Internet of Things (IoT) in Insurance

There are many Insurers with well-defined IoT based solutions in their core business product space, such as Usage-Based Insurance in auto insurance, discounted smart sensor device offers etc. Large Property and Casualty (P&C) insurers have been watching the IoT technology space mature over a period of last couple of years, and thus have capitalized well on their learnings and analysis. Expectations from IoT continues to grow in the field of insurance.

IoT is not just about the connected devices, but any IoT solution is incomplete without capturing the real-time and relevant data. This captured data should be available in cloud, to have the ability to run advanced analytics to provide appropriate customer and other stakeholder dashboards. It is key for the insurers to leverage their existing high volume of data, and develop the ability to drive improved outcomes for customers, brokers & partners.

In this article, we review the journey of IoT in the insurance industry, and we discuss what to expect from IoT in future. Other aspects of this article includes the impact of other technology trends with IoT, such as Blockchain, Artificial Intelligence, Natural Language processing etc.

Influence in P&C (Property & Casualty) and (Life & Annuities) L&A industries

IoT has been able to mark its impact in P&C market, but L&A market still needs exploring opportunities. P&C insurers have deployed more IoT projects than L&A players have. Connected ecosystem is one of the core IoT trends in the insurance space. Approximately 34 percent of customers have indicated that they would be inclined to smart homes and real estates. Close to follow in terms of trends are the wearables with 30 percent customer interest. In terms of numbers, L&A has only 5% projects deployed, whereas in P&C percentage is 12%. The trends clearly indicate that growth of IoT based solutions in both the domains is obvious. As IoT grows in adoption, leading insurers will find ways to leverage the data available from these technologies to improve operations and better engage customers.

BI Intelligence recently projected that by 2020, there will be over 34 billion connected IoT devices, and over $6 trillion spent on IoT solutions in the next 5 years. With this expected growth in IoT and wearables, insurers need to plan for their use by consumers and the impact of these devices on consumer behavior and expectations.

Below are a couple of success stories in the P&C world where IoT has played a significant role in improving their business:

Progressive Snapshot®

Progressive insurance group’s Snapshot® product is a flagship initiative that primary deals with IoT and high volume of data with analytics to provide Usage-based insurance to its customers. Its primary intent is to reward good driving, and thereby encourage insureds to save in their insurance costs.  Snapshot® is an OBD II based simple device that pluggable into most modern cars. This device keeps a track on the driving habits such as usage of brakes, average speed etc., along with other relevant data such as time of driving etc.

Liberty Mutual – Google Nest

Liberty Mutual has collaborated with Google Nest to provide its customers an ability to prevent perils. Customers are offered the Nest protect device along with their insurance at no extra cost. This IoT device helps customers identify and alert on critical parameters such as smoke, CO emission levels, temperature variations etc. It rewards the insureds for staying safe.

Challenges and Barriers for IoT in insurance

Some of the apparent challenges that comes along with IoT based solutions in the insurance industry are:

- Security Risk

IoT is susceptible to cyberattacks as it involves multiple devices and multiple protocols. IoT based solutions are effective with very large volumes of data flow between entities, over networks and many a times over public networks. Such solutions make the Insurance Company vulnerable to interceptions.

Large investments are required to secure IoT generated data, to avoid intrusions as well as misuses of such data for fraudulent activities. IoT solutions should include a clear focus on identifying and addressing the possible security risks and threats as an important aspect. Insurers and the insureds should understand the security dimension of such solutions to ensure appropriate measures are in place.

- Data Volume management

Strength of IoT solution is to provide and capture data (real-time in most cases), which is added to the Insurers big data repositories. Such large datasets are the assets for the insurance companies and the whole solution relies on how stakeholders utilize these large volumes for the benefit of all. With large data volumes, comes the volume management challenges that requires significant planning and appropriate enterprise strategy.  It is also very important to plan the inclusion of the IoT real-time data with the historic data such as Policy, Client, and Claims data etc.

Data ownership is also a challenge with IoT data management strategies. It is always a challenge to understand if the data belongs to the insured or the insurer. There are other data challenges such as privacy, data tampering etc., which need absolute attention from the Insurers while defining and establishing a long-term solution.

- Standardization and Regulation

With an increasing trend of growing numbers of IoT devices, interoperability is already a challenge. Plenty of startups as well as large players are trying to capitalize on the IoT market by deploying and integrating devices. With lack of regulations and agreements in place, the IoT solutions are bound to fail. There have been quite a few initiatives by many players on this front, but the process maturity will take some time.

- Disruption to existing large business models

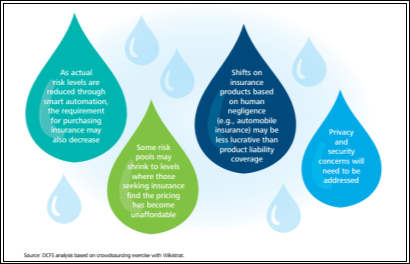

Insurance industry’s business relies on the right balance between the volume of risk managed, and the claims associated with the covered risks. To understand this better, insurers always seek to contain the volume of claims by preventive measures to have a good handle on the loss ratio. This leads to have a direct impact on their written premium to losses ratio and thus improves their margins.  IoT solutions give a great advantage in avoidance of claims by providing relevant indications and alerts for most of the critical major perils.

Insurance industry’s business relies on the right balance between the volume of risk managed, and the claims associated with the covered risks. To understand this better, insurers always seek to contain the volume of claims by preventive measures to have a good handle on the loss ratio. This leads to have a direct impact on their written premium to losses ratio and thus improves their margins.  IoT solutions give a great advantage in avoidance of claims by providing relevant indications and alerts for most of the critical major perils.

There is always a threshold to such business theory because if the claims keep going down then it will have a direct effect on bringing down the premiums as well. Insurers need to ensure the IoT based solutions provide the right balance and manage the alignment between solutions and core business models.

IoT – with other technologies

Insurance industry has recognized the importance of IoT in its business, and we have seen a clear growth trend for the last couple of years. We believe that the trend will continue in the same direction, with an increase in the implementations of IoT based solutions. IoT solutions involve multiple technologies to maximize benefits for stakeholders. For example, IoT solutions are inclusive of Analytics, Cloud, protocol management etc.

Some of the other trends where we see an immediate impact in the insurance industry are:

Natural Language Processing

Talking to devices is not something new for the human beings. We have had our smartphone based digital assistants in existence for quite long now.  Amazon echo has already pioneered in the home digital assistant space. Imagine a situation where an IoT device like Amazon echo, captures the conversations by a senior citizen living alone. IoT devices can be extremely beneficial in emergencies for senior homes, and NLP capabilities to such sensors can help prevent any medical situation by understanding, processing and alerting appropriate agencies for help.

NLP and Text processing is predicted to have a positive disruption in the insurance industry by providing abilities such as information retrieval from unstructured data, sentimental analysis to streamline the flow of information to customers thereby improving customer relationships, kiosk based Chabot etc.

Blockchain

Blockchain looks very promising when it comes to providing some of the challenges that IoT solutions possess. Roadblocks such as inorganic scaling of IoT devices (without identity, or interoperability), information and privacy concerns etc. can leverage the fundamental principles of Blockchain technology for an appropriate resolution. We foresee Blockchain considered as a heavyweight partner technology for IoT based initiatives.

Insurance companies and their technology arms will need to understand and implement the appropriate solutions involving Blockchain. Blockchain comes with its own baggage of challenges hence we recommend a thorough study of the problem scenario.

Artificial Intelligence

IoT generates high volumes of data, and such significant and relevant data is of no use if we do not have machine-learning capabilities introduced in our IoT based solutions. As the devices are increasing, so will the data volume as well. This significant and invaluable data will help our systems to understand what is working vs what is not working.

This data volume goes beyond human capabilities for analytics; hence, a machine learning will be inevitable to maximize the return from IoT based solutions.

Future Impact of IoT in Insurance Industry

IoT based solutions have done tremendous development in all horizons of human life and the impact has been on positive as well as negative side. On the positive side, IoT provides real time data, which provides useful information ahead of time to both Insurers and Insureds that helps them in taking preventive action and reduces/eliminates losses. On the negative side, IoT brings risks, both physical and financial; with the connected devices over Internet. Some of the significant areas of IoT impact listed below:

- Need of Cyber Insurance policies will grow – With the growth of IoT, the risk of data loss and resulting liabilities will increase. Cyber insurance policies provide coverage against data & liability losses and the costs involved due to data breaches, hence there will be improved focus on cyber insurance products, which increase the sale of such policies.

- List of excluded risks will increase in cyber policies – With IoT penetrating more and more in human life the risk of cyber-attacks on IoT devices will also increase. Providing coverage against all these risks will be loss for Insurance carriers hence insurers will provide specific exclusion for cyber perils.

- Minimize the insurance need – IoT based solutions will continue to alter the risk associated with customers and their perils, which will make both Insurance carriers & Insureds aware of the risks before time. This will have an impact on the global insurance market, as the chances of error will reduce which results in shrinking the insurance market thereby minimizing the need for insurance.

- Artificial Intelligence and containers will distribute IoT: The year 2017 would see Internet of Things software distributed across cloud services, edge devices, and gateways. Further, machine-learning cloud services and Artificial Intelligence will be used to mine data from IoT devices.

- Role of Insurance carriers in IoT security will increase – More and more inclination of consumers towards IoT enabled devices lead to more security risk for them. Since IoT technology is changing so fast, it has become a big challenge for the insurance regulators to cope up with that and design the new products accordingly. Insurers are taking on the financial risk associated with the increase use of IoT; hence, they will address the IoT security via proper underwriting.

- IoT will affect the mobile industry in both directions – Many upcoming solutions will create enhanced mobility solution requirements and at the same time, we will see some IoT solutions making mobile apps redundant. With increased connected devices, mobility solutions will enhance the user experience using digital assistants, smart watches etc.

- IoT certification will suppress Industry specific certification – In order to get into the nerves of IoT, the vendors will be motivated to get IoT certified inspite of having Industry specific certified. Investments will be focused on minimal cost based trainings and certifications along with maintaining high standards of these certifications. Along with it, all major industrial vendors will come together to jointly certify their IoT-enabled products with enterprise vendors.

*Forrester & ICRMC Report

NIIT technologies – IoT

We have been participating in the growth of IoT based solutions across industries. NIIT Technologies Ltd has already worked with a large US based insurer to come up with a complete connected solution suite. This solution involves end-to-end IoT based package for the Personal lines insurers, especially dealing home and dwelling insurance based.

NIIT Technologies also has in-depth experience with IoT based devices including, but not limited to, Bosch XDK, Google Nest, Amazon Echo, VR devices, Pressure and Temperature measuring devices as well as expertise in learning and research devices such as Raspberry pi, Arduino etc. Our dedicated IoT lab and its experienced resources work closely with our Data Analytics experts to design comprehensive solutions for the insurance industry.

NIIT Technologies is also working on other relevant initiatives i.e. IoT solutions integrated with NLP, machine learning and Non Natural disaster artificial intelligence solutions etc.

Recommendations for Insurers

- Research and understand customer needs and identify how IoT based solutions can improve your business model. Understand your capabilities and whether you have the right solutions in place with the existing landscape for data management

- IoT in isolation is not beneficial for long term; invest on solutions that are beneficial for all stakeholders. Invest on partner technologies, as per relevance with your business

- Start looking beyond business as usual. Disruption in business has already become a norm, hence business, technology and product research should be an ongoing process. Focus on impact by IoT innovations on insurance products, for example, insuring driverless cars, drones etc.

- Enhance your business model and focus on how to help customers adopt the IoT based solutions. Without customer buy-in, IoT solutions will have no value, and the benefits to the insurance companies is quite high hence, it is worth the focus.

- For many insurance products, IoT has minimized the need of large historic data and maturity. This has happened because IoT has the ability to provide real-time, more relevant and custom user specific data to improve and customize underwriting. This has allowed smaller players to jump in to participate in this levelled field. Large insurers need to be flexible to customization of products and need to bring in more agility in product designing as well.

- Insurers should invest on appropriate Proof of Value and Proof of Concept initiatives for IoT solutions with their trusted partners before initiating any industry scale implementation or solution.

Abbreviations and Acronyms

IoT – Internet of Things

P&C – Property and Casualty insurance

L&A – Life and Annuities insurance

NLP – Natural Language Processing