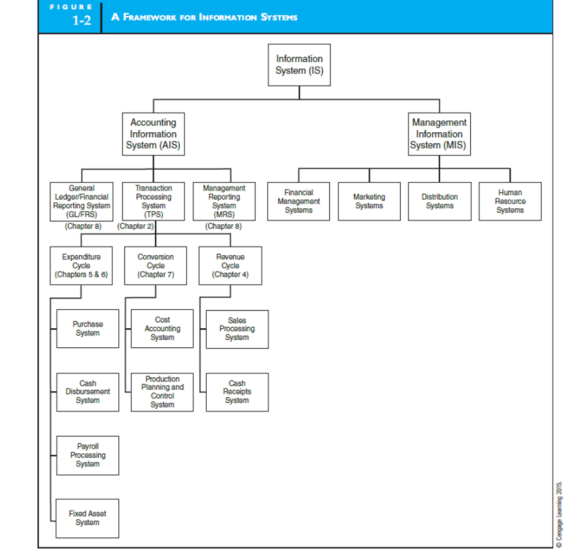

The major difference is AIS and MIS provide diverse information to the organization by different transactions. AIS subsystems processing by financial transactions which are monetary transactions affect assets and equity, shown on the accounts. Whilst it also process nonfinancial transactions that directly affect the processing of financial transactions. (p.7) According to the figure 1-2, those transactions and cycles under AIS are all about economic event convert to financial transactions and expressed as numbers or figures in the accounts. Such as sold inventories, this movement will incur the revenue and equity figures changed on accounts. These kinds of changes will also affect the GL and MRS to provide information timely changed. In another hand if the customer account detail changed which is nonfinancial transaction processed by AIS,

The MIS processes nonfinancial transactions that are not normally processed by traditional AIS. (p.7)Â the organization normally has many departments such as production planning, inventory warehouse planning, market research, and so on. MIS is to help those different areas operate normally and provide information for further decision making.

Another important difference is AIS and MIS provide information to different parties. AIS are not only providing the information for internal users but also for the external users such as suppliers, customers and auditors and so on. Especially for the auditors, AIS is help to provide correctly and legally information. MIS is mainly providing information to internal users such as the management team of the organization.

In conclusion, AIS and MIS provide different information through different transactions to different parties. But there are also connections between AIS and MIS. AIS also provide the financial information to the MIS. Some movement in MIS is also affecting AIS. AIS and MIS are all important system to any organization.

- Briefly discuss the characteristics of information in the context of accounting information system.

Information is can be defined as processed data and can help user to take further actions or make further decisions. (p.10). The characteristics of information in AIS include relevance, timeliness, accuracy, completeness, and summarization. (p.12)

Relevance means relevant information for a specific purpose of the task or help manager to do further decision. For example, the main purpose of an invoice is let customer pay the right amount and know what they bought. Therefore the invoice shows the amount that customer should pay, and also shows the product name, code which customer bought.

Timeliness means provide timely information. For instance, if a statement shows pay it within 15 days will get a 2% discount, if they receive this statement and information within 15 days, that will be useful, otherwise will lose the value of this information.

Accuracy means avoid to provide information with major errors. For example, if a balance sheet shows the total asset is $100000, but the actual amount should be $90000, this error may cause the user make poor decisions. It could be cause by a data errors or process error. Sometimes, we have to give up the absolutely accurate to provide timely information, therefore system designer need make balance between accuracy and timeliness.

Completeness means should include all the essential information for decision making or daily tasks. For example, an income statement should include the calculation of the profit or loss, and must be clearly showing the figures.

Summarization means the information should summarized as the user needs. As the higher management, the more summarized information is needed.

Others, the independent of the information which means the accounting activities must be separated and independent from physical resources management and preservation.

In conclusion, relevance, timeliness, accuracy, completeness, and summarization are very important to obtain reliable information to the user. Reliability can determine the value of the information. (p.16) If follow those characteristic, information will be reliable and provides maximum value to the user.

- When developing, or selecting an accounting system, identify who should be involved and the contribution that they bring to the process.

Organizations usually get the accounting system through two ways, self-developing and purchase or rent commercial software. To develop or selecting an accounting system, we need someone who understand accounting knowledge which is accountant, and someone who understand the database and network which is IT professionals. Accountant and IT professionals are all plays very important roles. But they have different contributions bring to the process.

Accountant as a domain expert is a very vital role. They provide professional accounting concept and frame to the system. Such as set accounting process rules, reporting requirements, and build the internal control goals. (p.20) For example, different customers have different payment terms, sales department or credit department for some business need the delinquent accounts information from the AR department. This information will help the sales or credit department make a further decision to hold the sales of the customer or not. Accountant need set the standard to identify delinquent customer account in this case. They may set a credit amount for every customer and the system might show a message once over the amount or hold the accounts until they pay off. “Accountant need determine the nature of the required information, its source, destination and the need of accounting rules.”(p.20)

Accountant as a system auditor is also an important role for developing or selecting the accounting system. Some public accounting firm can give advisory service of “information system design and implementation, and internal control assessments for compliance with SOX.” (p.21) although the accounting firm could use their auditor concepts for the advisory service, they could not be the real auditor to the company, it is no value to the organization and it is illegal under SOX legislation.

IT professionals are responsible for the establishment of actual physical system. The physical system includes the database and programming for calculate and present information. IT professionals need ensure to build the accounting system work efficiently. They also play an important role for the test and maintenance of the accounting system. Once the system is selected or development is completed, they will need doing test and if any errors they need fixed the errors. System requires constant maintenance and repair to ensure the accuracy of information.

Accountant and IT professionals need work together when developing or selecting an accounting system. They are all essential.

- Define fraud and identify and discuss three different examples to illustrate how it may arise in the workplace. In each case illustrate a strategy that may be used to mitigate its impact or occurrence.

- Briefly explain the COSO internal control framework.

The COSO internal control framework is issued by Committee of Sponsoring Organizations of the Treadway Commission. (p.116)Â It is recommended by SEC1, also is the general framework of internal control evaluation standard. The COSO framework defines internal control is affected by corporate board of directors, management and other personnel, in order to achieve operational effectiveness and efficiency, financial report reliability, the compliance of the relevant regulations and other objectives to provide a reasonable guarantee process.

We can explain it from 5 different aspects, the control environment, risk assessment, information and communication, monitoring, and control activities. (p.116)

Control environment is the fundamental key of the organization, it directly affect the control consciousness of the staffs. It include the integrity of the staff, professional ethics and organization structure; management of the business philosophy and management style; board of directors or the audit committee of the supervision and guidance; the allocation of authority and responsibility; the methods of performance evaluation and human resources policy. (p.116)It can be said that people and their activities are the core of enterprise, is the important factor of internal control environment, it interacts with environment.

Risk assessment is to identify and analyze the relevant risks to achieve the established goals; it is the basis of risk management. Each enterprise is faced with a lot of internal and external risks, affecting the realization of business goals, such as the changes of the operating environment, new staffs, the use of new system or new technology, new product introduction, entre into a foreign market or practice of new accounting rules and so on. It is necessary to identify, analyze and manage those risks that affect the achievement of the target and manage them in timely manner. (p.118)

Information and communication means that the information needed for business management must be identified, obtained and delivered in a certain form in a timely manner so that the employee can perform their duties. The accounting information includes not only internally generated information, but also external information related to business decision making and external reporting. It is important for an accounting information system whether the information is processed timely and accurately. The auditor needs to understand the transactions, accounting record, transaction processing steps, financial reporting process. (p. 118)

Monitoring is the process of assessing the effectiveness of the internal control system, through continuous monitoring, independent assessment or a combination of the two to achieve the internal control system supervision.

Internal control activities refer to policies and procedures that facilitate the smooth implementation of management decision-making. It includes information technology (IT) controls and physical controls. IT controls is rated to computer environment, it has two aspects, general control such as the control of database and network security and so on, and application control such as the control of accounts payable, and payroll applications and so on. Another aspect is physical control, which are human activities.

It includes “transaction authorization, segregation of duties, supervision, accounting records, access control, and independent verification.” (p.119)

COSO internal control framework is a relatively complete and systematic theory of internal control, and it put forward a lot of valuable ideas, constantly found the practical significance in practice.