Capital Market Union: Do We Need One?

Â

- Introduction

Capital market integration is not a new topic in the EU. It became however pressing again after the international financial crisis, that exposed the limits of European firms’ overreliance on banks.            ÂÂ

The Juncker Commission made CMU one of its flagships initiatives, aiming at reducing national fragmentation and barriers in order to create a better environment for firms financing.            ÂÂ

While such a decision can be easily understood from a single-market perspective of analysis, the proposed and implemented reforms in order to establish such a unified market do not tackle deep structural differences at the national level, while also avoiding the strengthening of a central supervisor, undermining the efforts of harmonisation.

- What is CMU?

The idea of a European Capital Market Union (thereafter CMU) was presented on 15 July 2014 by the soon to be President of the European Commission – Jean-Claude Juncker – addressing the European Parliament, subsequently inserted in the Commission’s priorities through the establishment of a new Directorate-General for Financial Stability, Financial Services and Capital Market Union.            ÂÂ

As repeatedly stressed by Juncker, the top priority of his presidency is to strengthen Europe’s economy and stimulate investment to create jobs, favouring a deepening of capital market integration and a reduction of the current fragmentation between national borders. In the words of former Commissioner Hill, the CMU is about “linking savings to growth in Europe”,

Capital market union is not a novelty in the integration debate: the free flow of capital is indeed one of the fundamental principles (the so-called four freedoms) on which European integration is based since the treaty of Rome (art. 63 TFUE).            ÂÂ

In the 1980s a first wave of integration dealt with harmonisation of public offering and listing particulars. In 1993 the Investment Service Directive (ISD) was agreed.            ÂÂ

In the wake of the EMU a new wave of harmonising measures was proposed under the aegis of the Financial Services Action Plan (FSAP), with the ambition to increase growth and reduce funding costs. The centrepiece was the 2004 Markets in Financial Instruments Directive (MiFID), but it also contained measures regulating disclosure and market manipulation.

Notwithstanding years of harmonising regulation and a common currency for most EU member states, capital market is still fragmented, integration often rests on a vertical base, few EU-wide structures have emerged in the last decade and the most powerful intermediaries are often of US parentage. Europe has struggled for decades to create a decent capital market, heavily relying on bank financing, and the financial crisis has retrenched and re-fragmented the landscape.

A capital market channels money provided by investors and banks to borrowers through a variety of instruments, called securities. A central problem in the development of such a market is the information asymmetry between issuers and investors.            ÂÂ

As noted in Black (2000), both governmental bodies and self-regulatory organizations and reputational intermediaries play a role in guaranteeing the enforcement of transparency of information and correct price formation. Formal rules are only the beginning: the real challenge is the direct and indirect enforcement of new legislation.

- Rationale for CMU

The proposal for CMU can be analysed through different lenses, justifying its rationale.

First and foremost, the allocation of resources in the actual structure of the EU is over-relying on bank loans. While retail banks have a better knowledge of local situation, often providing more information to investors and borrowers, bank funding is not always the most efficient way for dynamic and highly growing enterprise to fund themselves. Moreover, due to the increased capital requirement for banks after the financial crisis and the difficulties encountered by some banks regarding their balance-sheets and the bias over sovereign bonds of their home country, financing opportunities have decreased.

National fragmentation and the bias for national portfolios reduce the opportunities for cross-border funding, complicating the way investors and borrowers can meet their needs.

Finally – especially valuable for the Eurozone – enhanced financial integration act as a private risk-sharing mechanism, spreading the risk inherent in investment on a cross-national field, thus reducing the risk of asymmetric shocks in the area and fostering the resilience of the block. This consideration is even more important considering the lack of political will to establish a public shock absorption mechanism – as for instance proposed in the Five President Report (Juncker, Tusk, Dijsselbloem, Draghi, & Schulz, 2015).             ÂÂ

Moreover, numerous forms of financing and better allocation of resources within the Eurozone foster the transmission channel of monetary policy, enhancing the ability of the ECB to meet its targets (ECB 2012).

- European and US capital markets

The natural benchmark for capital markets is the US. Comparisons can be made at the EU level, but once we consider the country specificity we have an even more complex landscape. In fact big differences remain between national markets, mostly of a structural nature.

When the CMU action plan was presented, although US and EU economies have roughly the same size, US venture capital market is five times EU’s one and US equity markets are twice the EU ones in term of capitalization.

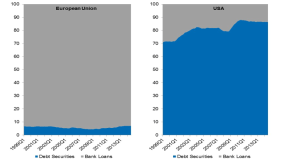

Europe has a universal banking landscape with large banks covering commercial and investment activities. While in the US 80% of corporate debt financing depends on capital markets, in the EU 90% depends on bank financing. Such dependence made the European economy vulnerable when banking conditions tightened in a number of member States during and following the international financial crisis.

Moreover, the financial crisis had a considerable negative impact on securitization issuance in Europe, dropping from 594 billion euro at the end of 2007 to 216 billion in 2014 (on the rise since 2011). Finally, international capital requirement and EU banking regulation changes during the crisis impacted bank lending.

- Variation within Europe

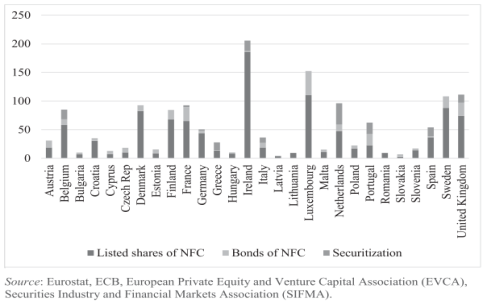

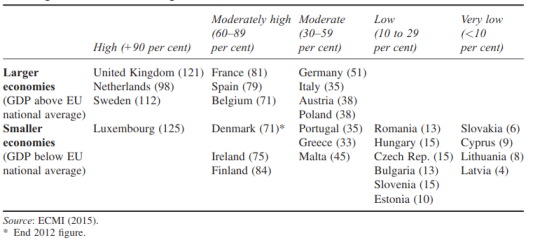

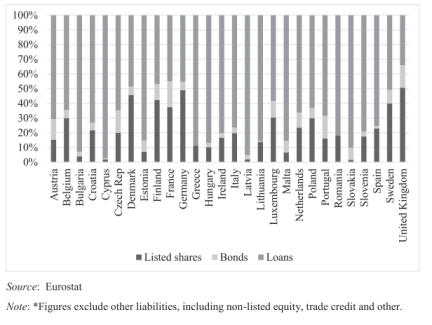

Other than having a different system to the one of the US on aggregate, within the EU there is also great variation on the depth and development of capital markets nationally.

Only 9 Member states have non-banking financial intermediation above 50% of GDP. Divergence can be seen also in the stock market capitalization of different member states as a percentage of GDP.

Moreover, also the access to firms and individuals differ considerably among member states. Non-financial company reliance on equity issuance exceeded reliance on bank credit in only the UK and Denmark. Reliance on both equity and debt issuance exceeded reliance on bank credit in external company finance in only UK, Denmark, Finland, France, and Germany (European Commission, 2015a).

- Obstacles and barriers in the European Union landscape

In the EU there are actually 28 different codes of tax, company and insolvency law that transnational investors have to deal with, blocking the smooth flow of capital between member states.            ÂÂ

Taking the example of bankruptcy law, different traditions and level of protections for investors are in place in member states. As Jey Westbrook, emeritus director of the International Insolvency Institute highlighted, “The Brits have always had a more sympathetic idea to saving a debtor in trouble,” Westbrook said. “The Germans have had a much stricter view: There remains a big bias in favour of the idea that ‘the management of this company screwed up, they’re losers, they probably did something fraudulent, the company should be bankrupt and pay the creditors as best they can, and the management should go join a monastery,’ so to speak. And then you have French law, which is somewhere in between but has much more emphasis on protecting employees and protecting jobs.”.

The creation of truly European-wide securities moreover runs into the quest for harmonisation. Creating a security for home-mortgages, for example, requires that repossession laws in member states is to a certain degree homogeneous, same as the length of time spent in court to enforce a contract. Data from the World Bank doing Business indicators show that litigation in court in countries like Italy and Greece can take up to three times the time spent in court in the Netherlands or Sweden. Banks normally bundle securities together into homogeneous groups (in our case Dutch mortgages packed together and Greek ones in a different securities). Moving to a single market for capital would require further harmonisation in national law in order to overcome national bias.

- Juncker CMU action plan

After the publication of a Green paper in February 2015 and a public consultation to gather expert opinions, on 30 September 2015, the Commission adopted an action plan setting out a list of key measures to achieve a true single market for capital in Europe. It is supposed to be fully in place by 2019.            ÂÂ

As the plan reads “there is no single measure that will deliver a Capital Market Union”, meaning that a set of initiatives will be undertook in the short to medium run to facilitate the flow of capital, with the aim of reducing barriers between national borders. The process will take years, so it has not to be seen as a cyclical patch for relaunching growth in a stagnating post-crisis EU, but as a structural reform on the way credit is allocated throughout the continent.            ÂÂ

As outlined in the Green Paper the Commission supports market driven solutions when they are likely to be effective, and regulatory changes only where necessary (European Commission 2015a).

Other than the action plan on CMU the commission also presented two directives on securitization: the first building blocks of CMU.

The concrete outcome consists mainly of few technical proposals and amendments. First, changes to the prospectus Directive are proposed in order to facilitate SME financing, limiting the burden that these companies have to take in order to enter capital markets.             ÂÂ

Secondly, it recognizes the need to facilitate infrastructure financing and securitization through changes in the solvency II Directive and the capital requirement Regulation.            ÂÂ

SME financing is a focal point of the plan given the importance of those enterprises in creating jobs in Europe.            ÂÂ

The Commission plan aims at:

- Financing for innovation, start-ups and non-listed companies

- Making it easier for companies to enter and raise capital on public markets

- Investing for long-term, infrastructure and sustainable investment

- Fostering retail and institutional investment

- Leveraging banking capacity to support the wider economy

- Facilitating cross-border investing

These broad goals are not fully operationalised and from the text there seems to be some inconsistencies. While the proposed approach is bottom-up, removing barriers when encountered, the Commission action aims at harmonising practices while possibly (as stated in the 5 Presidents Report) central supervision.

- What has been done until now

- In December 2016 the Council has agreed on the revision of EuVECA and EuSEF making it easier for investors to diversify funding sources.

- Prospectus directive has been amended in December 2016 and now awaits implementation (capital rising up to 1 million euro will not need a prospectus; EU prospectus only required for risings over 8 million; new EU growth prospectus for facilitating cross-border money rising; ESMA will maintain a European online prospectus database; prospectus will be shorter and less costly to produce).

- Amendments to Solvency II legislation regarding infrastructure projects took effects in April 2016, concerning the calculation of regulatory capital requirements for several categories of assets held by insurance and reinsurance undertakings.

- No legislative steps yet.

- Proposal on simple, transparent and standardised (STS) securitisations and revision of the capital calibrations for banks.

- Structural Reform Support Programme within the Commission to spread best-practice and suggest reforms to member states. No other legislative procedures already enacted.

- Critical analysis

While aiming at promoting investments in Europe, Giovannini et al. (2015) argue that it is not clear what are the causes of low investments in Europe, whether it depends on fragmented financial systems or if it is due to a low demand for capital. This means that the presumed effect of the CMU cannot be yet fully quantified.

In order to strengthen cross-border transaction one of the most pressing issue is to improve the quality of information flow in order to establish market mechanism. This would require actions to increase the quality and harmonization of company data across Europe, including accounting standards, credit information and ownership.

Considering the legislative outcomes so far, the CMU project has relied mainly on technical adjustments on existing legislation, creating new layers in order to arrive at a European-wide rulebook. The reformed prospectus directive, combined with the agreement of banks all over the continent to give feedbacks to firms in the case funds are not granted is a positive step forward. SMEs, having feedbacks on the best way to raise money will now be able to more easily access capital market due to the more limited fixed costs related to it.

The STS securitization regulation includes a list of 55 criteria that a securitization should comply with in order to qualify for the STS label. These criteria aim at mitigating the risks arising from the process of securitization itself, allowing the investors to focus their assessment on the credit of the underlying assets.             ÂÂ

A major critical point however is that such a regulation without a proper enforcement mechanism is deemed to be at best suboptimal. National supervisors will be tasked to control the respect of these standards and sanction non-compliance, undermining the role of these assets in being really European, and creating possible conflicts due to different applications of standards between national regulators.

- Conclusion and final remarks

The CMU action plan do not promise to eliminate the deep structural barriers that stands in the way of fully integrated capital markets. Moreover, much of the CMU’s success depends on whether financing instruments represent free choices by SMEs or whether they are mainly dependent on the domestic market structure. In the latter case reform of the regulatory framework without harmonisation of national legislation will not guarantee enhanced financing opportunities for enterprises, jeopardizing the success of CMU itself.            ÂÂ

If the deep structural barriers that prevent cross-border integration of capital markets are not tackled, financial centres that are already at a competitive advantage will be in a good position to increase their market share.

On a side note, the effect of Brexit has a huge weight in the future of CMU, being London the most important financial hub in the continent. Brexit offers however also the opportunity to revise the governance system of the CMU, proposing the stepping up of ESMA competencies in supervising European instruments. The UK was against further centralisation of competencies at the EU level, but now such a possibility should be taken into consideration, in order to strengthen the common supervision same as happened within the framework of the Banking union.

- Reference:

Black, B. S. (2000) The Core Institutions that Support Strong Securities Markets. Business Lawyer, 55, 1565-1607.

Commain, S., (2016) ‘The securitisation regulation’: missing the target?. CEPOB, 16/16

Demary, M., Hornik, J., Watfe, G. (2016) SME financing in the EU: moving beyond the one-size-fits-all. Bruges European Economic Policy Briefings, 40/2016.

ECB (European Central Bank) (2012) Financial Integration Report (Frankfurt: ECB).

European Commission (2015a) ‘Green Paper: Building a Capital Markets Union’, COM(2015) 63 ï¬Ânal.

European Commission (2015b) ‘Action Plan on Building a Capital Market Union’, COM(2015) 468 final.

Giovannini, A., Mayer, C., Micossi, S., Di Noia, C., Onado, M., Pagano, M., Polo, A. (2015) Restarting European Long-Term Investment Finance, CEPR Press.

Quaglia, L., Howarth, D., & Liebe, M. (2016) The Political Economy of European Capital Markets Union. Journal of Common Market Studies, 54, 185-203.

‘A New Start for Europe: My Agenda for Jobs, Growth, Fairness and Democratic Change’, http://ec.europa.eu/about/juncker-commission/docs/pg_en.pdf

Chaired by the British Johnathan Hill and lately by Dombrovsksis after the Brexit vote.

Council Directive 93/22/EEC of 10 May 1993 on investment services in the securities field.

Markets in Financial Instruments Directive 2004/39/EC

Historically in the USA from 1933 with the Glass-Steagall Act commercial and investment banking were separated until 1991, fostering a deepening of capital market financing in the country.

Regulation (EU) No 345/2013 on European venture capital funds and Regulation (EU) No 346/2013 on European social entrepreneurship funds.