Monopolistic Competition Market Structure with Astro Company

All-Asian Satellite Television and Radio Operator, which is also well known as Astro, is a Malaysian media and entertainment broadcast company. It was founded by Tan Sri Ananda Krishnan and he started its service in Malaysia and Brunei in 1996 when there is the launch of MEASAT. According to Astro (n.d), the Astro provides satellite broadcast service with 22 television channel and 5 radio stations only when they first started their broadcast service. Astro is a wholly owned subsidiary of Astro All Asia Networks plc and it is operated by MEASAT Broadcast Network Systems Sdn. Bhd.

Astro was very successful in expanding their business to all over the Asia in the past few years. They had introduced 3 types of services to run their business which is Astro B.yond, Astro IPTV, and Astro NJOI. Astro B.yond had launched the first high-definition (HD) television service in the year 2009 December. It had video recording service which obtainable through PVR and a hard disk which connects to the decoder to save the video. Apart from that, Astro IPTV is also one of the services that provided by Astro to run their business. Astro IPTV launched in April 2011. It has some advanced function from the B.yond which consists of HD channels, PVR, video-on-demand, high-speed internet. Apart from that, Astro NJOI had launched on 2012 February. At first, it is started with 18 TV channel and 19 radio stations, and the customer who consumes it need to pay onetime fees to subscribe the package. Later, they had introduced prepaid service which you can top-up to enjoy more paid channels.

Astro IPTV which is also known as Internet Protocol Television is a monopolistic competition market structure. It has many competitors compete with each other around the world. With the launched of IPTV, Astro has a partnership with Maxis and Time to deliver an awesome experience to the user which bundles up pay tv and service internet together. IMoney.my (n.d) states that Astro IPTV offers 3 broadband internet plan to users who are Astro IPTV 10mbps, Astro IPTV 20mbps, and Astro IPTV 30mbps. They offer this 3 type of plans is because they had targeted a different group of people depends on their usage of the quota monthly. The user then can enjoy their favorite television channel through the internet with the quota they had purchased.

With the collaboration of Astro and Maxis, the user can enjoy more service with the affordable prices, and at the same time the firms are also making more profit to their company. According to rightways (2013), The Astro IPTV had collaborated with maxis for the broadband services at the same time to dominate the market in September 2012. In monopolistic competition market, there is low barrier to enter and also exit the market. That is why there are many competitors came in this segment to compete such as Hypp TV, eTv, and ABNxcess. If they are facing economic losses, they can leave the market easily as this is monopolistic competition market.

Astro is a company which under monopolistic competition market structure. Monopolistic competition industry has few characteristic which are many buyers and sellers, low barrier of entry and exit, product differentiation and price maker.

First, product differentiation is marketing strategy used by the firm to make their product unique from other competitors. Product is differentiated based on product quality, services, location, and pricing strategies (Tey, 2012). Astro differentiated their product by using bundle package while consist of internet broadband and IPTV package. For Chinese user, Astro provides them Super Pack plus 3, Super Pack 3 and Wah pack. For India user, Astro also offers Super Pack plus 2, Super Pack 2 and Namma pack. While for Malay user, Astro delivers offers with Super Pack plus 1, Super Pack 1 and Nilai pack. Astro also provides different broadband plan for different level of internet users, which are 10mbps, 20mbps and 30mbps (Astro, 2017). Each of the packages targets on different type of consumer with different preference, income, race and location (Agarwal, 2017).

In addition, monopolistic competition market has a low barrier to entry and exit the market. Low barrier indicates that firms only need to have capital and they can enter the market to start up business. Internet Protocol Television (IPTV) industry is a low barrier market. IPTV industry is under sector of network service provider, so firms have to apply for a license from the government, and there are two types of license which are individual license and class license (Malaysia Communications and Multimedia Commission, 2017). The requirement to apply these type of license is to pay up for RM50, 000 (Malaysia Communications and Multimedia Commission, 2015). Astro only needs low requirement to enter IPTV industry as they just need to pay for RM50, 000 to get the license. Under this type of market, the firm can earn a supernormal profit in short run but only normal profit in the long run. However, when firms face economic loss, they can leave the market easily. In short run, Astro earns a supernormal profit because it will enter a new market and target new consumers. However, in the long run, it will only earn a normal profit as their new consumer will become normal subscribers. eTV launch on 26 January 2010, ABNxcess was also known as Asian Broadcasting Network (M) Sdn Bhd launched on 8 June 2013, all of these firm enter market easily because of the low barrier of market structure. However, eTV left the industry in July 2012 as they facing loses in this market and ABNxcess also left this market in August 2016.

Next, large amount of buyers and sellers also one of the characteristics of monopolistic competition. Buyers are people who purchase product or services also call as consumer or customer, while sellers are the firms that produce a product or provide services that call as producer or manufacturer. In IPTV industry, several competitors are Hypp TV, Netflix, iflix, Amazon Prime Video, Crunchyroll, Indieflix, Viu, Google Play Movie&TV, Happy IPTV, Family IPTV.According to Communication & Multimedia Fact 2016, the household broadband penetration rate in Malaysia is 77.9% of 7.57million which is 5.89million, and all of these are the potential consumers for the IPTV industry.

Moreover, one of the characteristics of monopolistic competition is a price maker. Price maker means that firm can decide the prices of its goods because there is no close substitute in the market. Monopolistic competition market has more monopoly power on its price than perfect competition market but lower than monopoly market. Astro set their package price based on its package offer. Astro set its Super pack plus range from RM188.68 until RM241.68, Super pack from RM154.76 until RM172.78, Value pack from RM84.80 until RM113.42, Family pack RM42.35.

Furthermore, non-price competition occurs as common circumstances in monopolistic competition market. The non-price competition involves advertising and focuses on a promotion that highlights their feature of products. Astro promoted its company through several ways, such as collaboration with government, foreign multimedia company and sports association. Astro partnered with Ministry of Health, Malaysia Army Forces and Projek Hati Nurani to provide Kampus Astro learning system to 76 pediatric wards, child’s oncology wards and School-In-Hospital classrooms in hospitals around Malaysia with call as Astro Kasih Bersama Wad Pediatrik. Besides, Astro also collaborated with Badminton Association of Malaysia and Fetch TV from Australia to broadcast badminton competition and eGG Network that making it the first eSports and gaming entertainment channel in Malaysia. Other than that, Astro conducted corporate social responsibility such as Astro Scholarship Awards that provide undergraduate students to pursue their study at higher education and Astro Kasih Knowledge Zone that equipped 25 charity homes that affiliated to Welfare Department with a mini library and books. Corporate social responsibility can build a good image for the consumers.

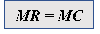

According to the Case, Fair, and Oster (2014) stated that a monopolistic competition company shows like a monopolist in the short run at profit maximizing level. Astro act as a monopolistic competition company, its product is different enough from its competitors due to the product differentiation, so that small price increase over those competitors do not eliminate all customers. At the same time, its marginal revenue is not equal to price, and it makes the output decisions based on the price respond. Astro company decided the output or price combination that maximizes profit. For maximize profit purpose, Astro company will increase production until the marginal revenue equals marginal cost:

In the short run, Astro company may face experience three situations:

- Supernormal profit

- Normal profit

- Subnormal profit or losses

-

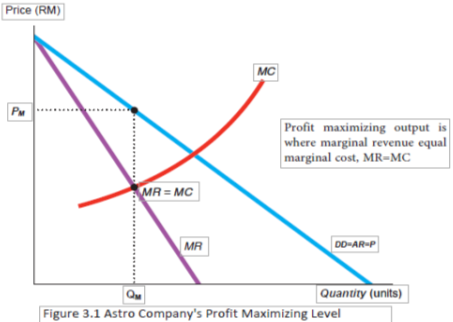

Supernormal profit

- Astro company produces the level of output (Qm) at profit maximizing level which is marginal revenue equals marginal cost and changes the prices at Pm. Since Astro company changes the price of product(Pm) higher than its average cost (AC) of production, so the company can earn a short-run economic profit or know as supernormal profit. Previously, Astro company earned supernormal profit since its revenue RM5.2 billion more than its cost RM2.5 billion which stated in its annual report 2016.

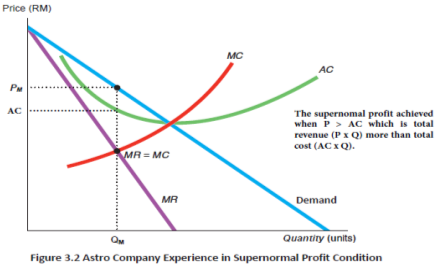

- Normal profit

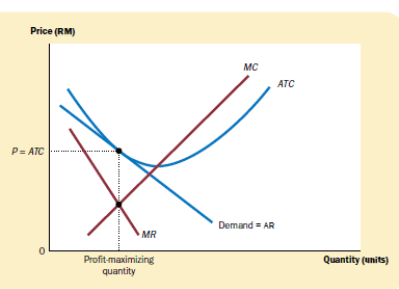

- Astro company produces the level of output (Qm) at profit maximizing level which is marginal revenue equals marginal cost and changes the prices at Pm. Since Astro company changes the price of product(Pm) equal to its average cost (AC) of production, so the company only can earn a normal profit.

-

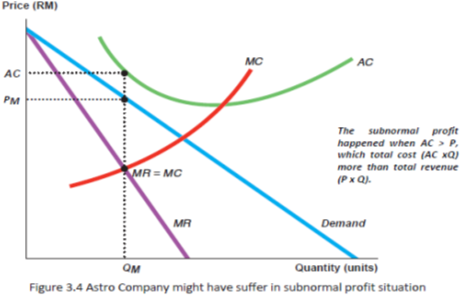

Subnormal profit

- Astro company produces the level of output (Qm) at profit maximizing level which is marginal revenue equals marginal cost and changes the prices at Pm. Since Astro company changes the price of product(Pm) less than its average cost (AC) of production, so the company incur losses or know as subnormal profit.

In a realistic world, there is not guaranteed for company always earned an economic profit in the market. When the company faced losses or subnormal profit, it must decide whether to produce at a loss or to choose to shut down. There are three situations for the company to make the decision.

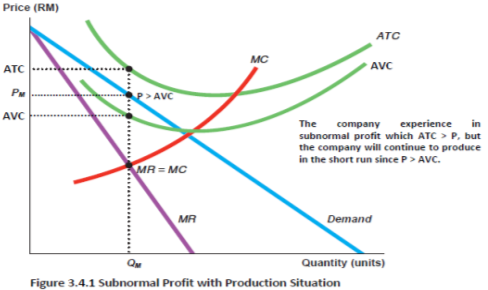

- Price of product more than Average variable cost (P > AVC)

- Astro company might face losses if its average total cost more than its demand curve (ATC > Demand), due to there is no quantity allows the company escape from losses. If the company can changes the price of product (Pm) more than the average variable cost (AVC), then the company can continue the production. This is due to its total revenue (P x Q) can cover the total variable cost (TVC) and a small portion of total fixed cost (TFC). Since the company can use its total revenue cover most of the cost, so it may continue its operation with little losses.

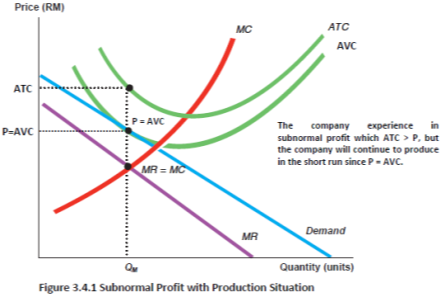

- Price of product equal Average variable cost (P = AVC)

- Astro company might face losses if its average total cost more than its demand curve (ATC > Demand), due to there is no quantity allows the company escape from losses. If the company can changes the price of product (Pm) equals the average variable cost (AVC), then the company can continue the production. This is due to its total revenue (P x Q) can cover the total variable cost (TVC). Even though the company cannot use its total revenue cover its total fixed cost( TFC), but as long as the total revenue can cover all the total variable cost. The company can still have a chance for getting back to the normal profit position so that it can keep its production.

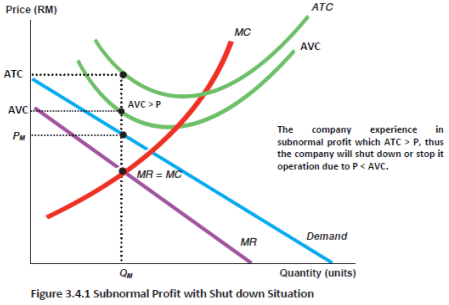

- Price of product less than Average variable cost (P < AVC)

- Astro company might face losses if its average total cost more than its demand curve (ATC > Demand), due to there is no quantity allows the company escape from losses. If the company can changes the price of product (Pm) lower than the average variable cost (AVC), then the company need to shut down its production. This is due to its total revenue (P x Q) cannot cover the total variable cost (TVC) and the total fixed cost (TFC). Since the company cannot use its total revenue cover all the cost, so it needs to shut down its operation to avoid from incurring more losses. Although some of the monopolistic competition firms will face this extreme situation, Astro company had not face this situation since it still having the operation until nowadays.

In the long run, Astro company will achieve zero economic profit due to the low barriers to entry or exit in the monopolistic competition market. There is two situation lead the Astro company achieved zero economic profit in the long run.

- The short-run economic profit attracted new entrants in the long run.

Astro company can earn a supernormal profit in the short run due to greater market share. Since the IPTV market is low barriers to entry, so the others company such as Hypp TV, iflix, Netflix and others will act as the competitor of Astro company to enter the IPTV market thus share the short run profit. When more and more competitors enter in IPTV market, lead the industry supply increase which lowers the market price at which P = AR. This situation continues until there are no more profits to be gained in the market which Astro company achieved zero economic profit in the long run.

- With losses some competitors will leave the market or industry.

Since there are not guaranteed for earned the economics profit so that some company may face losses. These loss-making company will leave the IPTV industry such as eTV and ABNxcess. When some of the competitors leave the industry, it will decrease the industry supply which increases the market price. This situation continues until there are no more profits to be gained in the market which Astro company earned zero economic profit in the long run.

Monopolistic Competition Market Structure and Economic Efficiency

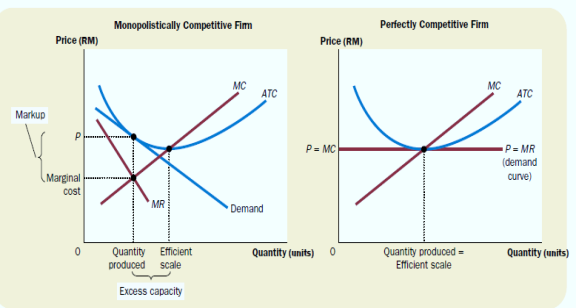

In the long run, the company who conduct its business under perfect competition market or monopolistic competition market will achieve zero economic profit condition. However, Astro company act as a monopolistic competition firm will incur allocative inefficiency compared with a company under perfect competition market structure. The reason behind that is the firm in pure competition or also known as perfect competition , always changes the price of product equal its marginal cost of production which at the point P = MC to achieved allocative efficiency, while the firm in monopolistic competition market such as Astro company changes the price of product greater than its marginal cost of production which at P > MC.

Moreover, the perfect competition company produces its product at minimum average total cost (ATC) to achieved productive efficiency, while monopolistic competition company such as Astro company are not producing at minimum average total cost (ATC) and excess capacity exits thus lead to inefficiency. As a result, consumer and producer surplus are maximized in perfect competition market structure, but there is society loses welfare occur in monopolistic competition market structure due to not enough of company’s output is produced and consumed.

In summary, Astro company which under monopolistic competition market have two key differences compared to the company has an efficient scale which is produced at minimum ATC (efficient scale) in perfect competition market structure. There is Astro company has excess capacity (different between Efficient scale and Quantity produce by monopolistic competition company) due to the quantity its produces is less than quantity at which ATC is minimum. In addition, Astro company’ markup amount by which price of product more than its marginal cost of production (P > MC) compare to the company under perfect competition changes the price of product same as the marginal cost (P = MC).

Astro IPTV is in a monopolistic market structure with competitors such as HyppTV, Iflix, Netflix, Viu and others. However illegal broadcasting has decreased the sales of licensed IPTV. Illegal broadcasting is the term given to unlicensed radio stations commonly known as pirate stations. These pirate stations provide illegal delivery of television content using signals based on the logical Internet protocol (IP), rather than through traditional terrestrial, satellite signal, and cable television formats.

Films and sports are being illegally broadcast at home and commercial premises in Malaysia. According to Malaysian Communications and Multimedia Commission (MCMC) Network Security, Enforcement and Advocacy Sector head Zulkarnain Mohd Yasin, MCMC has detained a group of men for operating satellite television service without a licence in two raids in Kuala Lumpur and Seremban last year. This unlicensed service has been operated for 3 years, and they promote their service through Facebook. They even enabled subscribers nationwide to enjoy paid television broadcast from Videocon, India with more than 100 channels, especially Bollywood films and programs (BERNAMA, 2017).

In addition, a total of 124 sets of Videocon brand decoders and parabolas worth RM120,000 were confiscated in the case. These illegal IPTV is now affecting the subscriptions and sales of Astro, because these illegal IPTV provide low price service, more channels and even pornography.

Furthermore, many households download movies from internet website illegally. These networks provide an illegal framework for users to request and receive digital transmissions of copyrighted movies from other users on the network. A request is sent out over the Internet to find the requested movie on another user’s computer. Within seconds, that illegal file is downloaded to the requestor’s desktop. Copyright of the particular movie is challenged and this also affected the profit of Astro IPTV.

(ii) Relate the selected market structure and the company to the implementation of Goods & Services Tax (GST).

The Goods and Services Tax (GST) in Malaysia are defined as recommended code listings to grant good allocation of different goods, and supply payment and these codes are based on a normal enterprise that is commonly encountered by GST registered companies in Malaysia. GST is a kind of value added tax and replaced the Sales and Service Tax (SST) to reduce government spending in Malaysia (Mansor, 2013). GST is levied on most transactions in the production process but is refunded with the exception of blocked input tax to all parties in the chain of production other than the final consumer. The existing standard rate for GST effective from 1 April 2015 to is 6%.

Astro IPTV is in a monopolistic market structure, the downward slope of a monopolistically competitive demand curve signifies that Astro IPTV has market power in the industry. Market power allows Astro to increase their prices without losing all of their customers.

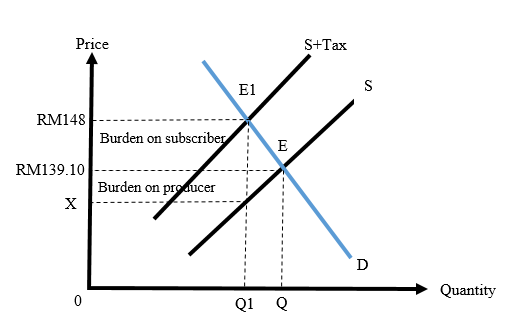

Before tax, Astro IPTV set its price at RM139.10 with the quantity of Q at equilibrium point E. When the government implemented the GST, this decrease the supply of Astro IPTV, supply curve S shift left to S+Tax the cost of production is increases, and the producers will reduce the quantity of supply.

After that price of IPTV paid by buyers is increased to RM148 per subscription. The new equilibrium point is E1 is achieved on Q1 and RM148. The total amount of tax on per subscription of IPTV is RM8.90 (RM 139.10 x 6%) which is paid by the subscriber and the rest of tax RM139.10 to X is the price Astro IPTV receive after tax.

In short, we can conclude that Astro Internet Protocol television (IPTV) market structure is in monopolistic competition market structure. To make sure we are going to a right direction we have examined and determine the characteristics of Astro IPTV market structure and the industry determine price and output decisions. We also analyze some economic issue, and implementation of goods & services tax (GST) bring the impact to IPTV market structure and Astro company.

First, we have analyzed the Astro IPTV market structure one by one by using the characteristics such as many buyers and sellers, low barrier of entry and exit, product differentiation, price maker and non-price competition. Then, all of the characteristics show us the same result that Astro IPTV is in monopolistic competition market structure. For example, in non-price competition Astro have involves in new product development such as add on a new channel which cooperates with eGG network for eSport channel and Fetch TV to broadcast badminton competition.

Then, for the price and output determination in short run Astro may experience supernormal, normal and subnormal profit. However, if Astro is having subnormal profit, it will choose to continue to run a business or close the business based the relation between average cost and the price of product. In the end for the long run, Astro will have a normal profit which is price of product equal to average total cost (P = ATC). This issue happened because of two reasons: in short-run firm earned supernormal profit attracted new entrants which are new competitors and some competitors incur losses choose to leave the industry.

Lastly, the current economic issue that affected the Astro IPTV is illegal activities such as illegal broadcasting from private stations and households tend to download movies from internet website illegally. All these reasons will hardly affect the profit of Astro no matter in satellite TV or IPTV. While implementation of Goods & Services Tax (GST). While bringing the effect to the Astro market supply and demand curve. When there is GST people will choose to spend less and decrease the demand for Astro services. This situation will increase the tax burden by supplier and customer. Hence, it will the increase in deadweight loss.

References

Allam, A. S. (2016). GST and the States: Sharing Tax Administration. Economic and

Political Weekly, 51(31).

Astro Annual Report 2016. (2016, May). Retrieved March 8, 2017, from

corporate.astro.com.my/Portals/_default/skins/amh2015/…/reports/AMH-AR16-

ENG.pdf

Astro Internet Plans (Home). (n.d.). Retrieved March 8, 2017, from

https://www.imoney.my/broadband/astro?utm_source=google-

search&utm_medium=ad-text&utm_campaign=gg/-sea/-exact/-[providers-astro]/-

kw:-astro-iptv-(my/-kl)-(my-bb

en)&utm_content=astro%20iptv%20packages&utm_term=726850706&agid=

34831754061&fiid=&tid=kwd78400120446&loc=9066500&net=g&dev=c&

devm=&cid=169020190031&aceid=&mt=e&ap=1t3&pl=&gclid=CLaEmPOmxd

ICFdgSaAodjY0Nxw

Astro Malaysia Holdings Berhad. (n.d.). About Us. Retrieved March 7, 2017, from

http://corporate.astro.com.my/aboutus.aspx

Case, K., & Fair, R., & Oster, S. (2014). Principles of Economics (11th edition). England:

Pearson Education Limited.

Demand curve. (2016, May). Retrieved March 7, 2017, from

https://www.boundless.com/economics/textbooks/boundless-economics-

textbook/monopolistic-competition-12/monopolistic-competition-75/demand-

curve-282-12379/

Illegal downloading and file sharing. (n.d.). Retrieved March 7, 2017, from

http://www.webster.edu/technology/service-desk/illegal-downloading.html

Tan, K.H. (2010, June 1). Video recording comes to Astro B.yond. The Star Online.

Retrieved March 8, 2017, from http://www.thestar.com.my/tech/tech-

news/2010/06/01/video-recording-comes-to-astro-byond/