KPMG Consultancy Firm Business Analysis

Unit 1 – The Business environment

P3 – describe how two businesses are organised.

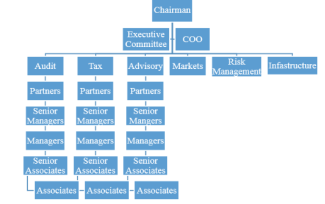

Structure of KPMG:

KPMGs board is making the main decisions with chairman Simon Collins, such as the built of KPMGs flagship office in Canary Warf in 2006. Every client facing person can be involved in the engagement process, although some people in the firm have specific roles. Some Partners are responsible of different sectors within the firm; such as Head of Finance or Head of Deal Advisory. They are managing the sector and making sure their orders are getting passed through by the directors in case. A Director then is responsible for the people working within the sector. Managers are making sure the engagement process is proceeding as planned. Problems such as level of staff shortness would get reported by a line manager to the HR department. Only very important queries are getting sent to the partners in charge. KPMG is a worldwide active company with headquarters in the Netherlands.

KPMGs board is making the main decisions with chairman Simon Collins, such as the built of KPMGs flagship office in Canary Warf in 2006. Every client facing person can be involved in the engagement process, although some people in the firm have specific roles. Some Partners are responsible of different sectors within the firm; such as Head of Finance or Head of Deal Advisory. They are managing the sector and making sure their orders are getting passed through by the directors in case. A Director then is responsible for the people working within the sector. Managers are making sure the engagement process is proceeding as planned. Problems such as level of staff shortness would get reported by a line manager to the HR department. Only very important queries are getting sent to the partners in charge. KPMG is a worldwide active company with headquarters in the Netherlands.

KPMG is a consultancy firm with focus on Advisory, Tax and Audit. Geographically wise, KPMG has 22 offices with about 16,000 employees, with headquarters in Canary Warf, London.

Structure of National Trust:

The National trust charity has a completely different leadership structure to KPMG. The senior management is making the main decisions. The middle management passes down the made decisions to the maintenance team. Ightham More in Kent is seen as National Trusts biggest conservation project and the senior management team decided to take it on. The two main income sources are National Trusts costumers and donators. The typical costumers are a middle aged to older people that have a strong interest in the wellbeing of Britain’s historic buildings as well as tourist. National Trust only operates in the UK. The trust has 4,2 million members, 60,000 volunteers and a staff of 10,000.

The National trust charity has a completely different leadership structure to KPMG. The senior management is making the main decisions. The middle management passes down the made decisions to the maintenance team. Ightham More in Kent is seen as National Trusts biggest conservation project and the senior management team decided to take it on. The two main income sources are National Trusts costumers and donators. The typical costumers are a middle aged to older people that have a strong interest in the wellbeing of Britain’s historic buildings as well as tourist. National Trust only operates in the UK. The trust has 4,2 million members, 60,000 volunteers and a staff of 10,000.

Functional Areas:

|

KPMG |

National Trust |

|

|

Finance |

KPMG is taking loans from different organisations to provide engagement work to the client. As most engagement processes take many months KPMG is operation at a huge risk. KPMG is consulting firm that are being close to bankruptcy. With a failing client work not only the client is facing enormous problems, also KPMG can’t pay its employees. Every failing engagement can cost the firm many million pounds revenue. Sometimes ‘provision work’ is being paid from KPMGs profit to ensure loyal clients will still be advised even with a low profitability. |

National trust is raising their finances via membership fees and donations. As a non-profit organisation the charity relies on the donations, as the membership fees and visitor income cover only a third of their total costs. The charity is also getting subsidised by the government as they have a huge interest of securing old and historic buildings across the UK. |

|

Marketing |

As KPMG is in an oligopolistic competition, where pricing strategy will most certainly end up in a price war. Non-pricing strategies such as marketing or R&D help to win the market. As the firm provides services for firms, they won’t have marketing strategies such as Nike or Adidas, as it’s a completely different environment. KPMG has their logo on the McLaren Formula One car to diverse their marketing strategies. |

National Trust is rethinking their marketing strategies by attracting the younger generation on social media such as Instagram, Facebook or Twitter. The Trust has continuing problems with getting the attention of the 16-25 y/o target group. |

|

Customer service |

The entire staff is trained to the best level to give the client the best outcome they can wish for, however KPMGs employees need to have greater knowledge than customer service, as only a few people will actually interact with the client. KPMG relies on that their clients come back to them for future engagement. |

As well as KPMG, National Trusts employees don’t rely as much on customer service as their job mainly requires experience. Their customer service will be keeping the historical buildings clean and provide a welcome and warm service at the ticket boxes. |

|

Human Resources |

KPMG has a separate HR department as many other big firms. They give out the open job places, where people can apply. The HR department communicates with the trading unions and employer associations to avoid strikes. |

Likewise KPMG, the trust is similarly structured in terms of HR. The staff welfare will heavily affect the charity as they are responsible for the maintenance of very important buildings. |

P4 – explain how their style of organisations helps them to fulfil their purposes.

Strategic planning:

|

KPMG |

National Trust |

|

|

Mission and Values |

KPMGs mission for the near future will be providing firms in the UK the best advice on the Brexit Referendum. Values are held high at KPMG. One of their mottos is ‘diversity makes a frim great’. The firm is employing from every cultural and ethnical background to support the society but also to differentiate the firm from other big advise giving firms. |

Their mission and values are very to KPMG. National Trust is a profit satisficing firm. The charities aim isn’t to maximise their profits to become wealthier, instead they focus on keeping their stakeholders happy and give something back to society by preserve and protect historic places. Their motto is ‘forever, for everyone’. |

|

Development of strategic aims |

In order to achieve strategic aims in the long run, the firm needs to reduce costs and increase efficiency. Strategic changes are usually planned by KPMGs innovation team. Differentiating is key in our fast growing and changing economy. Strategic changes need to be thought through carefully as a wrong decision can quickly lead to bankruptcy even for TNCs such as KPMG. |

The charity needs to raise money in order to develop their strategic aims. As National Trusts main income comes from donations, it is really important to NT to raise money in order to maintain the historic buildings. |

|

Cascading of Objectives |

One of KPMGs main aim is to win clients and their work in order to achieve profit maximisation. KMPGs process can start in various ways. Mainly though it starts that the client writes out certain work, where normally many consultancy firms apply for. The leadership team then decides if the engagement would be profitable or not. If it would be profitable then, an engagement team presents the client a piece of work (investment work), where they then decide if they want to work with KPMG or not. |

Their process starts with the senior management deciding taking on a new project. The middle management will operate with a Gantt chart to split up the different tasks across the maintenance team. They will then split their resources equally to control and observe these tasks to make sure the work is done to their best standards. It is very important that the maintenance team is working up to certain standards, as most secured buildings are tourist attractions and leaving a hazardous sphere is inacceptable and highly dangerous to the public. |

|

Strategic Planning Progress |

The strategic planning progress is fairly similar in both companies. The two organisations have different departments, however are always working together. Each department has a director/manager who sets the directions. In both organisations the Finance team supports the whole firm with background information on the engagement process or securing of buildings. |

|

|

Smart targets |

The SMART targets are acronyms, which summarises what should be considered before starting a project. SMART targets are being used to ensure that the workload is split up realistically and timed correctly. KPMG and National Trust senior leadership team are relying heavily on this, as it shows them a breakdown of their costs and it reduces KPMGs risk to fail and insures the partners an increasing survival against the competitors. |

|

Different aims:

|

KPMG |

National Trust |

|

KPMG aims to maximise profits in orders to grow on a higher scale than its competitors. In a world that is driven by wealth it is key for firms in the Private sector to achieve long-term growth. Profits will get invested to improve the workforce with specific trainings or spent on Research and Development. As KPMG is operating in an oligopolistic market it is important that the firms differentiates itself from the other big four consultancies. |

National Trusts financial main aim is to break even so that their revenue covers their costs. To survive National trust must make sure they are advertising the reconstruction of old buildings is of long term value and is tremendously important for Britain’s future. New donations will ensure that the charity can take on new projects and can secure old buildings from rotting. |

P5 – describe the influence of two contrasting economic environments on business activities within a selected organisation.

Introduction – KPMG’s business activities in the UK and India.

Demands:

1. Influenced by affordability

UK – The UK is seen as one of the strongest countries in the developed world. Shortly after the first effects of Brexit have hit the UK economy, the pound has depreciated by nearly 40%. That means that the services KPMG provides is getting fairly cheaper abroad. Due to the fall in the currency, KPMGs clients had the chance to export more and gain more revenue to demand KPMGs services.

India – The country is booming as never before, with a population of nearly 1,4 billion it is still seen as a developing country, as a reason of the bizarre income distribution. The richest people 10 % are earning more than the other 90% together. KPMG in India (KGS) however, is getting very influential in the Indian economy. The firm is helping big organisations setting up manufactories, but also helping Indian firms how to enter the Western culture.

2. Competition & availability of substitutes

UK – The competition is becoming tremendously stronger, as KPMG is operating in an oligopolistic market structure (4 firms have about 80% of the market share). KPMG really needs to match the other competitor’s prices to be efficient and not lose clients to the opposition. The brand image in the UK has a very strong connection in the society. The ‘Economist’ thinks that the main competition to consultancy firms in the future will be firms like Google, as the market is about to change completely.

India – The Indian citizen don’t have such a strong connection to a brand. They rather have quantity instead of quality. That makes it harder for KPMG, as the strong brand name doesn’t help the firm to win the clients. KPMG really needs to work hard and efficient in order to make the engagement profitable.

3. Level of Gross Domestic product (GDP)

UK – The UK has been for a few years in recession (two or more consecutive quarters of negative economic growth), but due to help from the Bank of England and certain government policies, the UK climbed out of the recession. People’s wages started to increase achieving a long-term goal of increasing economic growth (higher GDP). The population started to change their spending habits and firms had to produce more. That led to that KPMGs clients needed further help with developing their products or introducing new marketing strategies.

UK – The UK has been for a few years in recession (two or more consecutive quarters of negative economic growth), but due to help from the Bank of England and certain government policies, the UK climbed out of the recession. People’s wages started to increase achieving a long-term goal of increasing economic growth (higher GDP). The population started to change their spending habits and firms had to produce more. That led to that KPMGs clients needed further help with developing their products or introducing new marketing strategies.

India – As India is becoming a future economic superpower; KPMG has build a new headquarter in New Delhi. Achieving economic growths of over 5% in recent years, British TNC’s started to invest hugely in the Indian Economy. KPMG was a mayor part of developing new strategies, introducing marketing schemes or helping doing PR work.

4. Needs and aspirations of consumers

UK – In the 21st century, becoming more diverse as a country and firm is key to success. Offering a greater variety of services could extremely diversify the firm to gain new clients. In the Tech-century, where London the capital of start up companies in Europe is, it might be very useful working close with start-ups together and helping funding their idea and company. Many smaller consultancy firms have a private equity department, offering start-up companies the needed support but also the money could mean that in the future there is no need for investment firms anymore.

India – The country is fairly similar to the UK. Tech Start-ups are playing a big role in the countries economy but also society. As the country is moving from a primary product dependency economy (developing country) to one of the super powers in the world, it would be really important for KPMG to get in contact with those small businesses, which could potentially chance the world in a few years.

Supply:

1. Influence by availability and labour

UK – Investing Billions and Billions of Pounds every year into the wealth fare state over the last 30 years has provided the UK an extremely strong labour force. Introducing a law, which keeps students in full time education till the age of 18, educates the work force to a decent level. Nearly 20% of the population have a degree or higher, according to a study from the government. Due to the very high level work force, prestigious companies such as KPMG can choose their graduate trainees and consultants from top Universities to further improve their workforce.

India- India is currently still more active in the primary and secondary sector, where a high level work force is not needed. However, India is going through a big change in their education system, the current government wants to abolish underage working, so that the economy can take more profit from a greater workforce. KPMG could take great use of that, investing in new education schemes, could provide the firm a loyal and enthusiastic work force.

2. Logistics

UK – Logistics are the planning, organising and movements of activities for certain tasks. The UK has great transportation links such as motorways, train lines or for longer distances plane routes. Many KPMG clients are taking such a big use of those transportation opportunities. Tesco for example needs to be able to get their food every day to its stores.

India – KPMGs clients such as Tescos have altered the chain logistics to cut food waste, making sure that no food goes to waste. Like in the UK, India has a revolutionary road system in the bigger cities, however due to the heavy rainfalls during the spring months, it is really difficult to set up well developed roads in the country side.

3. Profitability

UK – The service KPMG offers is very inelastic, meaning that as people/firms are becoming richer they wouldn’t proportionately spend more money on advisory or consultancy costs. As KPMG is an oligopoly, their services are fairly similar to its competitors, meaning that KPMG can’t use pricing strategies to increase its profitability. KPMG can increase its profitability by non-pricing strategies, such as marketing or R&D.

UK – The service KPMG offers is very inelastic, meaning that as people/firms are becoming richer they wouldn’t proportionately spend more money on advisory or consultancy costs. As KPMG is an oligopoly, their services are fairly similar to its competitors, meaning that KPMG can’t use pricing strategies to increase its profitability. KPMG can increase its profitability by non-pricing strategies, such as marketing or R&D.

India – Even in India, the services KPMG offers are inelastic, although not as inelastic as in the UK. Foreign firms setting up projects in India relying more on KPMG’s services, as they sometimes don’t have the needed knowledge of what is needed to make the project successful.

4. Government support

4. Government support

UK – The government subsidises KPMG as they are with over 15,000 employees one of the biggest employers in the UK. KPMG also help the government setting up projects.

India – The Indian government compared to the British doesn’t have the capacity to support foreign firms. As most Asian countries want to be self sufficient, the government accepts the foreign firms but is often not willing to give out subsidies.

Global interaction:

1. Levels and types of interdependence

UK – As KPMG is a service providing based business its assets are the employees. As KPMG International is split into the different country roles, many offices are working together to achieve the best possible outcome for the client. KPMG isn’t dependant on any other party, such as suppliers. Although KPMG UK is trying to increasingly use the Indian link to reduce costs and increase profit margins.

UK – As KPMG is a service providing based business its assets are the employees. As KPMG International is split into the different country roles, many offices are working together to achieve the best possible outcome for the client. KPMG isn’t dependant on any other party, such as suppliers. Although KPMG UK is trying to increasingly use the Indian link to reduce costs and increase profit margins.

India –India/Indian firms are majorly dependent on their exports. India has one of the biggest tech supplier firms, but also go to less developed countries to import suitable pieces to decrease their cost of production and increase their global efficiency. KPMG as a service-providing firm, is giving those export depending firms advice on how to operate in such ways.

2. Ownership of business

UK – Each national KPMG firm is an independent legal entity and is a member of KPMG International. Every firm in the group is responsible for its own obligations and liabilities. Simon Collins is a senior partner and the chairperson for KPMG UK. He is responsible for long-term growth and sustainability of the UK firm. These actions provide the firm leadership through the organisation and implement their overseas strategies.

India – Same as in the UK, KMPG India is run as an independent member of KPMG International. Although KPMG India (KSG) is well integrated with the KPMGs in the western world. KSG is able to offer a cheaper service, as a reason of lower standards of livings in India. It is often quite common that KGS employees are getting used for engagement progresses in the UK to increase profit margins.

3. Movement of capital and business operations

UK – The UK firm is KPMGs flagship in Europe. With the prestigious headquarter in Canary Warf is used as eye candy for clients but also competitors. KPMGs clients in the UK manage the whole European and West African financial markets, which allows KPMG UK to invest more in such expenses than other countries. As KPMG is operating in an oligopolistic market, they only have a certain price setting function. KPMG and its competitors rather try with non-pricing strategies to win the market.

India – As well as in the UK, KPMG tries to win through first impressions. With an enormous building in New Delhi, where KPMG is controlling the Indian market from. They offer the same services as KPMG in the UK does. KPMG India is steadily growing as a reason of great economic growth in India.

M2 – compare the challenges to selected business activities within a selected organisation, in two different economic environments.

|

Similarities |

Differences |

|

|

|

|

|

|

|

|

P6 – describe how political, legal and social factors are impacting upon the business activities of the selected organisations and their stakeholders.

M3 – analyse how political, legal and social factors have impacted other contrasting organisations.

Political:

The UK and its democracy are seen as very stable. Led by the conservative party with Theresa May as prime minister, the government provides its citizens, as well as their companies a welfare state. It is safe for companies, such as KPMG to invest in future project, without having to fear to lose their assets in a civil war. India has as well as the UK a very stable government. With a six recognised national party system, India is seen as one of the most popular democracies in the world. Unlike the UK, India has to fight majorly with a fluctuate currency, the Indian rupee. That doesn’t give firms such as KPMG to make big investments, because major investments in such countries are often dependent on a stable currency. Both countries are trying to reduce their poverty and lift up their GDP per capita rates. India has difficulties with that, as the countryside is hugely dependent on its primary goods. It is very difficult to reduce its primary product dependency. Investing into states with high property is unlike for KPMG and many other big companies, as those countries are seen as too little educated.

The UK and its democracy are seen as very stable. Led by the conservative party with Theresa May as prime minister, the government provides its citizens, as well as their companies a welfare state. It is safe for companies, such as KPMG to invest in future project, without having to fear to lose their assets in a civil war. India has as well as the UK a very stable government. With a six recognised national party system, India is seen as one of the most popular democracies in the world. Unlike the UK, India has to fight majorly with a fluctuate currency, the Indian rupee. That doesn’t give firms such as KPMG to make big investments, because major investments in such countries are often dependent on a stable currency. Both countries are trying to reduce their poverty and lift up their GDP per capita rates. India has difficulties with that, as the countryside is hugely dependent on its primary goods. It is very difficult to reduce its primary product dependency. Investing into states with high property is unlike for KPMG and many other big companies, as those countries are seen as too little educated.

The UK has a fantastic infrastructure. London has 5 airports, which outlines excellent transport links to the capital. The government is planning to introduce the HS2 railway, which will enable KPMGs commuters to travel more efficient. India has a great and massively infrastructure, however big problems in the countryside. Monsoons and floods are natural disasters, which makes it difficult for the government to improve those transport links.

Brexit has been the most recent political event that has happened to the UK and the long-term effect is still uncertain. The short-term effect was tremendous, according to the Bank of England; it was the lowest exchange to the Euro since the financial crisis, with a record low of 1 Euro to 1,09 Pound. The newspaper stated it as a disaster, but 8 months after the referendum how does it actually look.

Brexit has been the most recent political event that has happened to the UK and the long-term effect is still uncertain. The short-term effect was tremendous, according to the Bank of England; it was the lowest exchange to the Euro since the financial crisis, with a record low of 1 Euro to 1,09 Pound. The newspaper stated it as a disaster, but 8 months after the referendum how does it actually look.

The Fin-tech industry with company such as TransferWise, is booming since the referendum. London is the capital of start-up companies in Europe and is close to overtaking Los Angeles and San Francisco. Major banks have stated their forecasts that the UK is unsafe to invest in the near future as a reason of fluctuating exchange rates, but so far there is no remarkable outcome.

But to every sunny side, there is a rainy one too. The property firm Frank Knight, for example said that due to the Brexit referendum, foreign investors backed off trading deals because of the uncertainty. The house prices, according to the telegraph, ‘The fall in house prices forecast for 2017 will bring prices back to what they were in the first quarter of 2016’, is going to fall.

The UKs infrastructure is spot on, great transport links between major cities and a free NHS, which allows everyone access to health care. Every year the government spends 142 billion pounds on the NHS. The Brexit referendum promised that the weekly 150 million pounds given to the EU would go straight to the funding of new roads and the health sector. Pharmaceutical industries, such as Novartis are taking profits from the NHS as the government is paying for all the medications. The company made revenue of 47 billion in 2014 and is still growing. On the shadow side of the NHS is the staff, such as doctors or nurses. They are getting hugely underpaid as the government is funding their salary. Long hours and too little breaks is one of the reasons for a strike once in a while. Most doctors are getting educated in the UK and then leave the country to go somewhere without a free health sector, as wages are higher.

The UKs infrastructure is spot on, great transport links between major cities and a free NHS, which allows everyone access to health care. Every year the government spends 142 billion pounds on the NHS. The Brexit referendum promised that the weekly 150 million pounds given to the EU would go straight to the funding of new roads and the health sector. Pharmaceutical industries, such as Novartis are taking profits from the NHS as the government is paying for all the medications. The company made revenue of 47 billion in 2014 and is still growing. On the shadow side of the NHS is the staff, such as doctors or nurses. They are getting hugely underpaid as the government is funding their salary. Long hours and too little breaks is one of the reasons for a strike once in a while. Most doctors are getting educated in the UK and then leave the country to go somewhere without a free health sector, as wages are higher.

Legal:

Ethnical is the UK one of the most cultural diverse countries in the world. In fact after the Second World War the UK experienced a big migration wave, were many people from the common wealth states entered the UK to seek for a better life. India experienced a human brain flight, meaning most academic families left India in the early 1950s. Well-educated Indians went abroad to take profit from the booming western economies and only saw a little chance to further proceed in the Indian society. Today, KPMG tries to employ people from all sorts of backgrounds, as diversity thrives an international operating firm forward.

In general, the Asian countries are seen as competitive and efficient. From the early age, students in India get taught under high pressure and failing is inacceptable. Although, the illiterate rate in India is far higher than in the UK, as different laws keep students in full-time education till they turn 18. As India’s countryside is majorly depending on primary goods, such as cotton and Kashmir, most children need to help their parents during the harvest season and don’t get a chance to attend school.

KPMG offers different programs, where less privileged children from those areas get an opportunity to turn their back to those low skilled jobs.

The UK gained tremendously from its common wealth states, such as India, Pakistan or Bangladesh. The economy got positively impacted from the foreigners not only because of the workforce they provide but also because of the cultural diversity. After the second world war was over, citizens from the common wealth states helped to UK shape how it is today; one of the strongest economical countries in the world. Every organization in the UK got impacted from foreigners, as they are willing to work hard in order to have a better life. Most recently, Uber is changing the whole human transport generation. Over years, taxis have been a solid rock in our society until Uber changed the whole game. Uber is an often cheaper and quicker method to get from one place to another. With fewer emissions it is an environment friendly way to travel. Uber closely works together with foreigners, as the firm believes speaking several languages helps communication with more people. No other country in Europe is as famous for take-away food as the UK. Due to the diverse culture in the UK, people from abroad brought their cultures with them and the UK grew through those different cultures.

The UK gained tremendously from its common wealth states, such as India, Pakistan or Bangladesh. The economy got positively impacted from the foreigners not only because of the workforce they provide but also because of the cultural diversity. After the second world war was over, citizens from the common wealth states helped to UK shape how it is today; one of the strongest economical countries in the world. Every organization in the UK got impacted from foreigners, as they are willing to work hard in order to have a better life. Most recently, Uber is changing the whole human transport generation. Over years, taxis have been a solid rock in our society until Uber changed the whole game. Uber is an often cheaper and quicker method to get from one place to another. With fewer emissions it is an environment friendly way to travel. Uber closely works together with foreigners, as the firm believes speaking several languages helps communication with more people. No other country in Europe is as famous for take-away food as the UK. Due to the diverse culture in the UK, people from abroad brought their cultures with them and the UK grew through those different cultures.

Social:

Social:

The UK is seen as a fairly right wing economy, however many government policies are making the UK sliding into a more left wing economy. Providing a free health-care system and its progressive tax system is trying to reduce the social and income inequality between rich and poor. Having an increasing NMW also helps to secure the welfare of a state. KPMG is increasingly helping to close the gap between the rich and poor. The company for example is paying its low skilled workers the living wage not the national minimum wage. That gives those workers another 3 pounds on top of the NMW.

India is very different in terms of welfare. Most Asian countries want to be self sufficient, therefore more left wing. However, the Indian economy is really depended on its foreign trade. Indians tax system is regressive, that often means creating an unfair income distribution, however as rich people tend to spend more in the circular flow of income, in the long run that may lead to future economic growth and higher employment. As well as in the UK, KPMG is paying its low skilled Indian employees the living wage to lift them out of poverty.

The UK is a welfare state, with a free national health care service and great education. The UKs total spending is 781.1 billion pounds on the public spending, with an enormous 86 billion pounds on Education. In matter of fact, the UK has 32 Universities in the TOP 200 Universities in the world according to the ‘times higher education’. From a young age most students get told that chances to succeed without a degree are quite low. As a new law holds students in full time education till the age of 18, many students then decide then go to university to get a degree. Perfect for firms in the UK, as they have the ability to just pick the best ones out. That leaves the UK with a completely different problem. As there are too many overqualified people, low-skilled jobs, like building get left out from the educational boom.

Firms like KPMG UK, literally can choose graduates from the best universities to make their workforce more competitive. As KPMG is operating internationally, they have then the ability to win against foreign competition too.

Constructing firms such as Balfour Beatty, can’t take profit from the educational boom at all, as most of their jobs requires experience and not as much the knowledge that gets thought at University. They claim that it is really hard for such firms to find accurate staff.

With a GDP per capita of about 40.500 US dollars in 2016 the UK can provide businesses or start-up companies the perfect surroundings. With a quality infrastructure and skilled people there is a good chance that start-up companies are turning out successful. As the cooperation tax with 20% is one of the lowest in Europe it attracts foreign firms, especially from Asia to open up new headquarters to cover the wealthy European single market. Toyota hugely takes profit from manufacturing cars in the UK. Toyota employees about 4.000 people in its manufactories in the UK. Toyota works strongly together with Uber as they provide them with most of their low emission cars. Also TransferWise was founded in the UK, as two guys from Estonia had issues with sending money back to their families while working in London. With their quality employees and a fantastic idea they are turning now the banking system upside down.

With a GDP per capita of about 40.500 US dollars in 2016 the UK can provide businesses or start-up companies the perfect surroundings. With a quality infrastructure and skilled people there is a good chance that start-up companies are turning out successful. As the cooperation tax with 20% is one of the lowest in Europe it attracts foreign firms, especially from Asia to open up new headquarters to cover the wealthy European single market. Toyota hugely takes profit from manufacturing cars in the UK. Toyota employees about 4.000 people in its manufactories in the UK. Toyota works strongly together with Uber as they provide them with most of their low emission cars. Also TransferWise was founded in the UK, as two guys from Estonia had issues with sending money back to their families while working in London. With their quality employees and a fantastic idea they are turning now the banking system upside down.

D2 – evaluate how future changes in economic political, legal and social factors, may impact on the strategy of a specified organisation.

Increase in national minimum wage (NMW).

Positive:

The national minimum wage refers to the minimum amount of compensation an employee must receive for performing labour. As such, it is illegal to pay an employee less than the minimum wage.

The minimum wage attempts to protect employees from exploitation, allowing them to afford the basic necessities of life. An advantage of increasing the NMW would create a greater demand for services provided by KPMG. Increasing the NMW would have a subsequent positive multiplier effect on the British economy, as the population will have more disposable income. As this occurs, firms providing goods rather than services in the UK will also experience a positive multiplier effect and then require consultancy services provided by KPMG.

Additionally, the NMW aims to reduce income inequality through preventing very low wages, people struggling to stay in work and hence preventing an unemployment trap. Increasing this wage will result in excess workers of all skill level to provide services at KPMG.

Negative:

Minimum wages have strong criticisms because it establishes a price floor on wages. Price floors can lead to a dead weight loss in the economy, which means that inefficiencies exist. In this case, the minimum wage might force companies to hire fewer employees, thus increasing unemployment.

On the other hand, an increase in NMW can lead to a surplus of workers in competitive markets, meaning a business such as KPMG will be faced with an oversupply of workers.

Improving infrastructure (HS2)

Positive:

Improvements to infrastructure, particularly the construction of HS2 will result in higher productivity in the UK economy. Commuting times will be far more efficient than previously meaning that workers travelling to the workplace or business meetings will be able to produce a greater unit of work relative to the time previously. Aggregate demand of the economy will shift outwards leading to positive economic growth as well as disinflation. His could also open up new pathways for KPMG as their increased productivity may be seen as an attractive asset to potential clients.

Negative:

The cost of such an extreme supply side policy will have implications for the government’s budget. Already, the UK national debt is 90.6% of its GDP, and such a costly operation such as HS2 will see far more of the government’s budget be drained. This will have negative impacts for future taxpayers who will, thus, be left to pay off such an extreme debt. On the other hand, one must consider that the provision of improved infrastructure is the of the most effective ways of reducing current account deficits, particularly keeping in mind the UK’s declining ‘productivity puzzle’. Improving the current account along with the UK’s surplus on the capital and financial account will see an improvement in the balance of payments.

Increase in immigration

Positive:

Increasing immigration may give rise to an increase in aggregate supply. The quantity of resources to employ will increase enabling firms such as KPMG exploit these changes. The choice of employees will increase, allowing KPMG to gain from the most skilled and efficient workers. Additionally, an increase in immigration may open up more opportunities across international borders as employed immigrants could negotiate trading deals and act as intermediaries for KPMG through a network of diverse languages.

Negative:

One must take into account that there may be a large proportion of these immigrants who lack the knowledge and expertise for KPMG to benefit from. The lack of skill may see KPMG lacking employees. Conversely, an increase in immigration may put a strain on the resources at KPMG, which may see the organisation struggle or perhaps become more inefficient.