Do Stocks in VN30 Basket Follow Weak Form?

The research question: Do stocks in VN30 basket follow weak form of Efficient Market Hypothesis?

In the investment world, portfolio management refers to actions taken to maximize the return on a portfolio (Investopedia, 2016). Under portfolio management., Efficient Market Hypothesis (EMH) is one of the most important theories that investors should take into consideration if they aim to earn abnormal returns. This hypothesis basically illustrates the relationship between stock price and available information on the stock, which is reflected in three forms including strong form, semi-strong form and weak form. Out of the three patterns, EMH at weak form states that historical prices cannot be used to make predictions about future stock prices. This research paper will examine the weak form EMH in the context of constituent stocks in the VN30 Index – an adjusted index of VN-Index (which is the market index of Ho Chi Minh Stock Exchange, Vietnam).

2.1 Random Walk Theory and Efficient Market Hypothesis

The origin of stock market efficiency can be traced back to early twentieth century when Bachelier (1900) proposed his idea about Random Walk Hypothesis. This theory affirms that prices of past, present and even the future have no correlation; in other words, security prices tend to follow randomness and therefore are unpredictable. A few studies around this issue were conducted in 1930’s; however, the Random Walk Theory was intensively discussed in the 1960’s. Bachelier’s work was then reinforced with the introduction of Efficient Market Hypothesis (EMH) by Fama (1970). According to this theory, stocks always trade at their intrinsic values, making it impossible for investors to benefit from stock mispricing i.e. purchase undervalued stocks and sell overvalued stocks. As a result, the only way investors can earn a higher return than the market is by engaging in riskier investments.

Nowadays, the Random Walk Theory is referred to as the weak form of EMH, stating that stock prices are random and past events have no influence on the current prices. Meanwhile, it is widely known that technical analysis is the science of using historical price patterns to anticipate future price movements. Hence, according to the weak form of EMH, there is no point in applying technical analysis to predict and “beat the market”.

2.2 Research studies conducted towards Weak form of Efficient Market Hypothesis

Many studies have been carried out to investigate the weak form of Efficient Market Hypothesis, some of which fail to support the weak-form efficiency. Srinivasan (2010) examines the validity of random walk hypothesis for two major stock markets in India, i.e. S&P CNX NIFTY and SENSEX, using observations from 1st July 1997 to 31st August 2010. The study applied Augmented Dickey-Fuller test and Phillips-Perron test to point out that characteristics of random walk are not present in Indian stock exchanges; hence, weak form efficiency is rejected in the case of Indian markets. As a result, this provides trading opportunities for investors to earn abnormal returns since they can make predictions about future stock prices. Similarly, Singh et al., (2016) tested the Efficient Market Hypothesis in “Carbon Efficient Indices” of India, the US, Japan and Brazil by using Kolmogrov-Smirnov test, Shapiro-Wilk test, runs test and autocorrelation test. The results from these statistical tests reveal that daily closing stock prices do not follow random walk in all countries under investigation. This is in line with Nwidobie & Adesina (2014), who conclude that Nigerian stock exchange is not efficient in weak form by employing the GARCH autoregressive model. This inefficiency, according to Nwidobie & Adesina, may be explained by limited information dissemination in the market, high trading and floatation costs, information hoarding and insider trading, as well as poor implementation of investor protection laws in the country. The rejection of weak form efficiency is also found in other emerging markets, evidenced by the studies of Islam, et al. (2005), Srivastava (2010), BüyükÅŸalvarci & Abdioglu (2011), Haroon (2012) and Agbam (2015).

Other studies, on the other hand, show evidence of market efficiency in some economies. Andrianto & Mirza (2016) used daily stock price data collected from LQ45 Index, Jakarta Islamic Index and Kompas 100 Index during the period 2013-2014 to examine weak form efficiency in Indonesia. The results from runs test and serial correlation test demonstrate that Indonesia stock market follows weak form efficient pattern. Specifically, the following conclusions are drawn from the study: 1) stock price movement is random; 2) there is no correlations between the stock price movement of the present day and previous days. Andrianto & Mirza also suggest that investors use fundamental analysis to react quickly for available information, as well as utilize news from digital media to update market conditions. Further evidence supporting the weak form efficiency of capital markets may lie in the findings of Jiang, et al. (2014), who examined WTI crude oil futures prices from 1983 to 2012. Using bootstrapping technique, the academics confirm the efficiency of crude oil futures market, and state that the market is inefficient only in case of turbulent events, such as the oil price crash in 1985, the Gulf war, and the oil price crash in 2008.

2.3 VN-Index, VN30 Index and VN30 stocks

VN-Index is the index used to illustrate price fluctuations of company stocks listed on Ho Chi Minh Stock Exchange (HOSE). The problem is that, VN-Index calculation takes into account all shares outstanding, which include free-float shares and restricted shares. Free-float shares are shares freely available for trading in the market (Standard and Poor’s, 2016). In contrast, restricted shares are not available for public trading as they are closely held by control group, other publicly traded companies or

government agencies (Standard and Poor’s, 2016). As a result, some stocks such as GAS, VNM, MSN, VCB and BID can largely influence VN-Index due to their large number of restricted shares.

2.3.2 VN30 Index and VN30 stocks

The VN30 Index (also known as VN30 Equal Weight Index) was first introduced to the market on February 2012, tracking the performance of the top 30 large-cap liquid stocks on the Ho Chi Minh City stock exchange in Vietnam (Phoenix Capital, 2017). This index can overcome the weaknesses of VN-Index in the following manners:

- Capitalization values of constituent stocks are based on the number of shares freely traded on the market (free-float);

- Restrict the excessive influence of a particular stock by setting the capitalization weighed limit of 10%;

- Among more than 300 stocks listed on HOSE categorized into 11 primary industries, stocks in VN30 basket are present in 9 industries. Moreover, stocks in the VN30 basket represent about 80% of HOSE market capitalization and 60% of HOSE market volume (Dao, 2014).

From the advantages above, it can be concluded that VN30 Index can represent the Ho Chi Minh market in terms of industries, market capitalization and liquidity. This makes VN30 Index a quite useful investment instrument for index funds.

This research paper employs the quantitative method to investigate the weak form of Efficient Market Hypothesis in the context of Vietnamese background. The study is based on secondary data, which are daily closing prices of stocks included in the VN30 basket. The data are collected from the database of Bao Viet Securities Company – a well-known securities firm in Vietnam.

It is noted that the VN30 basket is periodically reviewed and adjusted every six months on January and July (Dao, 2014). Since the introduction of VN30 Index in February 2012, the basket has been reviewed and adjusted totally 10 times. For the purpose of this study, not all 30 stocks in the basket are chosen for analysis. Specifically, the stocks selected must meet the criterion of being consecutively included in the basket for the past five years. Put it another way, if stock A is included in the basket for one period but excluded for the next period, stock A will not be considered as the object of this study. This ensures the continuity of the data and fair treatment for all stocks in the basket. After all, only 16 stocks meet the criterion (see Appendix A for the full list of stocks selected). Their closing prices are then collected for the examined period from 06th February 2012 (the first day of VN30 basket) until 20th January 2017 (the end of the latest reviewed period).

The data collected are analysed using IBM SPSS Statistics software version 20. Particularly, three tests are conducted to determine whether stocks selected are at weak-form efficiency, namely runs test, autocorrelation test and Ljung-Box Q statistic. The runs test is a non-parametric test that is designed to find out whether successive price changes are independent. The test is based on the premise that if a series of a data is random, the observed number of runs in the series should be close to the expected number of runs. In this context, the runs test at 5% significance level is used to test the following hypothesis:

H1: Stocks in the VN30 basket follows random walk

Meanwhile, autocorrelation (or serial correlation) test measures the correlation coefficient between the stock return at current period and its value in the previous period, whether the correlation coefficients are significantly different from zero. In addition, the Ljung-Box Q (LBQ) statistic examines the joint hypothesis that all autocorrelations are simultaneously equal to zero (that is, the data values are random and independent up to a certain number of lags). In this context, the autocorrelation test and Ljung-Box Q statistic (at 5% level of significance) are employed to test the following hypothesis:

H2: There is no correlation between stock prices of today and previous days

In short, the combination of tests mentioned above help determine whether 16 selected stocks in the VN30 basket follows weak-form efficiency or not.

Table 1 shows the results of the runs test based on daily closing stock prices of 16 chosen stocks.

|

STB |

VIC |

SSI |

MSN |

FPT |

HAG |

KDC |

DPM |

VNM |

REE |

VCB |

|

|

Test Valuea |

17.27 |

55.76 |

21.53 |

87.14 |

45.83 |

19.23 |

40.97 |

33.45 |

113.55 |

23.14 |

34.03 |

|

Cases < Test Value |

461 |

605 |

651 |

648 |

560 |

425 |

601 |

759 |

547 |

484 |

698 |

|

Cases >= Test Value |

727 |

583 |

537 |

540 |

628 |

763 |

587 |

429 |

641 |

704 |

490 |

|

Total Cases |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

1188 |

|

Number of Runs |

38 |

20 |

41 |

18 |

53 |

8 |

7 |

17 |

12 |

10 |

10 |

|

Z |

-32.222 |

-33.379 |

-32.139 |

-33.487 |

-31.453 |

-34.042 |

-34.134 |

-33.478 |

-33.840 |

-33.942 |

-33.944 |

|

Asymp. Sig. (2-tailed) |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

.000 |

|

Runs Test |

|||||

|

BVH |

HPG |

PVD |

CII |

GMD |

|

|

Test Valuea |

47.31 |

35.31 |

48.11 |

22.33 |

29.84 |

|

Cases < Test Value |

637 |

660 |

723 |

627 |

594 |

|

Cases >= Test Value |

551 |

528 |

465 |

561 |

594 |

|

Total Cases |

1188 |

1188 |

1188 |

1188 |

1188 |

|

Number of Runs |

39 |

8 |

9 |

34 |

43 |

|

Z |

-32.265 |

-34.071 |

-33.996 |

-32.560 |

-32.044 |

|

Asymp. Sig. (2-tailed) |

.000 |

.000 |

.000 |

.000 |

.000 |

|

a. Mean Source: IBM SPSS’s result, 2017 |

As can be seen from the above table, the actual number of runs is significantly less than the expected number of runs (total cases), which is evidenced by negative Z-values for all chosen stocks. Furthermore, it is observed that the significant values around the mean of all stocks are 0.000 which is below 0.05 (5% level of significance). This indicates that 16 selected stocks do not follow random walk behaviour, resulting in the rejection of the null hypothesis H1 which says stocks in the VN30 basket follows random walk.

4.2 Results of Autocorrelation test

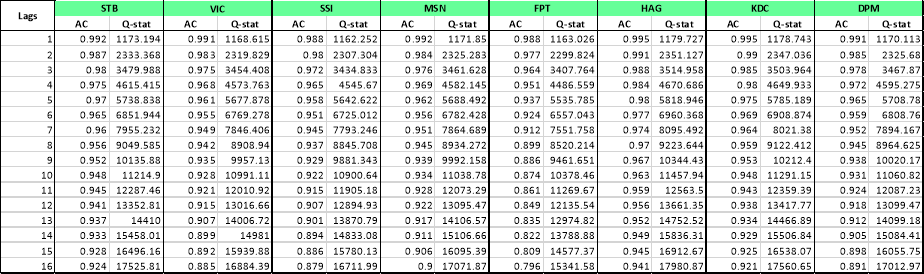

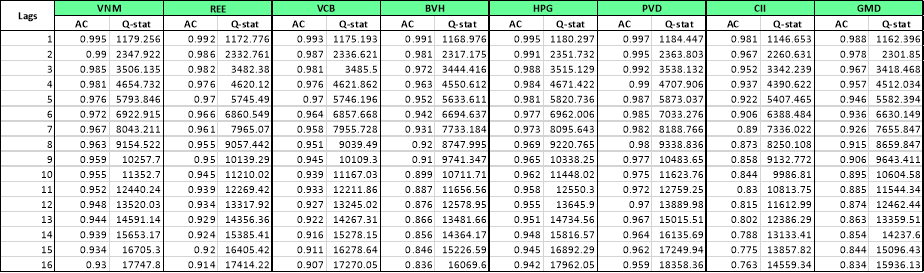

The results obtained from autocorrelation test and Ljung-Box Q statistic of 16 chosen stocks are presented in Table 2.

Table 2: Results of Autocorrelation test and Ljung-Box Q statistic

Source: IBM SPSS’s result, 2017

As can be observed from Table 2, significant positive autocorrelation (> 0.8) is detected at all 16 lags for all chosen stocks. It is noted that positive autocorrelation suggests predictability of stock prices in the short term, which provides confirmatory evidence that goes against market efficiency (BüyükÅŸalvarci & Abdioglu, 2011).

Moreover, evidence from Ljung-Box Q statistic seems to suggest dependence between current stock price and prices of previous periods. It is noticeable that p-values are all equal to zero for all lags on all 16 stocks. Therefore, the Q statistic fail to support the joint null hypothesis that all autocorrelation coefficients from lag 1 to 16 are equal to zero for the observed stocks. Put it another way, the null hypothesis H2 of absence of autocorrelation is strongly rejected for all lags at 5% significance level.

4.3 Interpretation of findings

On the basis of empirical results obtained from runs test, autocorrelation test and Ljung-Box Q statistic, both null hypotheses H1 and H2 are rejected. In other words, it can be concluded that 16 chosen stocks in the VN30 basket show no characteristics of weak-form efficiency. The findings of the current study are consistent with those of Truong et al. (2010), Vo & Le (2013) and Do et al. (2014) who found that Vietnamese stock market is inefficient in the weak form. In general, the results of this study contradict the Efficient Market Hypothesis (Fama, 1970) and Random Walk Theory (Bachelier, 1900).

As noted in the literature review, empirical studies on the weak form of Efficient Market Hypothesis in emerging markets have been thoroughly examined in recent years, as in cases of capital markets in India, Thailand, Indonesia, Pakistan and Nigeria. Although these studies generate mixed results, most of which suggest that Random Walk characteristic is not a good description of these markets. This study, by investigating a case study in Vietnam, further supports the idea of weak form inefficiency in emerging markets.

The rejection of market efficiency in Vietnam have been proven by a number of studies. It seems possible that this inefficiency is due to gaps in Vietnamese financial system. Non-transparency in the disclosure of information, crowding effect and speculation are popular phenomena in Vietnam stock exchanges; thus, stock prices somehow do not reflect companies’ intrinsic values. These gaps are signals of an underdeveloped financial system (Fry, 1994; Leung, 2009) where asymmetric information, moral hazard and adverse selection are likely to be found (Islam, et al., 2005). As a result, investors are vulnerable to losing a substantial amount of money. Additionally, as Vietnam currently does not have a derivatives market, the investment risk can be more severe for investors.

Since weak-form efficiency is not witnessed in this study, one implication of the result is that historical data and patterns may be used to make prediction about future stock prices. In other words, technical analysis might be employed by investors when making investment decisions to help them earn abnormal returns. Furthermore, as this study is based on daily data only, further research can test the Efficient Market Hypothesis by taking into account weekly, fortnightly, monthly, quarterly or yearly data on a longer time horizon. Alternatively, future research studies may investigate the hypothesis in certain industries or different indices in Vietnam.

Due to the nature of the research question, there exists some study limitations which can partially affect the results’ objectivity. First, because of the selection criterion, only 16 out of 30 stocks are chosen for the purpose of the study. Therefore, it is difficult to generalise the findings to the whole VN30 basket since its establishment. Second, precision of data is questionable since some data of closing stock prices are missing in some trading days. As a result, this somehow impacts the accuracy of statistical tests as well as their implications.

PART 5: REFLECTION ON THE RESEARCH PROCESS

At the beginning of the research process, we realized that portfolio management is a massive area in finance; therefore, narrowing down this topic was critical to our group as it would affect how we could construct individual topics and research questions. However, the familiar topic of each was not in favour of others, which caused conflicts in our discussions. Hence, it was important that we be aware of these conflicts and arrive at a reasonable compromise that is beneficial to the whole group (Hede, 2007; Wu et al., 2013). Eventually, since I had prior experiences of investing in the stock market for three years and had written a dissertation about technical analysis, I received the trust from my fellows when I proposed the topic related to Efficient Market Hypothesis (EMH). On the one hand, I felt happy to have helped my group figure out the appropriate topic. On the other hand, I was a little bit worried as my group members had little exposure to financial markets. In fact, I acknowledged that having to work on an unfamiliar area could lower their motivation for the research (Boneva, 2008).

When it came to work allocation, some serious issues arose as there was no leader in our group. Because most of the workloads were set by oral agreements without any meeting minutes, everyone was usually vague about their responsibilities. Furthermore, our discussions did not work very well because most of them took place through WhatsApp group rather than face-to-face meetings, leading to frequent distractions from social networks. I feel these problems were really time-consuming and slowed down our groupwork performance. If I had been engaged in a similar project again, I would have nominated myself as the group leader so that I could assign workloads clearly and equally for everyone. I would have also suggested face-to-face meetings in order to have direct conversations with members. This should have brought more efficiency to the group in terms of time and contributions.

Another issue that obstructed our groupwork productivity was bad time management of my team members. We all had two deadlines for two reports on the same date, but while I devised plans to finish both of which with adequate efforts, my partners fell into the trap of procrastination. Being rushed for two assignments at the same time was definitely not a good idea as it would negatively affect the performances of both (Peper, et al., 2014). To avoid this situation, we should have drawn up a timeline for the whole group so that everyone could effectively devote their time to each assignment.

With regards to literature search and data collection phase, some members in the group seemed to be passive in finding articles and sharing ideas to their peers. They neither knew how to write an adequate literature review nor kinds of online sources they could employ. I feel this was partly due to their lack of background in finance and partly because they had never conducted any formal research studies before. Although this annoyed the rest of group members, we understood that this sometimes could be unavoidable in a multicultural group. We tried to give them as many related articles as possible and instructed them about skim and scan technique in order to pick essential readings. In fact, we should have reported the issue to the tutor from the beginning of the research so that those falling behind could receive additional trainings in research skills.

In summary, this experience has taught me valuable lessons that are quite useful for me in future career, including how to communicate and collaborate with members in a multinational group, as well as things to do to become a good leader. I have also learnt more about how to improve time management skills, and how to resolve conflicts occurring during group works. Finally, I think I should speak my mind more frequently in the future if it is for the sake of the whole group.

References

Agbam, A. S., 2015. Tests of Random Walk and Efficient Market Hypothesis in Developing Economies: Evidence from Nigerian Capital Market. International Journal of Management Sciences, 5(1), pp. 1-53.

Andrianto, Y. & Mirza , A. R., 2016. A Testing of Efficient Markets Hypothesis in Indonesia Stock Market. Procedia – Social and Behavioral Sciences, Volume 219, p. 99-103.

Bachelier, L., 1900. Louis Bachelier’s Theory of Speculation. 1st ed. Princeton: Princeton University Press.

Boneva, D. L., 2008. Effects of Work Ethic and Social Identification on Motivation in Groups. Illinois: ProQuest.

BüyükÅŸalvarci, A. & Abdioglu, H., 2011. Testing the weak form efficiency of the Turkish stock market. African Journal of Business Management, 5(34), pp. 13044-13056.

Dao, T. B., 2014. VN30 Index: An Overview and Default Probability Analysis. Social Science Research Network (SSRN).

Do, T. T. N., Le, T. B. & Nguyen, T. T., 2014. Stock market efficiency in emerging markets: Evidence from Vietnamese stock market. s.l., s.n.

Fama, E., 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance, 25(2), pp. 383-417.

Fry, M., 1994. Money, Interest, and Banking in Economic Development. 2nd ed. Baltimore: The Johns Hopkins University Press.

Haroon, M. A., 2012. Testing the Weak Form Efficiency of Karachi Stock Exchange. Pakistan Journal of Commerce and Social Sciences, 6(2), pp. 297-307.

Hede, A., 2007. The shadow group: Towards an explanation of interpersonal conflict in work groups. Journal of Managerial Psychology, 22(1), pp. 25 – 39.

Investopedia, 2016. Portfolio Management. [Online]

Available at: http://www.investopedia.com/terms/p/portfoliomanagement.asp

[Accessed 15 March 2017].

Islam, S., Watanapalachaikul, S. & Clark, C., 2005. Are Emerging Financial Markets Efficient? Some Evidence from the Models of the Thai Stock Market. Melbourne, Centre for Strategic Economic Studies.

Jiang, Z.-Q., Xie, W.-J. & Zhou, W.-X., 2014. Testing the weak-form efficiency of the WTI crude oil futures market. Physica A: Statistical Mechanics and its Applications, Volume 405, p. 235-244.

Leung, S., 2009. Banking and Financial Sector Reforms in Vietnam. Asean Economic Bulletin, 26(1), pp. 44-57.

Nwidobie, B. M. & Adesina, J. B., 2014. CAPITAL MARKET EFFICIENCY. AN EMPIRICAL TEST OF THE WEAK-FORM IN THE NIGERIAN CAPITAL MARKET. Journal of Advanced Studies in Finance, 2(10), pp. 164-170.

Peper, E., Harvey, R., Lin, I.-M. & Duvvuri, P., 2014. Increase Productivity, Decrease Procrastination, and Increase Energy. Biofeedback, 42(2), p. 82-87.

Phoenix Capital, 2017. VN30 EQUAL WEIGHT TOTAL RETURN INDEX. [Online]

Available at: http://www.customindices.spindices.com/indices/custom-indices/vn30-equal-weight-total-return-index

[Accessed 18 March 2017].

Singh, R., Leepsa, N. M. & Kushwaha, N., 2016. Testing the weak form of efficient market hypothesis in carbon efficient stock indices along with their benchmark indices in select countries. Iranian Journal of Management Studies, 9(3), pp. 627-650.

Srinivasan, P., 2010. Testing weak-form efficiency of indian stock markets. Asia Pacific Journal of Research in Business Management, 1(2), pp. 134-140.

Srivastava, A., 2010. Are Asian Stock Markets Weak-Form Effcient: An Evidence from India. Asia-Pacifc Business Review, 6(4), pp. 5-11.

Standard and Poor’s, 2016. Float Adjustment Methodology, s.l.: S&P Global.

Truong, D. L., Lanjouw, G. & Lensink, R., 2010. Stock-Market Efficiency in Thin-Trading Markets: The Case of the Vietnamese Stock Market. Applied Economics, 42(27), pp. 3519-3532.

Vo, X. V. & Le, D. B. T., 2013. Empirical Investigation of Efficient Market Hypothesis in Vietnam Stock Market. Social Science Research Network (SSRN).

Wu, K. et al., 2013. Supporting group collaboration in Wiki by increasing the awareness of task conflict. Aslib Proceedings: New Information Perspectives, 65(6), pp. 581 – 604.

Appendix A: List of chosen stocks in the VN30 basket based on the selection criterion

|

No. |

TICKER |

COMPANY NAMES |

|

1 |

STB |

Sai Gon Thuong Tin Commercial Joint Stock Bank |

|

2 |

VIC |

Vingroup Joint Stock Company |

|

3 |

SSI |

Sai Gon Securities Incorporation |

|

4 |

MSN |

Masan Group Corporation |

|

5 |

FPT |

FPT Corporation |

|

6 |

HAG |

Hoang Anh Gia Lai Joint Stock Company |

|

7 |

KDC |

Kinh Do Corporation |

|

8 |

DPM |

PetroVietnam Fertilizer & Chemicals Corporation |

|

9 |

VNM |

Viet Nam Dairy Products Joint Stock Company |

|

10 |

REE |

Refrigeration Electrical Engineering Corporation |

|

11 |

VCB |

Bank for Foreign Trade of Vietnam |

|

12 |

BVH |

Bao Viet Holdings |

|

13 |

HPG |

Hoa Phat Group Joint Stock Company |

|

14 |

PVD |

PetroVietnam Drilling & Well Services Corporation |

|

15 |

CII |

Ho Chi Minh City Infrastructure Investment JSC |

|

16 |

GMD |

Gemadept Corporation |