Financial Report on Abans Electrical PLC

Table of Contents

2.Abbreviations included in the Report………………………………………………………..

3. Sri Lanka Electricals Industry at Overview………………………………………………

4. Introduction of Abans Electricals PLC………………………………………………………

5. Profitability Analysis………………………………………………………………………..

6.Efficiency / Underwriting Analysis…………………………………………………………

7.Solvency Analysis…………………………………………………………………………….

8.Market Base Ratio Analysis………………………………………………………………….

9.Recommendations and Conclusion…………………………………………………………

10. Reference………………………………………………………………………………..

11.Annexures………………………………………………………………………………….

Executive summary

Public listed companies prepare and present their annual reports included of the financial statements in order to persuade the diversified information and regulatory requirements of different stakeholders and you can divide the into two user groups (The Investor group / Preference share holders),

The Investor group look for mainly in a financial statement is Profitability ( especially future profitability ), management efficiency ( effective utilization of assets ), Return on Investment-ROI (Within the firm / Alternatives), Risk taken ( Financial risks and business risk), Return to owners (Dividends/Drawings) and the Preference share holders look for mainly Future profitability, Net realization value of assets and extent to which dividends are covered by profit,

This reports analyses the reported performance of the market leader of the Sri Lankan Electricals Industry, Abans Electricals PLC covering the profitability, efficiency, solvency and market based ratios. The report has been prepared highlighting the fact that the above aspects of an electrical company are being measured and evaluated using industry specific measures where applicable, which are not common to other industries. Recommendations have been made for improvement based on the analysis, in the areas which has room for improvement and better performance.

2. Abbreviations Included in the report

- Sri Lanka Ports Authority market Intelligence report

- Abans Electricals PLC

- ROE – Return on Equity (Profit)

- ROA – Return on Assets

- ROR – Return on Revenue

- EPS – Earnings per share

3. Sri Lanka Electricals Industry at a Overview

Sri Lanka Ports Authority market Intelligence report as below given report there are mainly 9 key electricalcompany dominating the market, as per the two of companies are registered members of Chamber of commerce Sri lanka Import section and main two significant players are given in below chat hold 75% share of the total market, with government tax of imported electronics goods revision to embark of the vision of Sri lanaka current government & president vision make Sri lanka also like Dubai, Singapore, Hong kong a hub for duty free and duty paid competitive electronic goods seller to attract tourism industry,

Industry Player as 2013

|

CATEGORY |

CONSIGNEE |

CONTAINERS |

|

ELECTRICAL GOODS IMPORTERS |

ABANS ELECTRICALS PLC |

2534 |

|

SINGER SRI LANKA PLC |

1219 |

|

|

UNI WALKERS LTD,,,,. |

443 |

|

|

EVEREST INDL LANKA CO LTD |

161 |

|

|

RICH WORLD INTL. |

151 |

|

|

TELESONIC LANKA, |

148 |

|

|

SINGHAGIRI PVT LTD |

147 |

|

|

DAMRO ELECTRONICS PVT LTD. |

140 |

4. Introduction of Abans Electricals PLC

Incorporated in 1981, Abans PLC is the vital trading arm of the Abans Group, representing world famous brands of electric and electronic home appliances, crockery and cookware, sanitary and light fittings and a host of other household items that make Sri Lankan people’s lives easier and better,Abans PLC have a network of over 230 showrooms throughout Sri Lanka with their main showrooms located in three floors of their group head office on the main thoroughfare in the heart of the Colombo City, with 14 more elite showrooms in Liberty Plaza, Rajagiriya, Mt Lavinia, Welisara, Dehiwala, Katunayaka, Anuradhapura, Peliyagoda, Malabe, Maharagama, Kalutara, Kandy etc. Abans also have more than 400 authorized dealers representing them in the remotest rural areas bringing their products within reach of each family and every household in the country. All products sold by Abans carry a trusted guarantee of quality and reliable after sales service.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Profitability Analysis

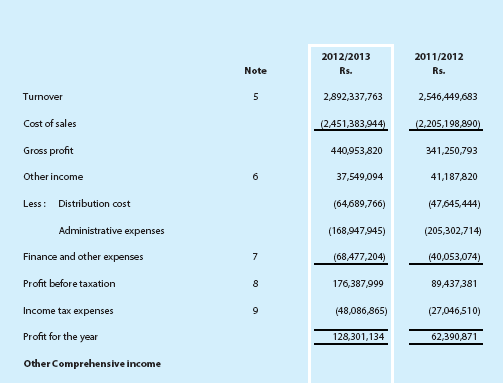

Profitability analysis is very important for management and the investors as it gives an indication whether the company has performed up to the expectations and whether to invest in a company’s stocks. According to Abans Electrical PLC annual report the share holder and investor information profitability measure on selling of goods compare to previous year,

It clear shows a growth on sales 2013/2012 compare to 2011/2012 grown by 13% and The profit however, increase by over 97%,

Source: Statement of Comprehensive Income For the Year Ended 31st March 2013

Source: Statement of Comprehensive Income For the Year Ended 31st March 2013

5.1 ROR – This is the profit after deducting all expenses and taxes, which determines the profitability of the company.

ROR = Net Operating Income / Total Revenues

For Year 2013 = 128, 301, 134 / 2892, 337,763

= 4.4%

For Year 2012 =62390871 / 2546,449, 683

= 2.4 %

Accordingly the company has increase it’s ROR 2% during the year increasing profitability.

5.2 ROE – This showcase the net profits that are earned and returned to equity shareholders.

ROE = (Net Operating Income ( less preferred stock dividends / Average common equity )

For year 2013 = 128,301,134- 0 / 551, 054920

= 23%

For year 2012 = 62390871 / 429,967, 401

= 14%

ROE has been increased by 9% promising higher returns to the shareholders of the company.

5.3 ROA – The profitability on existing investment securities and premiums are measured using this ratio.

ROA = ( Net Operating Income / Mean Average Assets )

For year 2013 = 128, 301, 134 + 48,086,865 / 198, 845, 7597

= 8.8%

For year 2012= 639,0871 + 27046510 / 120 8902, 531

= 7.3 %

There is a slight decrease in the ROA due to the rapid increase of assets during the financial year 2013, compare to 2012.

5.4 Share base Earnings – These ratios measures the share based profitability and earnings of the company. The relevant ratios are follows,

Source: Statement of Comprehensive Income For the Year Ended 31st March 2013

6. Efficiency / Underwriting Analysis

Efficiency Ratio mainly use to aims the access of management efficiency of the business following will few analysis self made to analysis efficiency level of Abans Electrical PLC,

6.1 Debtors’ Turnover = Sales / Debtors

For year 2013 = 289,233, 776,3 / 59,588,576

= 48.5 times

For year 2012 = 2546,449, 683 / 40196076

= 63.3 times

Debtor’s collection period = 365 days / Debtors Turn over

For year 2013 = 365 days / 48.5 times

= 7.5 days

For year 2012 = 365 days / 63.3 times

= 6 days

Abans PLC have been maintain 1 days difference on outstanding collection days compare to 2013/2012,

7. Solvency Analysis

Solvency is again another area where industry specific measurement are in place to measure the solvency of industry, solvency is a very important and essential for customer to maintain consistence level of solvency margins and you can define Solvency in two groups one is short term solvency / long term solvency ratios,

Abans Electrical PLC short terms Solvency Ratios as follows,

Current Ratio = Current Assets / Current Liabilities

For 2013 = 1547035 / 1355743 = 1.14 times

For 2012 = 951146 / 735746 = 1.29 times

Quick Ratio = Share Capital / Current Liabilities

For 2013 = 4258800 / 1355743 = 3.14 times

For 212 = 122,850, 000/ 735740 = 166 times

Abans Electrical PLC Long Term Solvency Ratios as follows,

Depth Equity = Total Liabilities / Total Share holders’ equity

For 2013 = 1437402 / 551,055 = 2.60 times

For 2012 = 778935 / 429,967 = 1.81 times

Leverage ratio = Total Assets / Total Share holders’ equity

For 2013 = 1988457 / 551,055 = 3.60 times

For 2012 = 1,208, 902 / 429,967 = 2.81 times

Compare with short term Solvency Ratios and Long term Solvency Ratios the shows Abans Electrical PLC has been able to maintain very healthy solvency margin, which is 0.79 times an increase compare to previous year.

8. Market base Ratio Analysis

Market base ratio Analysis means primary focus on performance and value of the company shares in stock market. Below table represent a comprehensive summary of all market base ratios of Abans Electrical PLC,

Given the below table shows a positive growth during the finical year 2011, further we can see Abans Electrical PLC have executing set goal’s and strategic objectives are met will attack more and more investors.

Source: Statement of Comprehensive Income For the Year Ended 31st March 2013

9. Recommendation and Conclusion

Profitability – Abans Electrical PLC shown 14.43 % increase on Earning per Share and Comprehensive income for the year incremental by 61,429,945 which double income compare with previous year, this records company is moving forward solid growth under blue ocean strategy earning supreme profitability, below table explain by recommendation supported by numbers,

Source: Statement of Comprehensive Income For the Year Ended 31st March 2013

Market Ranking

How to continue the achievement in the coming financial year is due to introduction of new product manufacturing and contribution of the Service Division which has enhanced the share

value to stake holders and provided an opportunity to the company for expansion into new lines of manufacture. Despite global and domestic challenges, the company has introduced products of world renowned brands to increase revenue and enhance customer confidence. The management continuously negotiates terms and conditions with suppliers in order to bring down costs and be competitive in pricing while maintaining high standards of

quality, this should be key Abans Electrical should maintain to have a edge over competitors

Financial risk management

However the negative side to notice is the main factors influence the financial risk of the organization links with its credit risk and market risk. Under the market, risk, interest rate risk and exchange rate risk are prominent. Credit risk of the organization has been mitigated with the evaluation of proper credit term for credit worthy customers and obtaining extended credit terms with supplier. The frequent changes in interest rates are negotiated in line with the intended cost of capital of the organization. Exchange rates are managed with proper negotiation and absorbed to cost structure in advance

In conclusion Abans Electrical PLC is a comprehensive performance driven company reach supreme profitability to be one step ahead than competitor to strive for market leadership among the local competitors and it should good impression attract new investors / new share holders to delivery greater return on shares purchase.

References

Abans Group , Profile (2013) available at http://www.abansgroup.com Accessed on 24 May 2014

Annual Report of 2013/2-13 Abans Electrical PLC ( A copy submitted along with the assignment )

1 | Page

Order Now