Management of Direct and Indirect Taxes

The assignment attempts to bring out various dimensions of the Indian Tax structure. Three articles were reviewed along with the relevant case laws. All the three articles are based on one theme, the fact that the Indian Tax Structure needs reforms. The first article regarding the Direct Tax Code proposes changes in the Income Tax Act,1961 to be in line with the modern day changes and other economies. The next two articles bring to the notice that there are increasing incidences of the Tax Avoidance and Tax evasion. This is attributed to various factors discussed in the summary of the articles. There have been increase in the tax burden over the middle and lower income slab people and as a result they feel burdened. Also, there has been seen that the growth rate of tax rates for these two groups has went up speedily as compared to for the third group. For these reasons tax administration require changes so that such incidences can be reduced.

Article 1: An Appraisal of New Direct Tax Code in India – A New Challenge in Direct Taxation

by Sarbapriya Ray

This Article attempts to study about the new direct tax code which got introduced from the financial year 2012-2013, having replaced the five-decade old system. Further, the article move over to discuss the pros and cons of this new code. The article was written in the year 2011, so all the amendments are in comparison to the Income Tax Act,1961. It has been written by Sarbapriya Ray, Assistant professor at Calcutta University. Although, Direct tax code was introduced to bring about positive changes it was criticized and was considered to be confusing, and So, there have been certain other amendments after that as well, which is given after the summary of the article.

The aim of the new tax code was to make the system of direct taxation more equitable and straight-forward. The direct tax rates were henceforth not supposed to be part of the Budget. The modern tax system and provisions were required to come in line with the constantly changing economy. The objective was to end unnecessary exemptions, widen tax bases, increase the ratio of Tax-GDP, minimize disputes and litigation to bring about a more effective and equitable tax system. The reduction in the tax exemptions and deductions which have been increasing were to be reduced or amended because they helped in Tax evasion or Tax avoidance.

In the process of providing exemptions and deductions, the amount foregone is termed as the total expenditure and the amount has been increasing from one financial year to another. For instance, the figure for the year 2008-09 has been Rs.27389 crores.

General Concepts:

- 298 sections and 14 schedules were to be replaced by 319 sections and 22 schedules.

- A unified concept of ‘Financial Year’ replaced concept of ‘Assessment year’ and ‘Previous year’, doing away with the confusions that arose.

- Changes in terms of the income tax return filing date were:

- For corporates, due date proposed was August 31st ever FY.

- For individuals 30th June was proposed.

- Income to be divided into two parts:

- Income from special Sources: Income to be taxed at special rates in case of winning from lotteries, income of non-residents, etc.

- Income from ordinary sources: Income from salary, Income from capital gains, Income from house property, etc.

Features of the new tax code:

Tax Rates:

The following table shows the income tax slabs till FY 2010-11 and the amended tax slabs that would be applicable from the FY 2012-13 with the implementation of the new direct tax code.

|

Income Tax Slabs for others and Men & Women |

||||

|

S.NO |

Tax Percentage |

FY 10-11 |

FY 12-13 |

|

|

1 |

No Tax/ Exempt |

Upto 1,60,000 |

Upto 2,00,000 |

|

|

2 |

10% |

1,60,001 – 5,00,000 |

2,00,001 – 5,00,000 |

|

|

3 |

20% |

5,00,001 – 8,00,000 |

5,00,001-10, 00, 000 |

|

|

4 |

30% |

Above 8,00,000 |

Above 10,00,000 |

|

The proposed changes were estimated to bring down the tax liability of an individual having income greater than 10 lakhs by Rs.41040 annually.

The following table shows the changes in the corporate tax rates with the implementation of the new direct tax code (DTC).

|

Particulars |

Income Tax Act, 1961 |

Original DTC |

Revised DTC |

|

Domestic Company |

33.22% |

25% |

30% |

|

Foreign Company |

42.23% |

25% |

30% |

|

Branch Profits Tax |

– |

15% |

15% |

|

MAT |

19.93% on Book Profit |

0.25% / 2% of Gross Assets |

0.25% / 2% of Gross Assets |

|

Dividend Distribution Tax |

16.61% |

15% |

15% |

|

Wealth Tax |

1% on Net wealth exceeding Rs. 3mn |

0.25% on Net Wealth exceeding Rs. 5 mn |

1% on Net wealth exceeding Rs10 mn |

Corporate tax rate was reduced from 33 to 30%.

Residential Status:

- Companies incorporated in India are domestic companies and resident.

- Only those foreign companies are to be treated resident whose place of effective management is partially or wholly in India.

Income from Employment:

Another change in the new Direct tax code is in terms of replacing EEE (Exempt-Exempt-Exempt) to EET (Exempt- Exempt-Taxed). These changes mean that till accumulation of income, withdrawal will be exempt otherwise it is taxed.

The following table shows a comparison of the EEE and proposed EET system:

|

EEE under Income Tax Act, 1961 |

EET under DTC |

|

Providing incentive in the investment year |

Incentive in the form of deductions from gross taxable income in the investment year |

|

No tax on income from this investment |

No tax on income on the investment |

|

No Tax on the maturity of the investment |

Tax is levied on the amount withdrawn |

EET was proposed to deal with the shortage of resources with India. Also, In India since savings form a major part of the earnings, taxation would help in solving the problem of dealing with the debt accumulated with the government.

MAT:

The amendments led to capital intensive industries to pay MAT even in case of book losses. The changes will lead to increased efficiency and utilization of the assets.

Wealth Tax Benefits

The new direct tax code also proposed changes related to wealth tax calculations.

|

Particulars |

Income Tax Act,1961 |

New Direct Tax Code |

|

Threshold Limit |

Rs. 30 lakhs |

Rs. 50 Crore |

|

Tax Rate |

0.25% |

1% |

Wealth Tax includes calculation of financial assets – fixed deposits, corporate bonds, shares, which are done at cost or at market price, whichever is lower. Companies are not supposed to pay wealth tax anymore.

Capital Gains:

The following are the changes according to the new direct tax code:

- The structure of long-term capital gain and short-term capital gain tax is replaced with the uniform system as capital gains were now to be taxed at the marginal tax rate as per that applicable to the assesse.

- The period of holding has no bearing on the Tax liability of the assesse.

- Securities transaction tax concept is to be removed.

- Business loss and loss from capital gains can be carried forward for an indefinite time period as per this new DTC. Loss under capital gain can also be adjusted against income from capital gains.

Conclusion:

New DTC introduced a stable and effective system for the FIIs. However, there were two opposite view points about it. DTC was criticised on accounts of the fact that the new amendments may not be beneficial to the investors and FIIs, for whom primarily they were proposed. On the other hand, the concessions or relaxations would lead to loss of revenue.

India still needs the Direct Tax Code

Nov 01 2015

This article is from MINT and was published on Nove,01,2015. In 2015 budget, DTC was removed giving the explanation that a lot of provisions have already been considered or merged in the Income Tax Act, 1961.The finance minister, gave up the provision of reducing the corporate tax to 25% in the years to come. But further cuts on tax rate would require the Direct Tax Code.

The requirement of direct tax code if felt today because a simpler version of tax structure is required in India as it leads to the growth of the economy. A tax consultant feels that an efficient tax system reduces tax avoidance and evasion.

An article from the economic times mention that when Direct Tax code was proposed in 2011 to be implemented from the FY 2012-2013. Some of the provisions of the DTC as mentioned in the summary of article were not accepted by the government, which were as follows:

- “Widening of Tax slabs.

- Increase in basic exemption limit.

- Securities transaction Tax not to be abolished.”

Direct Taxes Code: Revised bill makes avoiding tax tougher for foreign companies

Wed, Apr 02 2014

This is another article from the newspaper MINT. This is a case of Vodafone group versus the supreme court and happened because of the original provisions of the proposed DTC and hence after this certain provisions were revised. The revised provision could help in reducing the incidences in which the foreign companies avoid taxes. This case happened when Vodafone group decided to acquire Hutchison to become Vodafone India.

|

Original DTC |

Revised DTC |

|

50% of total assets in India, then income from such a transaction would be taxed |

20% of total assets in India, then income from such a transaction would be taxed |

In a case, previously of Vodafone, the supreme court gave the judgement that if the shares are transferred by a foreign company having a subsidiary in India, from one non-resident person to another, is not considered a transfer of a capital asset and hence and so any income from such transaction would not attract tax.

However, when Vodafone International Holdings (British Company) acquired Hutchinson’s (again a foreign company) Indian subsidiary. The government intervened on the ruling of the supreme court that the transactions which “derives its value substantially from the assets located in India”[1] are to be taxed.

“At present, section 9 of the income tax Act does not provide any threshold as to what is the meaning of substantially deriving value from assets located in India. Though this now brings in clarity, lowering the threshold from 50% to 20% will lead to many more indirect transfer cases coming under the tax ambit.”[2]

Due to the need of a variety of changes to be required in the original DTC, revised DTC was proposed in 2013: “KEY CHANGES IN THE REVISED DIRECT TAXES CODE 2013:

- An indirect share transaction will be liable to be taxed in India if 20% of the assets are based in India.

- New tax slab introduced; individuals earning more than Rs10 crore a year to be taxed at 35%.

- No changes in other tax slabs for individuals; age for senior citizens relaxed to 60 years from 65 years. ​

- Levy an additional 10% tax on the recipient of dividend payments if the dividend income exceeds Rs1 crore.

- Financial assets included under the ambit of wealth tax as compared to only physical assets at present.

- Rationalization of provisions related to non-profit organizations.

- Ring-fencing of losses from business availing investment linked incentives.

- Provision of settlement commission removed.”[3]

One of the provisions of the new Direct Tax code is the abolishment of the securities Transaction Tax (STT). This will help company’s in reduction of tax as STT was a tax paid while purchasing shares. Since this was a part of the amount paid to the broker that cost would also be lessened. Further, the reduction in the corporation tax rates from 30% to 25% would reduce the tax burden on the companies.

The changes in the provision of MAT may have negative effect on the companies that are asset based companies. The investments by corporates would be reduced.

The change of provisions in terms of Income from employment – that is a change from EEE to EET is expected to increase costs. EET has an increase in the limit and the following are the two points related to it:

- Savings on the amount of Rs. 2lakhs invested.

- Income on this invested is exempted from tax.

Further, DTC proposes the reduction in the tax rates for LTCG and STT. This would lead to an increase in the trades in securities market.

Article 2: Personal Income Tax Structure in India – An Evaluation

by Dr. Radha Gupta

The article is from January 2013. An attempt is made wherein the personal tax structure in India is reviewed and the issues and amendments required to lessen the tax burden on the lower income groups are highlighted. Research is carried out for the same by using descriptive and exploratory techniques of research.

Tax slabs and the rates were higher during the period under study in this paper and the need for its rationalization was felt. The characteristics of a good tax system include a change in the national income corresponding to a high response in tax revenue. Further tax revenue has in total three components on which it depends – tax rate, tax base and national income.

There were three main objectives behind undertaking this study by Dr. Gupta and they are as follows:

- To see the trend of Indian personal tax structure

- To see the present situation and estimate the future trends

- Based on the study, finally suggesting ways to improve or rationalize the structure if need be.

The study was undertaken with respect to the general tax payers. The time span under study is 12 financial years from 2000-01 to 2011-12. The study has five broad elements:

- “Composition and comparative analysis of Income exempted from tax.

- Composition of Total Tax liability of general tax payer for period under review.

- Composition of growth rate of tax burden.

- Composition of tax liability on different income Slabs.

- Conclusion and Suggestions.”[4]

1) Composition and Comparative Analysis of Income Exempted from Tax

Tax free Income for Male, Female and Senior Citizen:

|

Financial Year |

Male |

Female |

Senior Citizen |

|

2000 – 01 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2001 – 02 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2002 – 03 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2003 – 04 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2004 – 05 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2005 – 06 |

Rs. 50,000 |

Rs. 50,000 |

Rs. 50,000 |

|

2006 – 07 |

Rs. 100,000 |

Rs. 135,000 |

Rs. 185,000 |

|

2007 – 08 |

Rs. 110,000 |

Rs. 145,000 |

Rs. 195,000 |

|

2008 – 09 |

Rs. 150,000 |

Rs. 180,000 |

Rs. 225,000 |

|

2009 – 10 |

Rs. 160,000 |

Rs. 190,000 |

Rs. 240,000 |

|

2010 – 11 |

Rs. 160,000 |

Rs. 190,000 |

Rs. 240,000 |

|

2011 – 12 |

Rs. 180,000 |

Rs. 190,000 |

Rs. 250,000 |

The table consists of the data from the highlights of budget in the newspaper. The table shows that despite increase in the cost of living, the tax exemption limit remained constant for fist six years. From the seventh year, there has been an increase in trend but that was found not to be in line with the increase in prices. Also, from the financial year 2011-12, a new head was introduced – Very senior citizen – citizens of more than 80 years of age. Tax exemption limit for this category is Rs. 500,000. One notable finding under the first head was that, the amount of tax exemption limit was directly proportional to the number of individuals falling under each category or age limit.

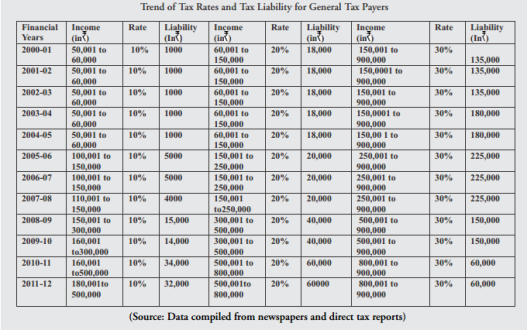

2) Composition of Tax Liability for General Tax Payers for Period under Review:

As can be seen from the table showing trend of tax rates and tax liability, the trend for first and second slab category is increasing. Thus, it was indicated that those falling in these two slabs were paying higher taxes as compared to those in the third slab. And so, a need was felt to bring about changes in the prevailing structure. Furthermore, because of the inflationary trend in the country, people falling under these two tax slabs feel that their sustainability is being affected and on the other, affect their willingness to pay tax.

The following table shows the trend of tax liability for 12 financial years under review:

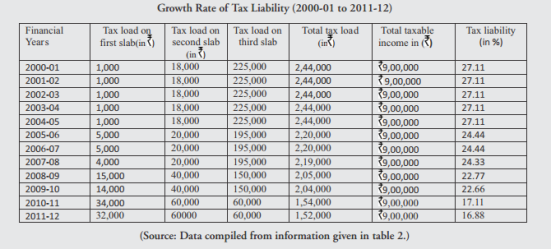

4) Composition of growth rate of Tax burden

The following table shows the growth in the tax liability of the different income groups. So, when it comes to the lower and middle income group to pay taxes, looking at the growth they feel burdened and so a reason requiring changes in the tax administration.

4) Composition of Tax Liability on Different Slabs

Tax liability with respect to different slabs was calculated. It was found that the maximum amount of people, based on income, fall in the first two categories and they form the middle-income group. Also, the tax payers whose income fall in all slabs belong to the higher income group.

Tax weight on General Tax Payer of Different Slabs:

|

FY |

Tax burden on First Slab |

Tax burden on Second Slab |

Tax burden on Third Slab |

|

2000 – 2005 |

Rs. 1,000 |

Rs. 18,000 |

Rs.225000 |

|

2005 – 2007 |

Rs. 5000 |

Rs. 20000 |

Rs. 195000 |

|

2007- 2008 |

Rs. 4000 |

Rs. 20000 |

Rs. 195000 |

|

2008 – 2009 |

Rs. 15000 |

Rs. 40000 |

Rs. 150000 |

|

2009 – 2010 |

Rs. 14000 |

Rs. 40000 |

Rs. 150000 |

|

2010 – 2011 |

Rs. 34000 |

Rs. 60000 |

Rs. 60000 |

|

2011 – 2012 |

Rs. 32000 |

Rs. 60000 |

Rs. 60000 |

There has been a growth in the tax rates and tax liability for those falling in the first slab and so they are increasingly being burdened. This comes to the point out lower income group is paying more tax liability as compared to other tax payers. Thus, a reform is required in the personal income tax structure.

When it comes to the middle-income group tax payers, they are also bearing the tax liability burden as compared to the third slab group. The difference between the first slab group and second slab group is that the rate with which their tax liability is increasing is less as compared to the first slab bracket. Because of this difference, there is the violation of “Equity Principle” of taxation given by Adam Smith. So, another reason backing the requirement of the change in the tax structure and making it more equitable. This would also ensure that the practices of tax avoidance and tax evasion are lessened.

5) CONCLUSION AND SUGGESTIONS

Dr. Gupta comes to the concluding points based on the research she did that despite of the fact that tax payers are aware that the tax collected by the government is used for the welfare of the people only, yet because of the findings and reasons found above, there have been increasing incidences of Tax avoidance and Tax evasion. This also affects the economic situation of the country. So, policies are to be changed and tax rates to be administered properly. A way to reduce the burden on the first two slabs is that the tax slabs can be fewer and should fair and equitable.

Cairn India vs Government:

There is a gap between what government has to say and the work the tax department does. One notable difference was highlighted in case of Cairn India, where despite of having said that there would be no retrospective amendments in tax laws, the government demanded company with the same. Retrospective demands are said to be there only in case of the need to increase revenues, as there could be an urgent requirement for some social cause or infrastructural development. Thus, revenue forecasts are to be realistic and desirable. The targets are to be completed and looked after by the transfer pricing officers and they have to ensure that there is no incidence of tax evasion.

Article 3: Indian Tax Structure- An Analytical Perspective

by Nishant Ravindra Ghuge and Dr Vivek Vasantrao Katdare

India has a well-defined taxation structure and it is divided into three tiers. This paper attempts to bring out the changes that the Indian Tax structure has gone through in a move to becoming an ideal tax structure. Further, it highlights the issues and problems that prevail in the structure and still needs to undergo further changes to get rid of the problems. The problems prevailing are the tax avoidance, black money and reliance on indirect taxation system. The study is done based on the data collected from the sites of the government. It goes over to explain the various types of direct taxes and indirect taxes and the pros and cons of each. This paper is from September, 2015.

The following are the three tiers:

- The main taxes that the union government levy – Income Tax, Customs duty, sales tax, excise duty and service tax.

- The main taxes that the state government levy – Intra- state tax on goods, stamp duty, land revenue, agricultural tax, Tax on professions and Duty on Entertainment.

- Local bodies levy taxes – Octroi, Tax on properties and markets, tax on utilities.

Due to the liberalization since 1991, the following are the changes noted that the tax structure in India had undergone:

- “Rationalization of tax structure.

- Progressive reduction in peak rates of customs duty.

- Reduction in corporate tax rate.

- Customs duty aligned with ASEAN levels.

- Introduction of VAT

- Widening of tax base”[5]

There are two types of taxes – direct and indirect taxes.

Direct Taxes

Taxes which are paid directly to the authority who imposes it by the tax payer and are levied on profits and income. The list includes the following – Taxes on income, corporation tax, interest tax, gift tax, estate duty, wealth tax, agricultural tax, expenditure tax, land revenue, Hotel receipts tax.

Indirect Taxes

Taxes which are not paid directly to the authority who imposes it by the tax payer and are levied on goods and services. The list includes the following – state excise duty, customs duty, Entertainment tax, service tax, taxes on purchase of sugarcane, General sales tax, Union excise duty, tax on electricity, Stamp and registration fees.

In this study, certain research papers were reviewed and the results are presented thereof. Three papers were as follows:

- “Taxation laws of India – Overview and fiscal analysis written by Kumat in 2014.

- Tax structure in India and its effect on Corporate & Individual written by Jha in 2013.

- Tax system reforms in India: achievement and challenges ahead written by Rao in 2005.”[6]

All the three papers mentioned above suggests the following:

- Coordinated tax consumption system.

- Focus on the decreasing the reliance on indirect taxes and levy direct taxes more on the upper income group tax payers.

- Transfer pricing to be abolished.

Analysis of the Indian Tax Structure

The following table shows the amount of direct taxes and indirect taxes collected by the government for period under review:

|

Year |

2010-11 |

2011 – 12 |

2012 – 13 |

2013 – 14 |

|

Revenue Receipt Direct Tax |

45822.09 |

501394.92 |

574680.54 |

679297.56 |

|

Revenue Receipt Indirect Tax |

820843.26 |

966495.51 |

1151867.99 |

1353191.51 |

Source- (Public Finance Statistics, Ministry of Finance, 2013-14)

The table above clearly shows more amount is being collected through the indirect taxes.

The table below shows a comparison of direct and indirect taxes on the parameters in which direct tax is considered better over the indirect tax:

|

Cons of Indirect Taxes |

Pros of Direct Taxes |

|

Inequitable |

Equitable |

|

Uneconomical |

Economical |

|

Uncertainty |

Certain |

|

Inflationary |

Productive |

|

Non-Awareness |

Means of developing civic sense |

|

Evasion |

|

|

Discourage Industries |

|

|

Unfair profit |

|

|

Unemployment |

Proportion of different direct taxes under direct taxes heading for the year 2013-14:

|

Name of Direct Tax |

Amount Collected (Rs crore) |

Percentage share in Total Direct tax |

|

Corporation Tax |

419520 |

61.75% |

|

Taxes on Income |

240922.10 |

35.47% |

|

Estate Duty |

0.00% |

|

|

Interest Tax |

0.00% |

|

|

Wealth Tax |

950 |

0.13% |

|

Gift tax |

0.00% |

|

|

Land Revenue |

11744.01 |

1.73% |

|

Agricultural Tax |

134.59 |

0.02% |

|

Hotel Receipts tax |

90.04 |

0.01% |

|

Expenditure tax |

0.00 |

0.00% |

|

Other’s |

5936.82 |

0.87% |

Based on the report of Ministry of Finance for the FY 2012-13, it was found that the maximum amount of direct tax is contributed by corporation tax, which was 62% and in case of indirect tax, it is sales tax at 37%. Based on the data collected graph was drawn and it was seen that the amount of expenditure on the collection of taxes has been increasing from one year to another. Further the amount of revenue collected from tax forms the major portion of the revenue from non-tax activities or sources.

Findings

1) There are various heads under which assesse have to pay taxes in India and that is collected by the differing authorities.

2) As has already been seen from the data and graph, there are evidences that the reliance on indirect taxes is more as compared to the direct taxes.

3) The major chunk of direct taxes comes from corporation tax and in case of indirect taxes, it is customs and excise duty.

Conclusion

Owing to the array of taxes levied on the tax payers, they feel burdened, despite knowing the fact that the tax revenue is used for the welfare of the society. Also, due to the different taxes are being collected and levied by different authorities, there is a need for the tax payer to reach and contact concerned authorities and keep a record of that as well. The Indian Tax structure is not considered an ideal and effective structure because of the following reasons which are to be dealt with “over dependence on indirect taxes, Inequality, regressive, uneconomical, inflationary, etc.”

McDowell & Co. Ltd. v. State of Andhra Pradesh[ 1985] 154 ITR 148 ( SC) / [TS-1-SC-1985]

This case is regarding the emphasis on the distinction between tax avoidance and tax evasion. Further, Colourable devices are not allowed to be part of tax planning and tax cannot be avoided by the usage of suspicious methods. The decision was made that any transaction done just to avoid taxes even if legal is to be avoided or penalty is to be charged. “This decision clearly was the guidance for an important principle that stretching of the law beyond a point would be counterproductive.”[7]

According to the constitutional law, “the incidence of excise duty is directly relatable to manufacture” and its payment “is the primary and exclusive obligation of the manufacturer … but (only) its collection can be deferred to a later stage as a measure of convenience or expediency”. [8] This case presented two issues to be discussed and they are:

- The excise duty liability lies with the assesse.

- And if so, then the excise duty paid by the customer is supposed to be a part of the assessee’s turnover.

Article 2 and 3 review the tax structure in India and highlight the issues and problems prevailing and thus, call for a need of changes in the tax administration structure. Here are some suggestions, through which the incidences of tax avoidance and tax evasion can be avoided:

1) A need to focus on structural reforms as compared to the policy reforms.

2) The implementation of the Goods and services tax(GST) would lead to a decrease in the variety of indirect taxes a tax payer is to be pay.

3) Further, Anti-Tax Evasion bill is to be brought about.

4) Often it is seen that the forecasts in terms of tax revenue is high and this leads to “tax terrorism”. So, there is a need to carry out analysis before any sort of changes are introduced in the tax laws. The forecasts are based on data which is to be systematic data.

5) There is a lack of Tax councillors in India, so it should be looked at.

6) There is a need to ensure that the resources are utilised effectively for auditing and processes.

7) A system is to be developed for the regular updating of the assessee’s records and registry.

- http://www.livemint.com/Opinion/5PGG7NPHqdOmwjAmyWJc2L/India-still-needs-the-Direct-Tax-Code.html

- http://economictimes.indiatimes.com/articleshow/21968891.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

- http://www.livemint.com/Politics/3YTK9ILnxNTJPWB10t0FEJ/Direct-Taxes-Code-2013-Govt-tightens-laws-around-indirect-t.html

- http://www.jagoinvestor.com/2009/08/what-is-direct-tax-code-and-how-does-it.html

- http://www.ebc-india.com/lawyer/articles/2003v5a5.htm

- https://www.youthkiawaaz.com/2016/05/income-tax-data-india/

- https://indiankanoon.org/doc/187204262/

Gupta, D. R. (2013). PERSONAL INCOME TAX STRUCTURE IN INDIA: AN EVALUATION. Pacific Business Review International, 6.

Katdare, N. R. (2015). INDIAN TAX STRUCTURE- AN ANALYTICAL PERSPECTIVE. International Journal in Management and Social Science, 11.

RAY, S. (2011). AN APPRAISAL OF NEW DIRECT TAX CODE IN INDIA: A NEW CHALLENGE IN DIRECT TAXATION . International Journal of Research in Commerce & Management , 12.

[1] From the article, based on which the judgement was taken

[2] From this article, defining substantial amount

[3] Taken from this Article from MINT

[4] The article was studied under these five broad categories

[5] Reforms Indian Tax structure has gone through, from the time of liberalization

[6] Names of the articles which were reviewed

[7] Judgement in the case

[8] Further explanation of the context with the constitutional bench