Finance in an SME Context

When it comes to analyzing the performance of any business for a specific accounting period, the ratios or the accounting ratios are the most widely used tools (Cassedy, 2014). Among the various ratios, the most common ones are those that are used to figure out liquidity, profitability, efficiency etc. From the given data of the concerned company Trainline, the following six ratios have been used to analyze the performance of the company:

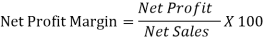

Net Profit Margin:

Profitability of a firm shows, to some extent, the firm’s performance position throughout any particular period (Cassedy, 2014). To figure out profitability, there can be many ratios, out of which Net Profit Margin (NPM) is a reliable one, since the NPM takes into account all the operating expenses & all the operating income & thus resulting in the net profit figure the firm has at the end of any period. Trainline company enjoyed the highest profit in 2014. NPM can be calculated through dividing the net profit of any period by the net sales of that period. Following is the position of Trainline as calculated using NPM formula:

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Net Profit Margin |

0.13 |

0.10 |

0.18 |

0.15 |

0.12 |

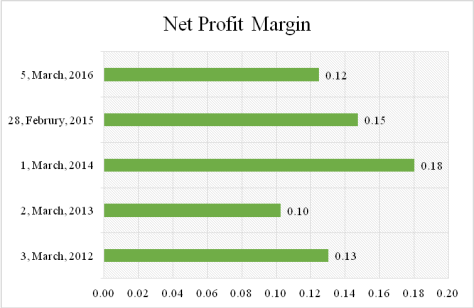

Gross Profit Margin:

The Gross Profit Margin (GPM) is also a ratio for calculating the profitability of any firm. The difference between the NPM & the GPM is that the latter one does not consider operating expenses (Cassedy, 2014). Gross profit margin shows the performance of the firm based on the firm’s capacity of first level activity or the main way through which Trainline earns profit. Though not that much reliable as net profit margin, it is easy to calculate. Trainline experienced similar percentage of gross profit over the years. The formula to figure out gross profit of Trainline is given below:

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Gross Profit Margin |

5% |

5% |

5% |

5% |

5% |

Inventory Turnover:

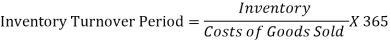

According to Clark, & Baker, (2011), There are several accounting ratios that help investors, creditors or any other stakeholders to figure out how much a company is efficient in selling its products in stock or inventory, i.e. inventory turnover period shows the company’s ability to use the inventory perfectly. The fact of multiplying the ratio with 365 is that it shows in how many days the firm is able to go on a cycle of inventory management (Clark, & Baker, 2011). Through this measure, stakeholders are also able to find out the return on assets. Trainline company shows consistent performance in the years 2012, 2013, & in 2014, but the company faced declining results in 2015 & 2016.

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Inventory Turnover Period |

0.598039216 |

0.591800494 |

0.561754521 |

0.329632384 |

0.24692301 |

Return on Capital Employed:

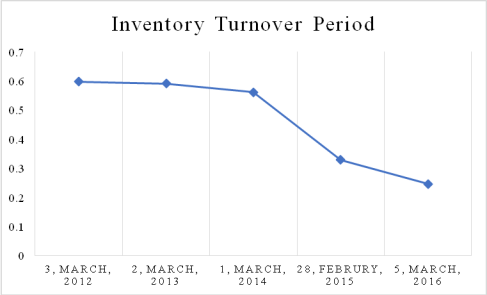

The Return on Capital Employed is measure that shows a company’s productivity in making appropriate use of the assets net of long term liabilities or the capital employed. The ratio provides information of the firm’s ability to use the invested amount (Clark, & Baker, 2011). ROCE, often times, is the most popular tool to see potential in any company. It is calculated through dividing net profit of the company by capital employed. Here, for the calculation of Trainline’s ROCE, the intangible assets have been deducted. The following table & graph show the results of Trainline over the years in terms of ROCE along with the formula:

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Return on Capital Employed |

0.169982548 |

0.422774021 |

1.141914376 |

1.092703315 |

1.518949954 |

Current Ratio:

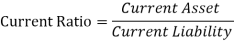

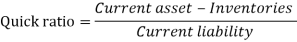

When it comes to finding out the liquidity of any business organization, the Current ratio is one of the prominent ones (Clark, & Baker, 2011). It shows how much capable Trainline company is in paying back its current liabilities using its current assets. Suppliers are the most frequent users of this ratio. Current ratio is calculated through dividing current assets of any accounting period by the current liabilities of that particular period. Current ratio is calculated by dividing the current assets by the current liabilities. The standard benchmark for current ratio is 1. If the current ratio is above 1, then its good, but if the ratio falls below 1, then it’s not good & the firm should focus on dealing with this. Trainline was consistent & performed well over the years in paying back its short-term liabilities using its current assets.

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Current Ratio |

1.59 |

1.86 |

1.18 |

1.41 |

1.21 |

Acid Test Ratio:

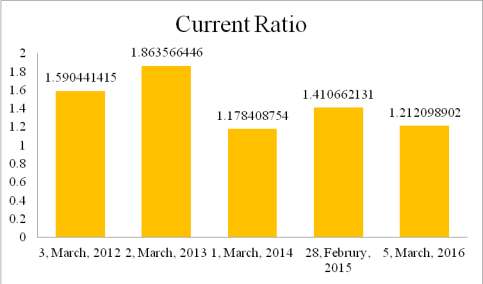

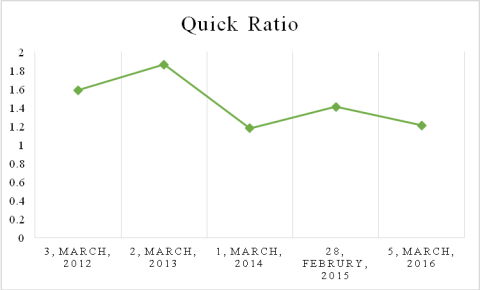

The Acid Test Ratio is also a measure to figure out the liquidity of any firm. It is more reliable than the current ratio, since it deducts stock or inventories from the current assets. Since inventories cannot be converted into liquid asset, they are deducted in acid test ratio. The ratio is calculated through dividing current assets net of inventories or stock by current liabilities (Shields, 2011). The ratio is also known as the quick ratio. Trainline company was performing good in 2012 & in 2013 & faced a decline in 2014, but was able to increase the ratio (Shields, 2011). The standard benchmark for acid test ratio is 1.5.

|

Date |

March 03, 2012 |

March 02, 2013 |

March 01, 2014 |

February 28, 2015 |

March 05, 2016 |

|

Acid Test Ratio |

1.59 |

1.86 |

1.18 |

1.41 |

1.21 |

Assuming a sales growth rate of 10.05% & an expense growth rate of 5.02% (one-half of the earnings growth rate), the following cash budget is forecasted:

Trainline.com

Cash Budget

For the Years from March-2016 to March-2019

|

March 05, 2016 |

March 05, 2017 |

March 05, 2018 |

March 05, 2019 |

|

|

Opening Cash Balance |

44408 |

2040477 |

4254439 |

|

|

Share Capital |

1131 |

1245 |

1370 |

1507 |

|

Ticket Sales |

1938116 |

2132883 |

2347222 |

2583101 |

|

Collection from receivables |

153121 |

153121 |

||

|

Total Cash Available |

2092368 |

2331656 |

4389069 |

6839047 |

|

Cost of Sales |

45824 |

48126 |

50545 |

53084 |

|

Administrative Expense |

61375 |

64459 |

67698 |

71099 |

|

Interest Payable & Similar Charges |

9994 |

10496 |

11024 |

11577 |

|

Tax on Profit |

4863 |

5107 |

5364 |

5633 |

|

Payment to Creditors |

162990 |

162990 |

||

|

Total Disbursement |

285046 |

291179 |

134630 |

141395 |

|

ClosingCash Balance |

1807322 |

2040477 |

4254439 |

6697653 |

Analysis on Sources of Cash:

Issuance of Shares:

Trainline collects cash from issuing different kinds of shares such as primary, preferred shares etc. Foer the purpose of issuing shares, Trainline.com must enlist in the regulatory body controlling issuance of shares, the London Stock Exchange. The company decided to float shares through London Stock Exchange with a prospective figure amounting £500. It had a capital amount of £1131000 in 2016 (Shields, 2011). Issuance of shares is most often a common source for collecting cash in short-term period.

Sale of Tickets:

Since the company stands for it, i.e. selling tickets is the main source of income of Trainline.com, it is the most important source through which the company collects cash. Trainline.com deals in train tickets. This facilitates the clients through booking seats in train. The company reported a sales figure of £1938116000 in 2016 from selling tickets the websites (Shields, 2011).

Receivables:

Collection from receivables is not actually a different source than that of the main source, that is, selling tickets, it is the due amount that the company owes to customers. Trainline provides services on credit as well. By Shields, (2011), in 2016, the company recorded an amount of £15312100 for receivables.

Retained Earnings:

Companies don’t pay all of the profit earned in any particular accounting period to their shareholders. The portion of net profit held by the company management is called retained earnings (Shields, 2011). The general thought behind this notion is that company management wants to keep cautious measure in order to prevent future uncertain issues. Trainline also retains part of its net profit every year in order to raise cash when needed. In 2016, the company reported £55027000 as retained earnings (Vence-Deza, & Metcalfe, 2012). Retained earnings is a part of trainline.com’s equity & a good source of collecting cash.

These sources are primarily seen on trainline.com. these help trainline.com to continue the business operation. Besides these there is the need of the proper management of the business operation on the basis of the accurate financial information.

These sources of collecting cash helps trainline.com run its day to day operations. The management of the company emphasizes on these sources in order to ensure solution to future uncertain issues as well.

Critical analysis of anything is done through evaluating the advantages & disadvantages of that particular thing (Siegel, & Shim, 2010). There are different sources available for trainline.com. The company prefers& does use the sources of finance based on their advantages. Followings are some of the common sources identified for trainline.com:

Capital through Issuing Shares & Debentures:

For a company like trainline.com, the issuance of shares or debentures is a better & easy source, since this source ensures short-term & quick financing (Siegel, & Shim, 2010). Trainline is an airline ticket selling company & the base income source is ticket-sales. The company needs to ensure short-term financing to run its daily operations. Besides, there are not that much regulatory requirements for secondary share issuance & as a result lesser costs to incur.

Sale of Tickets:

The main source of finance for trainline.com is the sale of airline as mentioned in its charter (Siegel, & Shim, 2010). The company earns its basic income from selling tickets. Whether short-term or long-term, the company is ought to carry on going with this source of finance. The costs associated with this source is the collective costs of operating expenses.

Receivables:

Trainline sells air tickets to its customers on credit as well (Rosenberg, 2013). Even though, this is not a different source than sale of tickets, the management of the company thinks in other way round, since this source ensures financing for future operations. This source doesn’t have any cost unless there is issue of granting discount on timely payment.

Retained Earnings:

Retained earnings is the that portion of net profit which is retained or withheld by the management of the company in order to prepare for future uncertainties (Rosenberg, 2013). Retained earnings is the most popular source of finance for companies like trainline.com, since this source makes sure of short-term & quick financing.

Bank Loans:

Different term loans granted by the banks are also a very common source of finance used by companies (Rosenberg, 2013). Trainline have affiliation with several banks, since the customers pay for the tickets through bank accounts. The company can ensure financing through borrowing loans from banks. There are costs such as interest, borrowing costs etc. There are also some regulatory requirements as well.

The above-mentioned sources are some of the most common sources of finance. Trainline is suggested to understand the relative advantages of each source & then choose the best one considering given situation & opportunities.

Evaluation of Investment Techniques:

Trainline can think of undertaking investment project through evaluating the benefits of the projects. For the evaluation purposes, there are several investment appraisal techniques. Among the various, the very common techniques are payback period (PBP), accounting rate of return (ARR), net present value (NPV). The payback period shows how many years or periods an investment project will take to recover the invested money. It doesn’t consider the time value of money. Accounting rate of return how much accounting profit trainline.com would earn from the average assets invested (Rosenberg, 2013). This technique doesn’t consider cash flows. Net present value is the most popular & significant investment appraisal technique, since it considers all the related cash flows & time value of money. This approach discounts the future cash flows from any project under consideration. Trainline is suggested to choose the best investment technique, the NPV & to choose the investment project that shows the highest positive net present value.

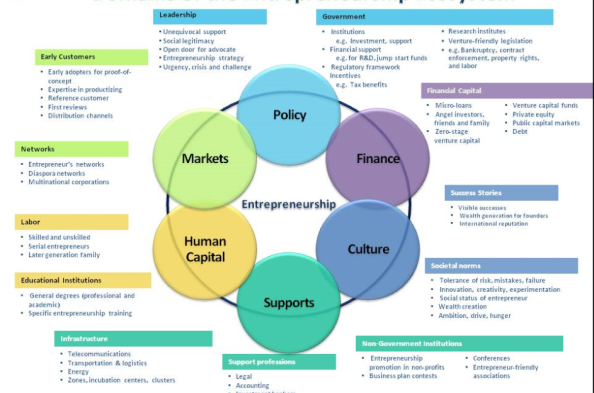

Entrepreneurial ecosystem is the lead frontier for the development of any kind of business organization (Rosenberg, 2013). There are some basic constituents that collectively form the entrepreneurial ecosystem which, in turn, is responsible for developing businesses. This rule works across the whole world, but very little that we are aware of this enormous fact. The fundamental elements that contribute to the development of an Entrepreneurial Ecosystem are Market Situation, Cultural Traits, Policies, Capital, Financial Position & different supporting elements. The general constitutional framework for Entrepreneurial Ecosystem is shown through the following figure:

Capital:

Without capital, no one can think of going for business (Rosenberg, 2013). It is called the life blood of businesses. Capital can be of, in general, two types such as the financial capital & the human capital. Both of these are significant. Human capital or resource is the most important constituent of an organizational setting. Human resource is the precondition for any organization stand by. Trainline needs to ensure proper management of its human resource.

Market Situation:

Market situation generally means the current position of the demand &supply altogether of any market & the interrelation of the driving forces that create the situation (Hussain, & Scott, 2010). Train line must comply with the market situation & provide service accordingly to gain sustainable competitive advantage & to ensure goal achievement through making sure of consistent growth. The company needs to conduct researches & make analysis to have a thorough understanding of the current market situation.

Policies:

Throughout the globe, due to several human & organizational needs, policies have been being developed & renovated across generations (Hussain, & Scott, 2010). These policies are developed to deal with the situations associated with different human needs. There are policies for businesses as well. Since trainline.com is a business organization that bases its operations through internet, the policies so enactedby the government of the UK are ought to be complied with by trainline.com.

Financial Position:

Since finance is the base for capital, it is also referred to as the life blood of businesses. Firms need to look for different sources to finance. Trainline needs to cope up with the basic management of financing for any project (Hussain, & Scott, 2010). The company needs to figure out where to get the funds from, where to invest the collected funds, & how to deal with interest settlements in order to develop the business situation.

Cultural Traits:

Cultural traits, norms, beliefs, values add greatly to the entrepreneurial ecosystem (Hussain, & Scott, 2010). The organization setting highly depends on the way people around the organization behave, perceive & interact with each other. Trainline needs to understand the cultural traits of the customers to get along with sustainable development. Entrepreneurial ecosystem through its culture component influences the business environment both in terms of emergence & development.

Supporting Elements:

According to Rosenberg, (2013), Different supporting elements such as legal infrastructure, reporting (bookkeeping & accounting) systems, corporate social responsibilities, social marketing etc. are also responsible for the development of entrepreneurial ecosystem surrounding a business. These elements may be favourable or unfavourable. Trainline needs to make appropriate analysis & derive meaningful conclusions to deal with these elements to ensure improvement.

The above discussed elements or constituents are responsible for entrepreneurial ecosystem. Through these collectively structured constituents, the entrepreneurial ecosystem is responsible for the development of businesses across the world.

When a company has the scope &abilities to go from private limited to publiclimited, it has to go through making Initial Public Offering (IPO), i.e. issuing primary shares through enlisting & registration into the regulatory authority of that particular country or region (Fardon, & Cox, 2014). For trainline.com to go for IPO, it must enlist into the London Stock Exchange, UK. Along with the scope & abilities, there are some ethical considerations as well to go for IPO. The ethical considerations are as follows:

Ensured Forecast Result:

If trainline.com can ensure that the forecast so made by the accountants or the professionals associated will be feasible in the long run for the development of the company & will not bring about any severe challenges for the stake of all the shareholders, the company may wish to go for making initial public offering (Fardon, & Cox, 2014). It can be said that this is the first & foremost stage where any firm can think of going public limited.

Reported Income & Financial Position:

Even though reported income figure & financial position as shown in the financial statements are not completely an ethical requirement for a company to go for IPO, the relative values associated with these requirements sometimes add greatly to the ethical considerations for going public. An expression of this fact is the need for full disclosure principle of accounting. Trainline must provide information of reported income, financial position to the stakeholders’ full extent. In 2016, trainline.com reported equity value of £56158000& liability amounting £162990000 (Dean, & Schwindt, 2015). The amount of accounts receivables is £153121000 that gives the notion of income in that accounting period amounting £32931000 (Dean, & Schwindt, 2015).

Shareholders’ Consent:

Before going for IPO, the trainline.com needs to arrange statutory meeting with the shareholders (Dalton, 2013). It will be considered unethical, if the company goes for IPO without letting the shareholders know about the issue. Not only does trainline.com have to let the shareholders know the issue of going for IPO, but also the company has to have strong agreement from all of the members.

Employment of Independent Auditor:

To ensure bias free situation, trainline.com needs to appoint independent auditors who would check & analyze the financial situation of the company through auditing financial statements (Dalton, 2013). If the auditors provide positive opinion about the reliability of the financial information so provided through the financial statements, then & only then trainline.com is allowed to go for IPO. Even though this requirement is a legal one, contributes to the ethical consideration in the sense that the fulfilment of this requirement reduces legal obligations of both shareholders & the government. The company should not disrespect the rights of shareholders or stakeholders as a whole before going public.

These are the some of the core ethical considerations that the concerned firm is suggested to comply with in order to go for IPO (Dalton, 2013). After making analysis of the situation so brought up here by the given information of Trainline, it can be said that the company is able to go for Initial Public Offering.

The effort to evaluate a firm’s performance based on ratios with the objective to make investment decisions is appreciable. There are several key factors that collectively ensure the success of the business. The Trainline company has been able to cope up with the drastically changing business environment. The company had its different sources of finance. The company evaluated, & analyzed different investment appraisal techniques to get along with projects with opportunities which, in turn, ensure growth. By getting through the business line with consistent & constant growth, the Trainline can obtain sustainable competitive advantage. The certain ethical issues that have the full privy to influence the decision to go for IPO. Accounting & financial analysis is necessary, since right decision comes out of right information. These analyses provide decisionmakers with the right information.

Berk, J., & DeMarzo, P. (2017). Corporate finance. Harlow, England: Pearson.

Cassedy, P. (2014). Finance. San Diego, Calif.: Lucent Books.

Clark, R., & Baker, D. (2011). Finance. Oxford: Oxford University Press.

Dalton, H. (2013). Principles of Public Finance. Hoboken: Taylor and Francis.

Dean, J., & Schwindt, R. (2015). FinanceI. Durham: Eno River Press.

Fardon, M., & Cox, D. (2014). Finance. Worcester: Osborne.

Hussain, J., & Scott, J. (2010) Research handbook on entrepreneurial finance.

Rosenberg, S. (2013). Finance. New York, N.Y.: Facts on File Publications.

Shields, D. (2011). Finance. Oxford: ISIS Large Print.

Siegel, J., & Shim, J. (2010). Finance. New York: Barron’s.

Vence-Deza, X., & Metcalfe, J. (2012). Wealth from Diversity. Boston, MA: Springer US.