Evidence from International Stock Markets

Portfolio Selection with Four Moments:

Evidence from International Stock Markets

Despite the international diversification suggested by several researchers (e.g. Grulbel, 1968; Levy and Sarnat, 1970; Solnik, 1974) and the increased integration of capital markets, the home bias has not decreased (Thomas et. al., 2004 and Coeurdacier and Rey, 2013) and there is no complete explanation of this puzzle. Furthermore, there are the fastgrowing concerns of investor for extreme risks[1] and the investors’ preference toward odd moments (e.g. mean and skewness) and an aversion toward even moments (e.g. variance and kurtosis) considered by numerous studies (e.g. Levy, 1969; Arditti, 1967 and 1971; Jurczenko and Maillet, 2006).

According to these reasons, this paper propose to investigate whether the incorporation of investor preferences in the higher moments into the international asset allocation problem can help explain the home bias puzzle. The study will allow investor preferences to depend not only the first two moments (i.e. mean and variance) but also on the higher moments, such as skewness and kurtosis, by using the polynomial goal programming (PGP) approach and then generate the three-dimensional efficient frontier.

The main objective of the proposed study is to investigate whether the incorporation of skewness and kurtosis into the international stock portfolio selection causes these issues: The changes in the construction of optimal portfolios, the patterns of relationships between moments, and the less diversification compared to the mean-variance model.

Since several researchers (e.g. Grulbel, 1968; Levy and Sarnat, 1970; Solnik, 1974) suggest that investment in a portfolio of equities across foreign markets provide great diversification opportunities, then investors should rebalance there portfolio away from domestic toward foreign equities. However, US investors continue to hold equity portfolios that are largely dominated by domestic assets. Thomas et. al. (2004) reported that by the end of 2003 US investors held only 14 percent of their equity portfolios in foreign stocks. Furthermore, Coeurdacier and Rey (2013) also reported that in 2007, US investors hold more than 80 percent of domestic equities.

Many explanations have been recommended in the literature to explain this home bias puzzle include direct barriers such as capital controls and transaction costs (e.g. Stulz, 1981; Black, 1990; Chaieb and Errunza, 2007), and indirect barriers such as information costs and higher estimation uncertainty for foreign than domestic equities (e.g. Brennan and Cao, 1997;

Guidolin, 2005; Ahearne et. al., 2004). Nevertheless, several studies (e.g. Karolyi and Stulz, 1996; Lewis, 1999) suggests that these explanations are weakened since the direct costs to international investment have come down significantly overtime and the financial globalization by electronic trading increases exchanges of information and decreases uncertainty across markets.

Since the modern portfolio theory of Markowitz (1952) indicates how risk-averse investors can construct optimal portfolios based upon mean-variance trade-off, there are numerous studies on portfolio selection in the framework of the first two moments of the return distributions. However, as many researchers (e.g., Kendall and Hill, 1953;

Mandelbrot, 1963a and 1963b; Fama, 1965) discovered that the presence of significant skewness and excess kurtosis in asset return distributions, there is a great concern that highermoments than the variance should be accounted in portfolio selection.

The motivation for the generalization to higher moments arises from the theoretical work of Levy (1969) provided the cubic utility function depending on the first three moments. Later, the empirical works of Arditti (1967 and 1971) documented the investor’s preference for positive skewness and aversion negative skewness in return distributions of individual stocks and mutual funds, respectively. Even Markowitz (1959) himself also supports this aspect by suggesting that a mean-semi-variance trade-off [2], which gives priority to avoiding downside risk, would be superior to the original mean-variance approach.

While the importance of the first three moments was recognized, there were some arguments on the incorporation of higher moments than the third into the analysis. First, Arditti (1967) suggested that most of the information about any probability distribution is contained in its first three moments. Later, Levy (1969) argued that even the higher moments are approximately functions of the first moments, but not that they are small in magnitude.

Several authors (Levy, 1969; Samuelson, 1970; Rubinstein, 1973) also recommend that in general the higher moments than the variance cannot be neglected, except when at least one of the following conditions must be true:

- All the higher moments beyond the first are zero.

- The derivatives of utility function are zero for the higher moments beyond the second.

- The distributions of asset returns are normal or the utility functions are quadratic.

However, ample evidence (e.g., Kendall and Hill, 1953; Mandelbrot, 1963a and 1963b; Fama, 1965) presented not only the higher moments beyond the first and their derivatives of the utility function are not zero, but also the asset returns are not normally distributed. Furthermore, several researchers (Tobin, 1958; Pratt, 1964; Samuelson, 1970; Levy and Sarnat, 1972) indicate that the assumption of quadratic utility function is appropriate only when return distributions are compact. Therefore, the higher moments of return distributions, such as skewness, are relevant to the investor’s decision on portfolio selection and cannot be ignored.

In the field of portfolio theory with higher moments, Samuelson (1970) was the first author who recommends the importance of higher moments than the second for portfolio analysis. He shows that when the investment decision restrict to the finite time horizon, the use of mean-variance analysis becomes insufficient and the higher moments than the variance become more relevant in portfolio selection. Therefore, he developed three-moment model based on the cubic utility function which expressed by Levy (1969)3. Following Samuelson

(1970), number of studies (e.g. Jean, 1971, 1972 and 1973; Ingersoll, 1975; and Schweser, 1978) explained the importance of skewness in security returns, derived the risk premium as functions of the first three moments, and generated the three-dimensional efficient frontier with a risk-free asset.

Later, Diacogiannis (1994) proposed the multi-moment portfolio optimization programme by minimizing variance at any given level of expected return and skewness. Consequently, Athayde and Flores (1997) developed portfolio theory taking the higher moments than the variance into consideration in a utility maximizing context. The expressions in this paper greatly simplified the numerical solutions of the multi-moment portfolio optimal asset allocation problems4.

- 23

Levy (1969) defines the cubic utility function as U(x) which has the form: U(x) = ax + bx + cx , where x is a random variable and a,b,c are coefficients. This function is concave in a certain range but convex in another.

- Jurczenko, E. and Maillet, B. (2006) Multi-Moment Asset Allocation and Pricing Models, Wiley Finance, p. xxii.

Different approaches have been developed to incorporate the individual preferences for higher-order moments into portfolio optimization. These approaches can be divided into two main groups, the primal and dual approaches.

The dual approach starts from a specification of the higher-moment utility function by using the Taylor’s series expansion to link between the utility function and the moments of the return distribution. Then, the dual approaches will determine the optimal portfolio via its parameters reflecting preferences for the moments of asset return distribution. Harvey et. al. (2004) uses this approach to construct the set of the three-moment efficient frontier by using two sets of returns[3]. The results show that as the investor’s preference in skewness increases, there are sudden change points in the expected utility that lead to dramatically modifications in the allocation of the optimal portfolio. Jondeau and Rockinger (2003 and 2006) and Guidolin and Timmermann (2008) extend the dual approach in portfolio selection from three- to four-moment framework.

A shortcoming of this dual approach is that the Taylor series expansion may converge to the expected utility under restrictive conditions. That is for some utility functions (e.g. the exponential function), the expansion converges for all possible levels of return, whereas for some types of utility function (e.g. the logarithm-power function), the convergence of Taylor series expansion to the expected utility is ensured only over a restricted range6. Furthermore, since Taylor series expansion have an infinite number of terms, then using a finite number of terms creates the truncation error.

To circumvent these problems, the primal approach parameters that used to weight the moment deviations are not relate precisely to the utility function. Tayi and Leonard (1988) introduced the Polynomial Goal Programming (PGP), which is a primal approach to solve the goal in portfolio optimization by trade-off between competing and conflicting objectives. Later, Lai (1991) is the first researcher who proposed this method to solve the multiple objectives determining the set of the mean-variance-skewness efficient portfolios. He illustrated the three-moment portfolio selection with three objectives, which are maximizing both the expected return and the skewness, and minimizing the variance of asset returns.

Follows Lai (1991) who uses a sample of five stocks and a risk-free asset, Chunhachinda et. al. (1997) and Prakash et. al. (2003) examines three-moment portfolio selection by using international stock indices.

Regarding the under-diversification, many studies (e.g. Simkowitz and Beedles, 1978; Mitton and Vorkink, 2004; and Briec et. al., 2007) suggested that incorporation of the higher moments in the investors’ objective functions can explain portfolio under-diversification. Home bias puzzle is one of the under-diversification. It is a tendency to invest in a large proportion in domestic securities, even there are potential gains from diversification of investment portfolios across national markets. Guidolin and Timmermann (2008)[4] indicate that home bias in US can be explained by incorporate the higher moments (i.e. skewness and kurtosis) with distinct bull and bear regimes in the investors’ objective functions.

Several researchers use the primal and the dual approaches to examine the international portfolio selection. Jondeau and Rockinger (2003 and 2006) and Guidolin and Timmermann (2008) applied the dual approaches using a higher-order Taylor expansion of the utility function. They provide the empirical evidence that under large departure from normality of the return distribution, the higher-moment optimization is more efficient than the mean-variance framework. Chunhachinda et. al. (1997) and Prakash (2003) applied the Polynomial Goal Programming (PGP), which is a primal approach, to determine the optimal portfolios of international stock indices. Their results indicated that the incorporation of skewness into the portfolio selection problem causes a major change in the allocation of the optimal portfolio and the trade-off between expected return and skewness of the efficient portfolio. Appendix 1 presents methodology and data of the previous papers that study international portfolio selection with higher moments.

In the proposed study, I will extend PGP approach to the mean-variance-skewnesskurtosis framework and investigate the international asset allocation problem that whether the incorporation of investor preferences in the higher moments of stock return distributions returns can help explain the home bias puzzle.

Since previous research (e.g. Levy, 1972; Singleton and Wingerder, 1986) points out that the estimated values of the moments of the asset return distribution sensitive to the choices of an investment horizon, I will examine daily, weekly, and monthly data sets in the study[5].

The sample data will consist of daily, weekly, and monthly rates of return of five international indices for all available data from January 1975 to December 2016. These five indices cover the stock markets in the main geographical areas, namely the United States, the

United Kingdom, Japan, the Pacific region (excluding Japan), and Europe (excluding United Kingdom)[6]. Moreover, the study also use three-month US Treasury bill rates as the existence of the risk-free asset in order that the investor is not restricted to invest only in risky assets.

The data source of these indices is the Morgan Stanley Capital International Index (MSCI) who reports these international price indices as converted into US dollar at the spot foreign exchange rate. The MSCI stock price indices and T-bill rates are available in Datastream.

The methodology proposed in the study consists of two parts. First, the rate of return distribution of each international index will be tested for normality by using the Shapiro-Wilk test. Then, the PGP approach will be utilized to determine the optimal portfolio in the fourmoment framework.

4.1 Testing for normality of return distribution

At the beginning of the empirical work, I will test the normality of return distributions of international stock indices and the US T-bill rates. This test provides the foundation for examine the portfolio selection problem in the mean-variance-skewness-kurtosis framework.

Although several methods are developed, there is an ample evidence that the ShapiroWilk is the best choice for evaluating normality of data under various specifications of the probability distribution. Shapiro et. al. (1968) provide an empirical sampling study of the sensitivities of nine normality-testing procedures and concluded that among those procedures, the Shapiro-Wilk statistic is a generally superior measure of non-normality. More recently,

Razali and Wah (2011) compared the power of four statistical tests of normality via Monte Carlo simulation of sample data generated from various alternation distributions. Their results support that Shapiro-Wilk test is the most powerful normality test for all types of the distributions and sample sizes.

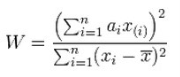

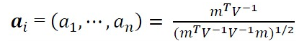

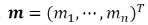

The Shapiro-Wilk statistic is defined as

where is the i th order statistic (rate of returns), ⋯ .

⋯ / is the sample mean,

are the expected values of the order statistics of independent

are the expected values of the order statistics of independent

and identically distributed random variables sampled from the standard normal, and

V is the covariance matrix of those order statistics.

Note that the values of are provided in Shapiro-Wilk (1965) table based on the order i.

The Shapiro-Wilk tests the null hypothesis of normality:

H0: The population is normally distributed.

H1: The population is not normally distributed.

If the p-value is less than the significant level (i.e. 1%, 5%, or 10%), then the null hypothesis of normal distribution is rejected. Thus, there is statistical evidence that the sample return distribution does not came from a normally distributed population. On the other hand, if the p-value is greater than the chosen alpha level, then the null hypothesis that the return distribution came from a normally distributed population cannot be rejected.

4.2 Solving for the multi-objective portfolio problem

Following Lai (1991) and Chunhachinda et. al. (1997), the multi-objective portfolio selection with higher momentscan be examined based on the following assumptions:

- Investors are risk-averse individuals who maximize the expected utility of their end-ofperiod wealth.

- There are n + 1 assets and the (n + 1)th asset is the risk-free asset.

- All assets are marketable, perfectly divisible, and have limited liability.

- The borrowing and lending rates are equal to the rate of return r on the risk-free asset.

- The capital market is perfect, there are no taxes and transaction costs.

- Unlimited short sales of all assets with full use of the proceeds are allowed.

The mean, variance, skewness, and kurtosis of the rate of return on asset are assumed to exist for all risky assets for 1,2, … . Then, I define the variables in the analysis as

= ,, … , be the transpose of portfolio component , where is the

percentage of wealth invested in the th risky asset,

= ,, … , be the transpose of whose mean denoted by ,

= the rate of return on the th risky asset,

= the rate of return on the risk-free asset,

= a (n x 1) vector of expected excess rates of return,

= the expectation operator,

= the (n x 1) vector of ones,

= the variance-covariance (n x n) matrix of ,

= the skewness-coskewness (n x n2) matrix of ,= the kurtosis-cokurtosis (n x n3) matrix of .

Then, the mean, the variance, the skewness, and the kurtosis of the portfolio returns can be defined as:[7]

,

,

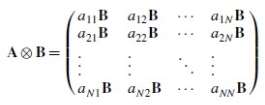

âŠ-,[8]

âŠ-,[8]

Kurtosis = = âŠ- âŠ- .

Note that because of certain symmetries, only ((n+1)*n)/2 elements of the skewnesscoskewness matrix and ((n+2)*(n+1)*n)/6 elements of the kurtosis-cokurtosis matrix must be computed. The components of the variance-covariance matrix, the skewness-coskewness matrix, and the kurtosis-cokurtosis matrix can be computed as follows:

∑,

∑,

∑,

∑,

∑,

∑,

∑,

∑,

∑,

∑,

∑.

∑.

Therefore, the optimal solution is to select a portfolio component . The portfolio selection can be determined by solving the following multiple objectives, which are maximizing the expected return and the skewness while minimizing the variance and the kurtosis:

|

, |

||

|

, |

||

|

âŠ-, |

||

|

= |

âŠ- âŠ- |

. |

|

subject to |

1. |

Since the percentage invested in each asset is the main concern of the portfolio decision, Lai (1991) suggests that the portfolio choice can be rescaled and restricted on the unit variance space (i.e. | 1 ). Under the condition of unit variance, the portfolio selection problem with skewness and kurtosis (P1) can be formulated as follows:

,

,

âŠ-,

(P1) = âŠ- âŠ- ,

subject to 1 ,

1 .

Usually, the solution of the problem (P1) does not satisfy three objectives (,

, ) simultaneously. As a result, the above multi-objective problem (P1) involves a two-step procedure. First, a set of non-dominated solutions independent of investor’s preferences is developed. Then, the next step can be accomplished by incorporating investor’s preferences for objectives into the construction of a polynomial goal programming (PGP). Consequently, portfolio selection by satisfying the multiple objectives that is the solution of PGP can be achieved.

In PGP the objective function ( ) does not contain a portfolio component , it contains deviational variables ( , , ) which represent deviations between goals and what can be achieved, given a set of constrains. Therefore, the objective function ( ) is minimization of the deviation variables ( , , ) to determine the portfolio component

. Moreover, if the goals are at the same priority level, the deviations from the goals ( , , ) are non-negative variables.

Given an investor’s preferences among mean, skewness, and kurtosis ( , , ), a PGP model can be expressed as:

.

.

subject to âˆ- ,

âŠ-âˆ- ,

(P2) âŠ- âŠ- = âˆ- ,

1 ,

1 ,

,, 0 .

where

âˆ- = the extreme value of objective when they are optimized individually, then

âˆ- |1 , âˆ- |1 ,

and âˆ- |1 ,

= the non-negative variables which represent the deviation of and âˆ-,

= the non-negative parameters representing the investor’s subjective degree of preferences between objectives,

The combinations of represent different preferences of the mean, the skewness, and the kurtosis of a portfolio return. For example, the higher , the more important the mean (skewness or kurtosis) of the portfolio return is to the investor. Thus, the efficient portfolios are the solutions of problem (P2) for various combinations of preferences .

The expected results provided in this section refer to two parts of methodology, the normality test and the international portfolio optimization in four-moment framework.

5.1 The expected results of the normality test

Many researches examine the international stock indices and found that most of the stock return distributions exhibit skewness and their excess kurtosis are far from zero. For instance, in the work of Chunhachinda et. al. (1997), the Shapiro-Wilk statistics indicate 5 markets and 11 markets reject the null hypothesis of normal distribution at ten percent significant level, for weekly and monthly data, respectively. Prakash et. al. (2003) use the Jarque-Bera test to trial the normality of each international stock index, their results indicate that for 17 markets for weekly returns and 10 markets for monthly returns reject the null hypothesis of normal distribution five percent significant level.

Therefore, I expected that the Shapiro-Wilk tests in the proposed study will be significant and reject the null hypothesis of normality. In other words, the return distributions of international stock markets during the period under study are expected to be non-normal.

5.2 The expected results of the multi-objective portfolio selection

5.2.1 The changes in the allocation of optimal portfolios

Chunhachinda et. al. (1997) and Prakash et. al. (2003) both indicated that the incorporation of skewness into the portfolio selection problem causes a major change in the allocation of the optimal portfolio. However, their definitions of ‘a major change’ are different. Chunhachinda et. al. (1997) found that there is a modification in the allocation when they compare between the mean-variance and the mean-variance-skewness efficient portfolios. However, both types of portfolios are dominated by the investment components of only four markets[9]. On the other hand, Prakash (2003) results show that the structural weights of the mean-variance and the mean-variance-skewness optimal portfolios are dominated by different markets.

Therefore, I expected that when I compare between of the mean-variance efficient portfolios, the three-moment efficient portfolios, and the mean-variance efficient portfolios, the percentage invested in each asset will be different in magnitude and ranking.

5.2.2 The trade-off between expected return and skewness

Most of the studies of international portfolio selection with higher moments (e.g. Chunhachinda et. al., 1997; Prakash et. al., 2003; Jondeau and Rockinger, 2003 and 2006) reported that the mean-variance efficient portfolios have the higher expected return while the three-moment efficient portfolios have greater skewness. Thus, they indicated that after incorporation of skewness into portfolio selection problem, the investor will trade the expected return of the portfolio for the skewness. More recently, Davies et. al. (2005) applied PGP to determine the set of the four-moment efficient funds of hedge funds and found not only the trade-off between the mean and the skewness, but also the trade-off between the variance and the kurtosis.

Thus, I expected to discover the trade-off between the expected return and the skewness and the trade-off between the variance and the kurtosis. In addition, I will also investigate other relationships between the moments of return distribution and report them in both numerical and graphical ways.

5.2.3 The less diversification compared to the mean-variance model.

To investigate whether the incorporation of higher moments than the second (i.e. skewness and kurtosis) can help explain the home bias puzzle, I will examine the hypothesis:

H0: ZMV ≤ ZMVSK.

H1: ZMV > ZMVSK.

where ZMV and ZMVSK are the number of nonzero weights of the mean-variance efficient portfolios and the four-moment efficient portfolios, respectively.

If the number of nonzero weights of the mean-variance efficient portfolios (ZMV) is greater than the number of nonzero weights of the four-moment efficient portfolios (ZMVSK), then I will rejected the null hypothesis. This implies that the incorporation of the higher moments into the portfolio decision can help explain the home bias puzzle.

However, the results from the literature are mixed. On one hand, several researchers (e.g. Prakash et. al., 2003; Briec et. al., 2007; Guidolin and Timmermann, 2008) provided the evidence that the incorporation of skewness into the portfolio selection causes the less diversification in the efficient portfolio. On the other hand, the results of some studies (e.g. Chunhachinda et. al., 1997; Jondeau and Rockinger, 2003 and 2006) found that when compare with the mean-variance efficient portfolios, the diversification of the higher-moment efficient portfolios seem to be same or even became more diversify.

I expected the results to show that the four-moment efficient portfolio is less diversified than the mean-variance one. In other words, the incorporation of the skewness and the kurtosis into the international portfolio selection can help explain the home bias.

[1] Jurczenko, E. and Maillet, B. (2006) Multi-Moment Asset Allocation and Pricing Models, Wiley Finance, p. xxii.

[2] Semi-variance is a measure of the dispersion of all observations that fall below the average or target value of a data set.

[3] The first set consists of four stocks and the second set consists of four equity indices, two commodities, and a risk-free asset. 6

Jurczenko, E. Maillet, B., and Merlin, P. (2006) Multi-Moment Asset Allocation and Pricing Models, Wiley Finance, p. 52.

[4] Guidolin and Timmermann (2008) analyze the portfolio selection problem by using the dual approach.

[5] Chunhachinda et. al. (1997) and Prakash et. al. (2003) studied the portfolio selection across national stock markets by using two data sets, weekly and monthly data.

[6] Guidolin and Timmermann (2008) reported that these markets represent roughly 97% of the world equity market capitalization.

[7] I use the derivations of skewness and kurtosis as provided in the textbook “Multi-Moment Asset Allocation and Pricing Models” of Jurczenko and Maillet (2006) to transform the expectation operators into the matrix terms.

[8] Let A be an (nÃ-p) matrix and B an (mÃ-q) matrix. The (mnÃ-pq) matrix AâŠ-B is called the of matrix A and matrix B:

[9] The four markets are Hong Kong, Netherlands, Singapore, and Switzerland. These markets have high rankings of the coefficient of variation under the sample period.