Analysis of Rio Tinto Mining Company

Â

- Industry: Rio Tinto

“Rio Tinto is a leading global mining company that focuses on finding, mining, processing and marketing the Earth’s mineral resources” [1]. Its mining operation operates globally ranging from Copper assets in America, coal in South Africa to Iron in Australia. Its current revenue in GBP sits at £27.22bn operating at a net income of £3.72bn. Year on year Rio Tinto grew net income at 433%. Since January 2016 share prices have risen from £1700, to £3600, as the mining sector has exploded. It’s no great surprise, with the costs of iron ores rising, the manufacturing sector exploding, and the demand for commodities having gone through the roof.

Its main competitors are also mining companies; Anglo American plc, Glencore PLC and BHP to name a few. They have followed similar trends to Rio Tinto and have seen their share prices soar in the most recent months. Table 1.0 shows the comparison in debt and equity between the four companies.

Its main competitors are also mining companies; Anglo American plc, Glencore PLC and BHP to name a few. They have followed similar trends to Rio Tinto and have seen their share prices soar in the most recent months. Table 1.0 shows the comparison in debt and equity between the four companies.

|

2015 |

Debt (mil USD) |

Equity (mil USD) |

|

RIO:LSE |

23,300 |

37,349 |

|

AAL:LSE |

17,967 |

16,569 |

|

GLEN:LSE |

48,980 |

41,254 |

|

BLT:LSE |

31,170 |

64,768 |

In 2016 Rio Tinto has managed to cut its debt to $18,372mil and grew its equity to $39,290mi.

2)

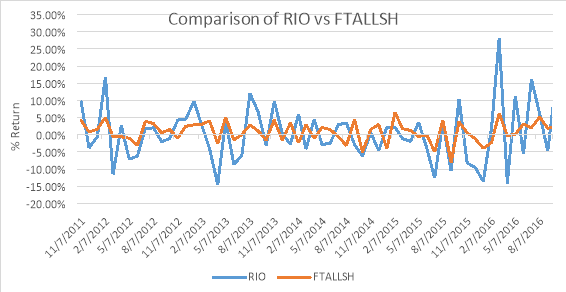

By just looking at figure 2.2 we can determine how volatile the RIO share price has been especially since the winter of 2015. It seems every other month (since Nov 15), has either been strongly positive or strongly negative. Before these months, the share price followed a similar trend to that of the FTALLSH with a few exceptions (early 2013).

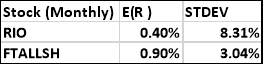

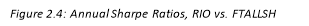

The overall monthly mean return sits at 0.4%, 0.5% lower than the average mean return of FTALLSH. The standard deviation (risk) is also considerably higher at 8.31% (compared to 3.04% – FTALLSH). As an investor, I would want my average return to be higher as the risk became higher. In this instance, this is not the case. FTALLSH has a higher return but a much lower risk, and as an investor, this would be my preferred choice. We must take into account that if as an investor we took a long position with RIO at JAN 16, our share value has doubled.

The overall monthly mean return sits at 0.4%, 0.5% lower than the average mean return of FTALLSH. The standard deviation (risk) is also considerably higher at 8.31% (compared to 3.04% – FTALLSH). As an investor, I would want my average return to be higher as the risk became higher. In this instance, this is not the case. FTALLSH has a higher return but a much lower risk, and as an investor, this would be my preferred choice. We must take into account that if as an investor we took a long position with RIO at JAN 16, our share value has doubled.

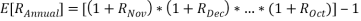

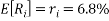

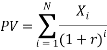

Annual mean return data is calculated by:

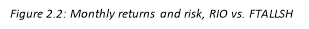

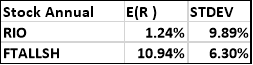

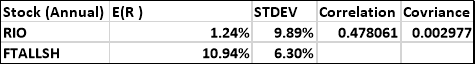

When looking at annual data (October of each year), we can see the mean return has significantly increased on both the FTALLSH and the RIO.

When looking at annual data (October of each year), we can see the mean return has significantly increased on both the FTALLSH and the RIO.

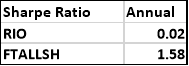

The slope of the line through a portfolio is given by the Sharpe ratio (figure 2.4). The risk free interest rate per annum is 1%. FTALLSH has higher annual returns than the risk free interest rate, but RIO has much lower returns. As an investor, you want better returns for higher risk. If the return is less than that of a risk free investment, the investment in RIO is not worth undertaking.

3)

3)

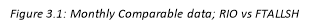

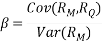

Correlation measures the degree in which two markets move in relation with each other. The correlation value ranges from -1 to +1. If the correlation is 0, the markets do not move in relation at all. Both the annual and monthly data has a mediocre correlation against the FTALLSH. This is probably mainly affected by the last 6 month’s data shown in figure 2.1, with how volatile the RIO market has been. Covariance is also measured by how changes in one market are associated with changes in the other market. It doesn’t really give the strength of the relationship between the two markets as well as correlation does. This is why it isn’t used to determine the relationship but it is vital in finding the Beta of the portfolio.

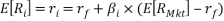

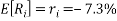

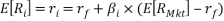

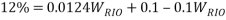

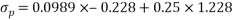

Expected return =

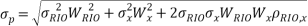

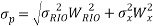

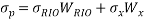

Volatility =

Annual,

Monthly,

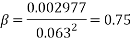

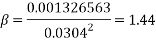

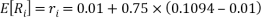

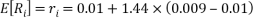

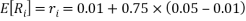

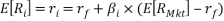

Annually, the Beta of the RIO market vs the FTALLSH, is 0.75, to be expected, as the correlation is mediocre, and the mean return is also high. The Beta of the market should be exactly 1. Therefore, the asset is defensive. The expected excess return is linked to its risk. As the market has a Beta of 1, and the Beta of RIO is .75, the RIO beta is 25% less volatile. Monthly, the beta is above 1 and is 44% more volatile. If the market rises or falls by £1, the RIO return will rise or fall by £1.44.

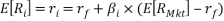

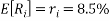

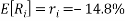

The Capital Asset Pricing Model allows the investor to identify the best portfolio of risky assets without knowing the expected return on each of securities [3]. The CAPM equation (annual return) implies a positive result. As the annual return suggested by the CAPM is only 8.5%, and the annual return computed for RIO is 1.24%, the market is under-performing, and investors are being under-compensated for bearing the market risk. Monthly return is slightly positive.

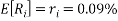

As the monthly return for RIO is 0.40%, and the monthly CAPM is 0.09%, Rio is outperforming the return suggested by the CAPM. Therefore, investors are being over-compensated for bearing the market-risk. The CAPM also implies that the annual return has a higher risk but worse return, and the monthly return has a lower risk but higher return [6].

Limitations

- Monthly risk free rate will not be exactly 1% every single month

- Return on the market. The market return at any given time can be negative.

- CAPM is a backwards looking model. Anything can happen (environmentally, politically, etc.) that can change the market

- FTALLSH is a limitation and is not the true market portfolio.

Annually

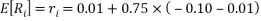

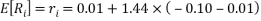

Beta = 0.75. If the market rose by 5%, the return would rise by

If the market fell by 10%

Monthly

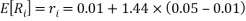

Beta = 1.44. If the market rose by 5%, the return would rise by

If the market fell by 10%

The monthly return has higher chance of greater returns, (the Beta is higher), however it also has a higher chance of bigger losses. If the markets rose by 5%, annually the investor would make a 4% return, vs 6.8% return on monthly data.

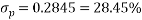

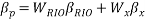

Annual Return

This means short selling RIO Tinto’s share’s, and buying excess shares of market x.

If the portfolio returns are uncorrelated, this gives a correlation of 0.

As we know ÃÂ = 0, the equation becomes

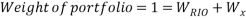

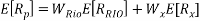

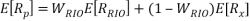

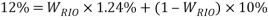

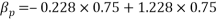

Working out the portfolio’s Beta

4) CAPM Return = 8.5%

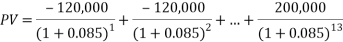

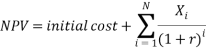

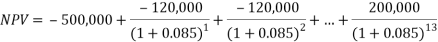

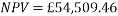

To work out the PV of the project the company is considering, the discount factor is needed to be known. Assuming the company’s required rate of return is given by the expected return on its equity, i.e. the CAPM return. As the CAPM equation has computed the expected returns, this is therefore the discount rate.

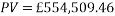

The present value is worth more than the initial value of £554,509.46>£500,000 so it’s a good deal for the company. This project could be set up for a multitude of reasons, which may affect its market’s price in a positive way, such as new jobs for a local area, which in turn will boost the company politically which may also contribute to the success of the company. It is also important to note that even though the present value of the cost of this project is better than the contract being offered, RIO Tinto won’t be positive in net return until the 9th year.

The NPV is positive as expected, so the benefits outweigh the costs [3].

If the company wanted to just make cash money on £500,000 they could just invest (risk-free) receiving, £569,046 in 13 years’ time.

5)

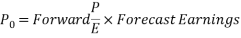

The method of comparables, values a firm’s cash flows directly, based on other firms (usually in a similar industry), that have similar cash flows or are expected to generate similar cash flows. The Law of One Price states that, “If equivalent investment opportunities trade simultaneously in different competitive markets, then they must trade for the same price in both markets” [3]. Using the Law of One Price we can use a company to measure (estimate) the valuation of a very similar company. As everyone knows, identical companies do not exist, but companies such as RIO, can have very similar competitors that prices can be judged by.

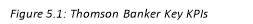

The price/earnings ratio (share price / earnings per share), is the most commonly used ratio to measure the company’s valuation. The more comparables there are, the better the reduced influence of any given company, making the overall result more trustworthy. When choosing the correct comparables to match against RIO, they all should have similar growth rates, similar required rate of returns and similar retention of earnings. I have chosen the three other mining companies, (Anglo American plc, Glencore plc, BHP) to compare against RIO. To value a company’s current price using multiples:

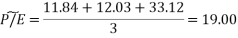

Using three other similar mining companies, to work out an average forward P/E ratio.

According to Thomson Banker [9], the average P/E ratio of the three other companies (19.00) is much higher than the actual 10.98 RIO value (+73.04%). The Last Price Close of RIO on the 20/02/2017 was 36.46. The value we calculated is much higher than the actual value. Therefore, we have overvalued the share price, and should be bought. The P/E multiple is high for companies that have higher growth rates. The current P/E ratios are high across the board, with AAL, the only company estimating to grow its P/E next year. All three others are expecting to stop growing, with BHP (BLT), to step back massively.

The companies compared above, are all mining companies, having spectacular performance in the markets, but realistically quite different. From figure 1.1, we know the difference in Equity and Debt values are similar, but RIO has much higher earnings per share (2.84), than any of the other three companies. Other than the Forward P/E ratio, RIO has the best values for all the metrics. We know that when we average the other three companies out, that the multiples based analysis will generally undervalue RIO. The differences are due to differences in expected risk, growth rate, etc. Multiples based valuation should ignore major anomalies, (e.g. GLEN’s 33.12 forward P/E ratio. Using the two other ratios gives an average of 11.98 which is much closer to the actual value of RIO). The set of comparables that were chosen (bar AAL), were not the best choice to match against RIO, as many of the metrics were so far apart.

Q6)

Arbitrage opportunities occur when a company’s price across two markets is different, and will always have a positive Net Present Value. An investor, (who is known to be greedy and want any possible risk free return), will immediately attempt to buy the lower priced share on one market, and sell the same share on the higher priced market, instantly making him/her a no risk return. Everyone will attempt to trade using this method quickly, therefore, the lower priced market will rise and the higher priced market will fall, both eventually ending up at the same price. All markets aim to have an absence of arbitrage to stop any greedy investors from exploiting risk free returns.

“If equivalent investment opportunities trade simultaneously in different competitive markets, then they must trade for the same price in both markets” [3]. If the Law of One Price is being applied correctly, there will be in absence of arbitrage across all markets. Bond Prices and interest rates also need to follow the Law of One Price. If a bond of a certain market gave a higher return than the risk free rate, they both need to follow the Law of One Price. The risk-free interest rate must equal the return from the investment of the risk-free bond.

American Depository Receipts are quick and easy ways for investors in the US, to trade with foreign companies [10]. US banks will buy foreign shares and reissue them on US markets. However, each share does not equal the same amount as the original market. US banks will often group shares together, and reissue them separately on their markets. ADR’s exist because foreign companies don’t want the expense or hassle of listing their stocks on the foreign to them US market [10]. To invest in an ADR, brokers will need to buy foreign shares of said company, on their respective markets. He/she will then deliver these shares to a Custodian bank. Another bank, the Depositary bank issues receipts, on the basis those shares held by Custodian banks. Those receipts can then be traded freely across US markets, with payments, dividends etc., being paid in US dollars. ADRs save money by reducing foreign taxes and administration costs, and also because they give the company’ exposure.

There are many risks involved with ADRs. Like normal market shares, there are political risks, inflationary risks etc. However, with ADRs, there are exchange rate risks. Using Tesco as the example [8], as the exchange rate of USD: GBP continues to improve for the US market, many investors will be looking to buy into British companies as it’s cheaper for them to do so. As the British and US markets trade at different hours, the closing prices of the Tesco share will be different, but in the normal market, the price of Tesco will be the same across all of the three different exchanges, (the Law of One Price), relative to that of their respective growth rates.

Every Tesco ADR share represents 3 normal shares [8]. The current value of Tesco’s is 189.77p, and the value of its ADR = $7.19 [7]. If we divide the ADR value by 3.

Using the current exchange rate of £1 = $1.25512 [4]

£1.91 is slightly higher than the actual value of Tesco (£1.90), but this is not taking into consideration the costs of administration, and exchange fees. The above is showing how the Law of One Price is applied across two different markets.

Bibliography

[1] FT. (2017) Rio Tinto PLC, RIO: LSE summary – FT.com. Available at: https://markets.ft.com/data/equities/tearsheet/summary?s=RIO:LSE (Accessed: 24 February 2017).

[2] About us (2017) Available at: http://www.riotinto.com/about-us-108.aspx (Accessed: 24 February 2017).

[3] Berk, J. and DeMarzo, P. (2013) Corporate finance. 3rd edn. Harlow: Pearson/Education.

[4] GBP – British pound (no date) Available at: http://www.xe.com/currencyconverter/convert/?From=GBP&To=USD (Accessed: 24 February 2017).

[5] MINING (2011) Market data – metal prices and world mining markets. Available at: http://www.mining.com/market-data/ (Accessed: 24 February 2017).

[6] Payne, R. (no date) Foundations of Finance. Available at: http://moodle.city.ac.uk/course/view.php?id=22726#section-0 (Accessed: 24 February 2017).

[7] Tesco PLC (ADR): OTCMKTS: TSCDY quotes & news – Google finance (2017) Available at: https://www.google.co.uk/finance?cid=664658 (Accessed: 24 February 2017).

[8] Tescoplc (2016) ADR information. Available at: https://www.tescoplc.com/investors/shareholder-centre/adr-information/ (Accessed: 24 February 2017).

[9] Thomson ONE banker (no date) Available at: http://banker.thomsonib.com (Accessed: 24 February 2017).

[10] Staff, I. (2003) ‘American depositary receipt – ADR’, in Available at: http://www.investopedia.com/terms/a/adr.asp (Accessed: 24 February 2017).