Financial Literacy and Stock Market Participation

THE RELATIONSHIP BETWEEN FINANCIAL LITERACY AND STOCK MARKET PARTICIPATION BY RETAIL INVESTORS IN NEPAL

Financial literacy is defined as education and understanding of various financial areas such as personal finance, corporate finance, financial services, public finance etc. It focuses on the ability to manage personal finance matters in an efficient and effective manner, and it includes the knowledge of making appropriate decisions about personal finance such as investing, insurance, real estate, paying for college, budgeting, retirement and tax planning. (Investopedia). Financial literacy alerts individual to save money for their retirement period. Investments in financial asset helps them to increase their future wealth. Lusardi & Mitchell (2008) write more financially literate people are more likely to plan for retirement and as a result they accumulate more wealth thus they participate in stock market . Guiso & Jappelli (2008), Kimball & Shumway (2007), Lusardi & Mitchell (2006, 2007), and Lusardi & Tufano (2009) (in Calcagno & Monticone, 2011) confirm that knowledge about basic financial principles in consumer and products is scarce and may not be sufficient to guarantee that individuals make sound financial decisions. Less knowledge of financial literacy means little knowledge of financial matters and terms related to them such as interest rates and risk minimizing techniques. Retail Investors who has little or no knowledge of finance, that is a person who is not financially sophisticated, is more likely to fall prey to high cost borrowing and pay a great amount of money to attainment different financial services (Lusardi and Mitchell, 2011) . The financially literate persons have more financial wealth (Lusardi, 2004). The leading to the financial crisis of 2007 was financial illiteracy . It is important for decision makers to integrate financial knowledge and skills with real life processes leading to better financial interests (Atkinson and Messy).

1.1.2 Stock Market Participation

Share trading in Nepal dates back to 1937 when the flotation of shares by Biratnagar Jute Mills Ltd. and Nepal Bank Ltd commenced the share trading which were involved in opening plantations in Nepal .

The establishment of a formal stock exchange took place in 13 January 1994 with the incorporation of the Nepal Stock Exchange (NEPSE), which took over the Securities Exchange Center Ltd. established in 1976. It currently has a membership of 2 market makers 50 stock brokers. As per the Securities Act 2007, rules and by-laws they operate on the trading floor.

The Nepal Stock Exchange (Nepal) is the main stock exchange in Nepal. It is one of the modern stock exchanges in South Asia, providing a fully automated trading platform. NEPSE operates the market on the ‘NEPSE Automated Trading System ‘(NATS. It adopts the principle of an order driven market. NATS is used to purchase & sell physical as well as dematerialized securities. The basic objective of NEPSE is to create without cost marketability and liquidity to the government and corporate securities which is done by facilitating transactions via market intermediaries such as brokers and market makers, etc. in its trading floor. The headquarters of the NEPSE have been situated at Singha Durbar Plaza, Kathmandu Nepal

Nepal Stock Exchange is the only stock exchange licensed by the Securities Board of Nepal (SEBON). It was nearly 23 years ago that, formalized share trading commenced in Nepal under the Government of Nepal and trading was conducted under the rules and by laws formulated by the Association.

It was only as recent as in 1994, that share trading in Nepal took a new turn with the establishment of a public trading floor and the introduction of the “open outcry” system of trading until 2007. In 2007, NEPSE moved to screen-based trading from open outcry by setting up Wide Area Network. It enabled stock brokers to be connected with NEPSE’s server from their offices. The partial automation of stock trading has helped boost transaction volume. NEPSE has adopted a T+3 system. It implies that after 3 days of Trading, settlement of transactions should be done.

The clearing and settlement procedures of the Nepal Stock Exchange were automated in 2011 with the establishment of the CDS and Clearing Limited. It is a company established under the company act promoted by NEPSE. The depository is known as the Central Depository System (CDS). CDS performs the role of central depository for Equity, Bonds etc. to handle these securities in dematerialized form.

In 1994, an Over the Counter market for trading of unlisted shares was introduced for the first time in Nepal, Securities Exchange Center (SEC) managed the operation of secondary market over-the-counter facility.

The delisted firms and state-owned corporations registers with the over the counter market (OTC) to allow trade of their shares. Shares without others finding out the price at which the transaction was done, can be bought and sold at the OTC market. Thus, the OTC market is less transparent than stock exchanges, and are also subject to fewer regulations in practice. The OTC market is rarely used to trades shares in Nepal. In 2012, shares of Nepal Bank Limited were traded in the OTC market for the first time where 71,928 Nepal Bank shares were transferred to its 2,664 employees that belonged to government.

SEBON as the market regulator has been concentrating its efforts on intensifying statutory and legal frameworks which are the bases for the healthy development of Nepalese stock market. The main objective of SEBON is to flourish and safeguard the interest of investors by regulating the securities market, to supervise the entire stock market, sale and distribution of securities and purchase, sale or exchange of securities. SEBON provides licenses to stock exchange and securities business person. It also monitors the activities carried by stock exchange to know if they are in accordance with the laws, bye laws or not. As per the securities regulations the depository functions such as safekeeping, deposit, and securities certificates withdrawal and transfer of ownership/rights of the said instruments of Securities will be carried out by SEBON. Nepalese stock market is still underdeveloped and there is lapse that needs to be identified. Hence, the present study is conducted in order to find investors awareness and participation in Nepalese stock market.

1.1.3 Retail Investors in Nepal

Investing Answers defines retail investors as an individual who purchases securities for his or her own personal account rather than for an organization. Generally retail investors trade in much smaller amounts than institutional investors such as pensions and mutual funds. Unfortunately, there is no data on the investors. But estimates are that there could be nearly 1 million retail investors (Ghimire, 2016) .The major problems of the stock market are unavailability of information, influenced by small number of large investors, insufficiency of legal rules and regulations, insufficient number of brokers and issue managers rumor based market, insufficient knowledge of investors etc. The retail investors are mainly driven by the rumor based market. (Dahal, 2010) .

1.1.4 Stock Market Participation and Financial Literacy

While reviewing the previous research, I found that financial literacy can have direct implications on stock market participation by retail investors . People with low financial literacy are more likely to have problems with debt (Lusardi and Tufano 2009), are less likely to participate in the stock market (van Rooij, Lusardi and Alessie 2007), are less likely to choose mutual funds with lower fees (Hastings and Tejeda-Ashton, 2008), are less likely to accumulate wealth and manage wealth effectively (Stango and Zinman, 2007; Hilgert, Hogarth and Beverly 2003).

1.2 Statement of Problem

There has been few research conducted on financial literacy in Nepal. Some of them are

(Bharat Singh Thapa, 2015) College students have basic level of financial knowledge and their level of financial knowledge is determined by their family income, age, stream of education, type of college they study and their financial attitude. The study found that in basic level of finance, students are more knowledgeable while students are less familiar with bank credit, taxes, financial statement, insurance, and share markets.

(Chaulagain, 2015) Financial literacy of individuals increases the likelihood of access to sustainable finance for identifying and consuming appropriate financial services competitively. The financial literacy is necessary but not sufficient condition for enhancing access to finance, neither it is a panacea for all the financial problems.

Baidhya and Parajuli (2004) Awareness increase amongst the general public about the capital market, regarding nature of risk and return, through promotional campaigns, seminars, publications, and programs in FM/TV etc.

In those research, they are focused about determinant of financial literacy and stock market awareness. In this research, we are concerned about the relationship between financial literacy and stock market participation by retail investors in Nepal. Probably this research has never been conducted in Nepal before.

This research tends to meet the shortcoming of comprehensive measures of financial literacy and is linked with the economic outcome: Stock market participation by Nepali retail investors.

1.3 Research Objectives

The main objective of this study is to find out the relationship between financial literacy and stock market participation by retail investors in Nepal and to measure retail investors financial knowledge.

1.4 Signification of the study

The findings of this study will be useful to Nepal Stock exchange (NEPSE), Security Board of Nepal (SEBON), Policy makers, individual retail investors and different government agencies. With the help of my research, people will be able to know the impact of financial literacy on stock market participation by retail investors. My research will help the academic sector and business school students.

Part of the core activity of the Securities Board of Nepal is investor education and awareness. As such the SEBON has a division to facilitates this divisions. Different financial awareness programs have been actively conducted over the years in diverse location. With this research, SEBON can formulate targeted financial literacy programmes, especially on stock market.

1.5Â Limitation of the study

There will certain limitation while doing this study .

- There is time constraint of 6 months

- Study is conducted in Kathmandu area only .

- The respondent while doing survey may not be willing to give the proper data

1.6 Research question/hypotheses

Research Question

- What is the relationship between financial literacy and stock market participation by retail investors in Nepal?

Hypothesis 1:

Null Hypothesis: (There is no significant relationship between financial literacy and stock market participation by retail investors in Nepal.)

.

Hypothesis 2:

Null Hypothesis: (Gender, age, level of education and specialization on personal financial management has no impact on stock market participation by retail investor in Nepal) .

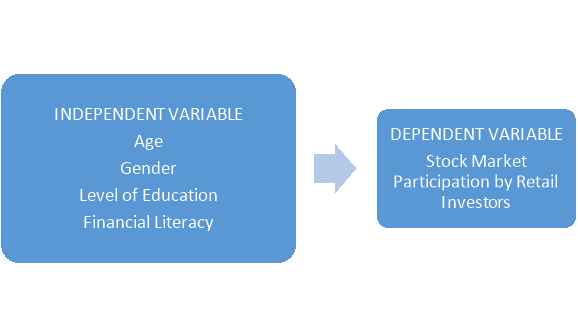

1.7 Theoritical framework

The theoretical framework is developed as it serves as a foundation on which the entire research is based .

Investors awareness is referred as the investor literacy and updated information about the investment environment. Investors׳ exposure and information about the industry is measured by the level of awareness. Many research has been conducted in this area. some of them are:

Paudyal (2010) Nepal particularly can learn from Indian market. India has formed National Institute of Securities Market (NISM) with huge physical infrastructure with the collaboration of industrial houses and different universities regarding investors’ education and awareness. Similarly, it can learn in the areas of the functioning of stock exchange central depository system of securities, instruments diversification, investors’ education and awareness building, adoption of information technology and opening the secondary market for NRN and foreign institutional investors (FIIs).

Baidhya and Parajuli (2004) Promotional campaigns, seminars, publications, and programs in FM/TV etc. can be used to increase awareness amongst the general public about the capital market, regarding nature of risk and return.

Volpe et al. (2002)Â Investors’ knowledge varied with people’s age, experience, education, income and gender. The online investors are more likely to be influenced by financial misinformation and manipulation. So, they should have more knowledge about stocks than normal investors to succeed in the securities market.

Maditinos et al. (2007) Professional investors rely more on fundamental and technical analysis whilst individual investors rely more on noise in the market and newspapers/media when making their investment decisions.

Jagongo and Mutswenje (2014) The very important factors that guide individual investment decisions were: reputation and firms’ status in industry, expected corporate earnings, expected divided by investors, and past performance firms stock.

Luigi Guiso and Tullio Jappelli on “Awareness and Stock Market Participation” was conducted in 1995 and 1998.  The objective of this study was a) to analyze the lack of awareness of financial assets (1995 and 1998) in Bank of Italy Surveys of Household Income and Wealth. b) to explore the determinants of awareness c) to find that the probability that survey respondents are aware of stocks, investments accounts and mutual fund is positively correlated with education, household resources, long- term bank relations and proxies for social interaction.

Haliassos and Bertaut (1995) They investigated factors explaining financial education and finding among its results whether university education influences more weight in the decision to invest in the stock market or those with lower educational provision, preferring savings deposits as an investment option.

Attanasio, Banks, and Tanner (2002) They studied about implications of limited participation in stock markets and the asset market. Their finding shows that a) the probability of having or invest in assets, is associated with factors such as age, and educational level b) the positive effect of higher education in the stock market tends to decrease over time.

Roncallo (2009) In his findings, Colombian capital market was backward in comparison to developed countries, Latin American countries, and several Asian countries due to the lack of knowledge and awareness of the general public and businesses. And also, highlights that the creation of specially designed market such as the Centre for development of the capital market institutions, for the strengthening and development of this market, has failed to make a real impact on the target audience i.e. businesses and the general public, evidenced in the lack of knowledge about the importance and functioning of the capital market.

(Chaulagain, 2015) Financial literacy of individuals increases the likelihood of access to sustainable finance for identifying and consuming appropriate financial services competitively. The financial literacy is necessary but not sufficient condition for enhancing access to finance, neither it is a panacea for all the financial problems.

Baidhya and Parajuli (2004) Awareness increase amongst the general public about the capital market, regarding nature of risk and return, through promotional campaigns, seminars, publications, and programs in FM/TV etc.

3.1 Research Design

A detailed outline of how an investigation will take place. A research design will typically include how data is to be collected, what instruments will be employed, how the instruments will be used and the intended means for analyzing data collected (Business Dictionary, 2016) . Descriptive survey research design will be used because research intended to explore the relationship between different variables which forms financial literacy and stock market participation by retail investors .

3.2 Population and Sample Size

The population of study will be comprised of key players in the stock market, which includes investors, employees working in stock market and stock brokers. This study will be based in capital city Kathmandu, where stock market activities are concentrated and people get involved in share market from around the country. The sample size for study will be as per convenience-sampling technique and respondents will be selected as per their convenient accessibility.

3.3 Nature and Source of Data

This study is both quantitative and qualitative in nature. It uses primary data obtained through questionnaires for analysis. Questionnaires are the most commonly used instrument in gathering and measuring qualitative data because they present the same questions to all respondents thereby fostering a comparable basis for assessment.

3.4 Instrumentation of Data

Different statistical techniques will be used for analyzing data, which includes regression analysis and descriptive statistics . Graphs, frequency tables and charts were used for results

3.5 Models Specification

The model that will be used in this study is based on the equation and econometric model adopted from Chong & Lal, (2011) as below

Y= β0 + β1 +β2 +β3 +β4 + ∈

Where: Y = Stock market participation.

βo= constant term

β1 = Financial Literacy Score

β2 = Age of respondent

β3 = Gender of respondent

β4 = Income of respondent

∈= disturbance term with an expected value of zero.

The model helps better understand how the independent variables are related to the dependent variable and explored the form of their relationship.

3.6 Reliability and Validity of Data

The research superviser and research expert of Business school will be requested to evaluate the applicability and validity of the research . Pre-test and re-test method will be done before the actual research .

Bharat Singh Thapa, S. R. (2015). Financial Literacy in Nepal: A Survey Analysis from College Students. Financial Literacy in Nepal: A Survey Analysis from College Students, 26.

Business Dictionary. (2016, 12 17). Retrieved from BusinessDictionary.com. WebFinance, Inc. : http://www.businessdictionary.com/definition/research-design.html

CDS and Clearing Limited. (2011). Retrieved from CDS and Clearing Limited: http://www.cdscnp.com/

Chaulagain, R. P. (2015). Financial Literacy for Increasing Sustainable Access to Finance in Nepal. NRB Working Paper series, 18.

Dahal, S. (2010). A STUDY ON NEPALESE STOCK MARKET IN THE LIGHT OF ITS GROWTH, PROBLEMS AND PROSPECTS. Kathmandu.

Ghimire, S. (2016, December 8). Retail Share Investors In Nepal. (K. Timilsina, Interviewer)

Investopedia. (n.d.). Retrieved from Investopedia: http://www.investopedia.com/terms/f/financial-literacy.asp

Investopedia . (n.d.). Retrieved from NASDAQ: IAC: http://www.investopedia.com/terms/o/over-the-countermarket.asp

Kathmandupost. (n.d.). Retrieved from Ekantipur: http://kathmandupost.ekantipur.com/news/2015-09-23/nepse-urges-otc-trade-of-shares.html

NepalShareMarket. (n.d.). Retrieved from NepalShareMarket: http://www.nepalsharemarket.com/NepalShareMarket/NEPSE/Analysis/news/printerfriendly_news.aspx?news_id=NEW-003992

Securities Board Of Nepal . (n.d.). Retrieved from SEBON: http://www.sebon.gov.np/

The Himalayan TImes. (n.d.). Retrieved from http://thehimalayantimes.com/business/capital-market-may-need-another-exchange-to-spark-competition/

Wikipedia. (n.d.). Retrieved from Wikipedia: https://en.wikipedia.org/wiki/Nepal_Stock_Exchange