New Product Development Project: Convenient Snack

- Introduction

Agri-food and Fisheries is Ireland’s largest indigenous industry, collectively employing some 150,000 people, with an annual output of over €24 billion. The Harvest 2020 vision is in summary an increase in :

- The value of primary output increased by £1.5 billion

- Value-added outputs increased by £3 billion

- Exports to €12 billion, representing growth of 42% over the period 2007-09.

To achieve the harvest 2020 vision Innovation and Product Development are key players. No matter what industry you’re in, innovation is often what sets your business apart from the crowd. The ability to create new products and services can easily be one of the most valuable assets a company has and with this in mind we set out to develop a novel, innovative food product for the 21st century.

The pace of life remains fast, it is still a challenge for many people to meet the demands of the many roles, activities and challenges in their daily lives. People are increasingly looking for ways to simplify their lives. The desire for convenience and simplicity in our food choices is growing. The culture of choosing the right balance of foods is increasing with the health food market and consumers knowledge of basic nutrition principles is growing.

With this in mind we began our journey of developing a convenience snack ‘with benefits’.

- Market / Consumer Trends and Idea Generation

We started our new product development project by looking at definitions of what a ‘snack’ and ‘convenience food’ means to consumers, and what the trends are in relation to snack time, choice etc.

“A snack is something, usually smaller than a meal that is eaten between, or outside of, regular meals for any reason” ref. Snacking in Ireland & UK 2014 Bord Bia.Â

“A convenience food is a commercially prepared food created as an easy way to get and consume. Most convenience foods provide little to no nutritional value.” ref. Onegreenplanet.org

We also carried out literature research on current market trends using two of the world’s leading market intelligence agencies –

Mintel (http://www.mintel.com) and Nielsen (http://www.nielsen.com/ie/en.html), and research generated by Bord Bia (snacking In Ireland & UK – Â Â Â Â Â Â Â Â Â Â Â Â Â 2014).

Survey :

We also carried out our own survey using Survey Monkey on our Facebook page. From the barchart results (ref. Appendix I) the following are the main points :

- The majority surveyed choose late afternoon and evening as the time they snack most.

- The majority stated they are most tired in late afternoon.

- Sweet was the category of choice over savoury for snack flavour and the reason for snacking was feeling tired and comfort.

- Chocolate scored the highest for the choice of snack (67%) followed by fruit (43%).

- 88% stated that there is gap in the market for a healthy balanced snack.

- Proteins scored the highest for nutrient preference in the snack at 42.11%.

- Slow release energy scored 44%, fast release 31% and boosting properties 31%. Price is still a very important factor to the consumer.

Based on literature reviews and this brain storming practice we decided on a multi-pack protein truffle & fruit combination. In the future we will consider line extensions using vegetable batons and dried fruit & nuts as the second compartment option. We chose fruit for our initial product based on our survey results and from the sensory analysis feed back “high moisture fruit complements high protein”.

Global ref. Nielsen Global consumer research 2014

- Annual snack sales grew more than two times faster in developing regions.

- Snacks as meal replacements are a growing opportunity.

- Women consume more snacks than men.

- Consumers want snacks to stick with the basics; the absence of ingredients is more important than the addition of them.

- Fresh fruit is best but chocolate is sweet.

- 64% chose chocolate as the top snack, 62% fresh fruit.

- Snacks that bridge the gap between nutrition and indulgence will break through the clutter.

Table 1: Percentage of consumers who said they ate these snacks in the last 30 days

Table 2: Percentage that rate health attributes as important in snacks

Nielsen Global consumer trends are pointing towards the following important criteria which we will take into account :

- All natural, no artificial colours or flavours, GMO free

- Low salt, low sugar/sugar free, low fat

- High in fibre, high in protein

- Ingredients sourced locally

2014 Bord Bia (UK and Ireland)

- Snacking is becoming more “planned”

- Seven out of ten snacks are purchased in a supermarket, with 59% bought as part of the larger shop. In terms of total snacks, the leading pack format was multipack at 34% but when we look at out of home snacks alone, this figure drops to 28%.

- How often: On average we snack 2.55 times per day, with Young Adults (16 – 24 year olds) being the highest snackers at over three times a day and the over sixties being the least likely to snack at 2.2. times per day.

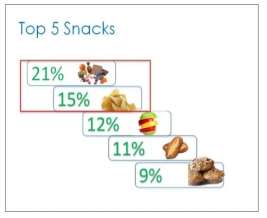

- What:Â The top three snacking categories across all markets are confectionery (21%), crisps (15%) and fruit (12%).

Table 3: Top 5 snack choices

- Where: Four out of five (78%) snacking occasions occur at home and 22% are out of home. 72% of total snacks are purchased in the supermarket.

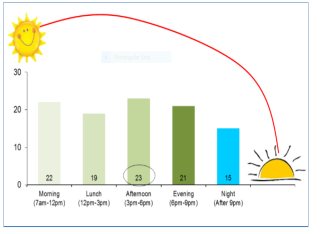

- When: We snack regularly throughout the day, with the peak period being between 3pm and 6pm accounting for almost one quarter (23%) of all snacking occasions. Â

Table 4: When do consumers snack ?

-

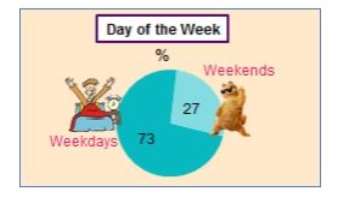

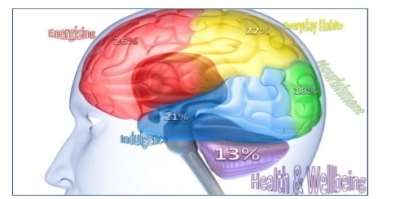

Why: Five key need states were identified for snacking – To energise (26%), as a habit (22%), indulge (21%), nourish (18%) and for health and wellbeing (13%)

- How much: On average we spend €2.13 per snack in the Republic of Ireland and £1.59 in the UK. In the Republic of Ireland, the Silvers are the top spenders on snacks and the Youth group the lowest. In the UK, the biggest spenders are those without children and the lowest are the Youth Segment.

Global ref. Mintel Global consumer research 2015

Global ref. Mintel Global consumer research 2015

- Consumer demands for natural and less processed, forcing companies to remove artificial ingredients.

- Eco is the new reality. In 2016 sustainability evolves from being good for the bottom line to being a necessary for new product development.

- Consumers are recognising that diets can connect with the way they look and feel.

- Novel protein sources and potential protein replacements are now appealing to the regular consumer, that was formerly an “alternative market”.

- Consumers are becoming more aware of sport nutrition to enhance energy and protein.

- Hand crafted products with a story are becoming more and more popular.

- Consumers negative stereotype that all fat is bad is now changing. The awareness of goods fats is growing.

- Getting back to basics and an interest in natural staple ingredients is increasing.

3. Competitor Analysis

All of the observed trends in this market research on snacking steered our team in the direction of :

- natural ingredients

- eco friendly (limited use of utilities)

- hand made

- protein

- energy

- health boosting properties

The next part of our NPD journey involved competitor analysis on what was out there already, following some/all of these trends. We reviewed on-line snack shops, health stores, local supermarkets and sunny California ! Table 5 below gives a graphic representation of this part of the journey.

Table 5:Â NPD journey in stores and on line research

|

Holland & Barrett, Mahonpoint, Cork

|

Here’s Health, Patrick street, Cork

|

|

|

|

|

|

We discovered the following types of snack products in some/all of these shops :

- High protein

- Products with novel ingredients

- Novel Foods *

- Balls

- Chips

- Bars

- Raw vegetables

* Novel Food is defined as food that has not been consumed to a significant degree by humans in the EU prior to 1997, when the first Regulation on novel food came into force. ‘Novel Food’ can be newly developed, innovative food or food produced using new technologies and production processes as well as food traditionally eaten outside of the EU. Examples of Novel Food include agriculture products from third world countries (chia seeds), newly produced nutrients (synthetic zeaxanthin) or extracts from existing food (rapeseed protein).

http://ec.europa.eu/food/safety/novel_food/index_en.htm

Table 6: Graphical representation of the competitor products we reviewed.

|

Product |

Weight |

Protein /100g |

Price |

References |

|

Organic Raw Chocolate Mulberries |

125 g

|

6.8 g |

€7.71 |

http://www.therawchocolatecompany.com/shop/raw-chocolate-snacks |

|

Kale-Os – Tomato & Basil |

12 g

|

– |

€2.75 |

http://www.nourish.ie/p/inspiral-kale-os–sweet-chilli-and-mint-12g/insm009 |

|

NUA Naturals Super Berry Mix |

190 g |

– |

€8.95 |

http://www.nourish.ie/p/nua-naturals-super-berry-mix—tangy-190g/nuam034 |

|

125 g

|

9.9 g |

€7.71 |

http://www.therawchocolatecompany.com/shop/raw-chocolate-snacks |

|

|

Protein Cookie |

12 x 75 g |

50 g |

€23.09 |

http://www.myprotein.com/sports-nutrition/protein-cookie/10530674.html |

|

Protein Chox |

12 x60g |

36 g |

€12.89 |

http://www.myprotein.com/sports-nutrition/protein-chox/10847275.html |

|

Protein Brownie |

1 x 75g |

31 g |

€1.99 |

http://www.myprotein.com/sports-nutrition/protein-brownie/11183251.html |

|

Protein Cookie |

1 x37.5 g |

50 g |

€2.49 |

http://www.myprotein.com/sports-nutrition/protein-cookie-sample/10662997.html |

|

Pulse Bar |

18 x 50g |

70 g |

€15.19 |

http://www.myprotein.com/sports-nutrition/pulse-bar/10864897.html |

|

Beanie Brownies Protein Energy Balls |

|

20g |

€1.50 each |

https://www.facebook.com/BeanBrownieCo/r |

|

Bounce Almond Protein Ball |

42 g |

28 g |

€2.75 |

http://www.nourish.ie/p/bounce-almond-protein-ball-42g/bspv003 |

|

Natasha’s Mighty Energy Bar |

100 g |

– |

€3.75 |

http://www.nourish.ie/p/natashas-mighty-energy-bar-100g/nlfm034 |

|

Bounce Peanut Protein Bar |

42 g |

29 g |

€2.75 |

|

|

Bounce Coconut |

42 g |

22 g |

€2.75 |

|

|

Balanced Bites |

44 g |

14 g |

€2.89 |

The protein in some other products listed above is higher than Balanced Bites but these are sold as high protein products, our product on the other hand is a balanced mix with the added super ingredients, plus our truffles are fresh and taste delicious !

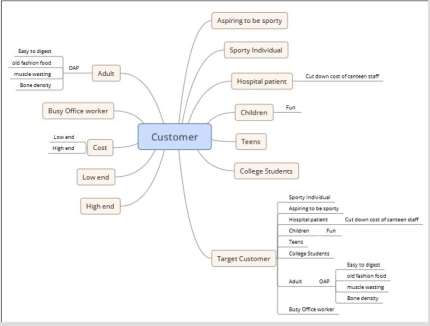

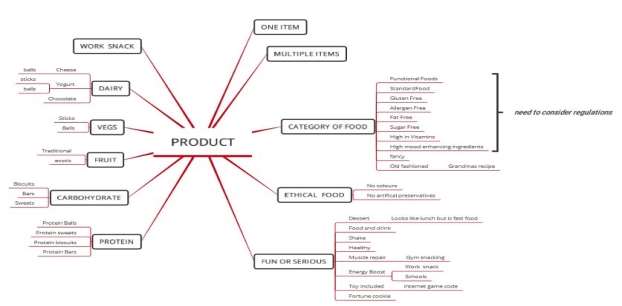

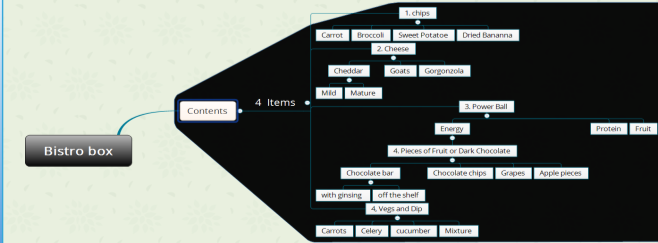

4. Target Demographic / Product

Following collation and review of all the research information we conducted several brainstorming sessions and documented the results using a Mind-mapping tool. The areas we covered in particular (Table 7) were :

-

Life stage -

Target market

Target market

-

Types of product

- Product content

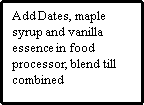

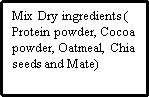

5.Recipe / Formulation

Keeping in mind our key attributes of a healthy balanced snack handmade with natural ingredients and the feedback from our consumer survey and market research; being that chocolate is the most popular snack and snacks that bridge the gap between health and indulgence will break through, we set about experimenting with various recipes for our protein energy truffle section of our snack.

First we looked for inspiration of what was already out there, most protein snacks made from all natural ingredients were made up largely of peanuts; this is a very popular flavour and packed full of protein but is also very available on the market already.

Over a three week period the team prepared 4 variations of our Truffle recipe. After each one we conducted a sensory analysis study (using Form, Appendix II) with the following age profile panels :

Class : Age range 23 to 50Friends : 30-50 Family: 14 -17

Recipes and feedback can be seen below.

Table 8 : Recipe 1

|

Ingredient |

Quantity |

|

Porridge Oat meal |

50g |

|

Dessicated Coconut |

30 g (& 20g to coat) |

|

Choc Whey protein |

10 g |

|

Peanut butter |

4 tbsp |

|

Honey |

2 tbsp |

|

Cocoa Powder |

1 tbsp |

|

Guarana powder |

1 tsp |

Sensory Analysis feedback :

Recipe 1: Dip in Carob, Dip in chocolate, Make smaller, Make rounder, Less Dry, Less dense, More chocolate, Less nuts, Add salt, Add chilli, Firmer, Change portion size, More bits of white coconut, A high moisture fruit would be of benefit as protein is quiet drying as mouth feel.

Table 9: Recipe 2

|

Ingredient |

Quantity |

|

Porridge Oat meal |

50g |

|

Dessicated Coconut |

10g (& 20g to coat) |

|

Choc Whey protein |

10 g |

|

Peanut butter |

4 tbsp |

|

Honey |

1 tbsp |

|

Maple syrup |

1 tbsp |

|

Cacao Powder |

1 tbsp |

|

Chia seeds |

1 dsp |

|

Guarana powder |

1 tsp |

Sensory Analysis feedback :

Recipe 2: Chia seeds adds texture and looks very good, A little dried and sweeter than the previous recipe 1, Very balanced not too sweet, Hint of maple in overpowering flavours, Looks like a luxury treat, Cocoa after taste.

Table10 : Recipe 3

|

Ingredient |

Quantity |

|

Almond flour |

200g |

|

Hazelnuts including dusting |

200g |

|

Cocoa powder |

100g |

|

Maple syrup |

100 ml |

|

Chia seeds |

50g |

|

Vanilla essence |

3 tsp |

|

Yerba Mate powder |

30g |

Sensory Analysis feedback :

Recipe 3: Almond and hazelnut flavour lovely, Too dense, Too calorific, Hazelnuts on the outside are lovely.

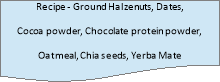

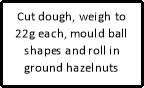

Table 11: Recipe 4 (x 14 truffles)

|

Hazelnuts ground (plus extra for coating around 50g) |

100g |

|

Dates |

50g |

|

Chocolate protein powder |

27g |

|

Vanilla essence |

1 tsp |

|

Cocoa powder |

10g |

|

Oatmeal |

100g |

|

Maple syrup |

20ml |

|

Chia seeds |

5g |

|

Yerba Mate |

5g |

Sensory Analysis feedback :

Recipe 4: Chia seeds adds texture and looks very good, a taste of more, lovely flavour of hazelnuts nicer than peanut taste, peanut flavour ‘has been done’ and hazelnut offers favourable and innovative alternative, taste heathy and natural, good size, no after taste, perfectly moist, nice balance of chocolate and nut flavour.

We evaluated the feed back of each one and agreed a slightly modified version of Recipe 4 would be the best one to launch with.

Table 12 : Nutritional Analysis of Recipe 4

|

Ingredients |

Carbohydrate(g) |

Protein (g) |

Fats (g) |

Calories |

|

100g Hazelnuts |

17 |

15 |

61 |

628 |

|

50g Dates |

38 |

1.2 |

0.2 |

141 |

|

27g Chocolate Protein Powder |

2.3 |

20.2 |

1.2 |

103 |

|

10g Cocoa Powder |

1.4 |

2.3 |

2.15 |

41.5 |

|

100g Oatmeal |

12 |

2.4 |

1.4 |

68 |

|

20ml Maple syrup |

13.3 |

0.01 |

0.01 |

53 |

|

5g Chia seeds |

2 |

1 |

2 |

24 |

|

5g Yerba Mate |

0.6 |

0.5 |

0 |

3.1 |

|

Total Batch Quantity |

86.6 |

42.61 |

67.96 |

1061.6 |

|

Per Truffle ( /14) = 22g |

6.2 |

3.0 |

4.9 |

75.8 |

|

X 2 |

12.4 |

6 |

9.8 |

151.6 |

Fruit section : Based on the nutritional analysis, portion size and visual appearance the fruit section of our Protein Snack was agreed to be 40 g of Blue berries and 35 g of Raspberries. We can consider inclusion of grapes if cost of product is not competitive.

|

Nutrient / 100 g |

Grapes |

Raspberries |

Blueberries |

|

Energy |

288 KJ (69 kcal) |

217 KJ (52 kcal) |

238 KJ (57 Kcal) |

|

Carbohydrate |

18.1 g |

12 g |

14 g |

|

Sugar |

15.48 g |

4 g |

10g |

|

Fibre |

0.9 g |

6 g |

2g |

|

Fat |

0.16 g |

0 g |

0g |

|

Protein |

0.72 g |

1g |

1 g |

|

Comments |

High moisture compliments drying taste of high protein |

Red colour adds cosmetically to product |

Contain unique phenol like antioxidants pterostilbene and resveratrol |

Recipe choice :

After experimenting with various recipes for protein truffles we finally decided after sensory analysis to go with the final Recipe 4. We wanted to make a luxurious looking healthy truffle, with inspiration from Ferrero Rocher© but a healthy alternative. This recipe therefore includes Hazelnuts as an alternative option to peanuts; hazelnuts are a good source of protein, calcium, dietary fibre, vitamin E and iron; they contain no cholesterol and are less allergenic than peanuts. They also offer an alternative pleasant flavour to peanuts.

The recipe also contains:

- Chocolate protein powder and cocoa powder to provide the chocolate flavour and added protein.

- Oatmeal to make the truffle lighter, less calorific and provide some carbohydrates and minerals.

- Vanilla essence for enhanced flavour.

- Chia seeds to provide desirable texture, omega 3, protein and minerals.

- Yerba Mate to provide boosting properties alternative and preferable to caffeine.

- Dates and maple syrup as sweeteners; Dates make up the bulk of the sweetness as they provide natural sweetness with little or no aftertaste unlike other popular natural sweeteners such as maple syrup of honey. The maple syrup helps the truffles to remain sticky so that they can be coated in hazelnuts.

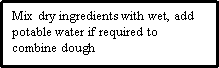

- To ensure the truffles are moist a small drop of potable water may be added to the dough.

The resulting truffles are a balance of healthy qualities and pleasant taste and texture; they are chocolatey and moist with a crunch of hazelnuts and chia seeds.

6.Process Flow Diagram / Production Process

The following Process flow diagram outlines the process that will be used when working from a home kitchen. A pilot project for upscaling may be carried out in CIK as detailed further on.

For any food product there are minimal tests that need to be carried out before/during production to ensure that the product is follows current legislation and is safe for human consumption.

Table 13: Quality Control Checks

|

Description |

Frequency |

Specification and tolerance |

|

Raw material inspections |

All deliveries at incoming stage |

See raw material specifications |

|

Checks weighing of scales (internal calibration) |

Daily |

+/- 1g |

|

Temperature checks |

Non applicable |

N/A |

|

Microbiological testing |

Every 10th batch |

As per FSAI guidelines |

|

Finished product weight |

3 per batch |

+/- 3 Packer rule |

|

Sensory checks : Taste, Appearance, Texture, Smell |

Every third batch |

Finished product specification |

Outsourcing facilities versus making in home kitchen

We met with Brendan Russell representative of Cork Incubator Kitchens (CIK). CIK, an initiative of the Cork County Council, aim to assist emerging and existing food ventures to start, grow and expand their business.

There are two fully equipped kitchen units, designed to the highest of standards, ready to cater for all operational needs. The two kitchens consist of the following equipment:

Bakery Kitchen

Ideal for all pastry production, puddings, pies, relishes, jams, pizzas, classes etc.

·Weighing Scales

·Zanolli Deck Oven

·Tilting Bratt pan

·Tilting Bratt pan

·Blast Chiller

·Spiral Mixer

Catering Kitchen

Perfect for Preparation work, volume oven cooking,

sauces, soups, wet dishes, classes etc.

·Gas cooker 4 ring hob

·Combi Oven

·Vacuum Packer

·Sealing Machine

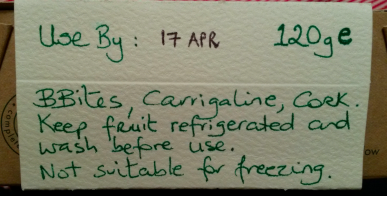

Located in Carrigaline industrial estate the cost would be €25 per hour, with min usage of 6 hrs. The booking of the times is all done on line and the location is very convenient. We decided to continue to make the products in our Jennies kitchen until the volumes grew.

7.Shelf life

Shelf-life is the period of time during which a food maintains its acceptable or desirable characteristics under specified storage and handling conditions. These acceptable or desirable characteristics can be related to the safety or quality of the product and can be microbiological, chemical or physical in nature. We based the shelf life determination on the characteristics of the product i.e. the intrinsic and extrinsic properties (ref. Table 14). Based on this information and the FSAI decision tree (see appendix 3) we set a Use By for our product and not Best Before.Â

Table 14 : Shelf life determination characteristics

|

Intrinsic properties |

Extrinsic properties |

|

Recipe |

Packaging |

|

pH |

Temperature during production |

|

Water activity |

Temperature during distribution |

|

Nutritional content of the food |

Temperature during storage |

|

Antimicrobial substances |

Relative humidity |

|

Product assembly |

Consumer practices |

|

Raw materials quality |

Procedures based on HACCP |

|

Shelf life of raw materials |

Historical data of similar products on the marker |

|

Microbial growth potential of ingredients |

We carried out physical shelf life studies by placing the pack in the fridge and also leaving at ambient temperature for 6 days. On carrying out sensory analysis at the end of each day it became clear that the fresh fruit was going to be the component that would dictate the shelf life. It started to lose it’s freshness quickly at ambient temp and from 5 days in refrigeration. Fruit in packs sold at cool temp in Tesco have 5 day shelf life also. The truffles were still ok at 5 days so we will not specify they need to be refrigerated as this takes away from their overall taste.

We also looked into accredited Laboratories who perform shelf life testing e.g. Exova, Co, Cork and Fitz Scientific Co. Louth. We plan to use Fitz Scientific who are a UKAS accredited laboratory based in Drogheda as they offer a special deal for first samples. They will perform the followingtests -Salmonella, Listeria, Staphylococcus Aureus, E Coli, Mould and Yeast, Total Coliforms, Enterobacteriaceae, TVC @ 30, Bacillus Cereus.

€75 per sample

We decided on a Use By +5 days with the storage instructions – Keep fruit refrigerated.

8.Product Name

Based on another brain storming session the following names were suggested :

- Snack box

- Boost Box

- Balance Box

- Bistro Box

- Protein snackies

- Protein Balls with fruit

- Protein truffles with fruit

- Balanced Boost Box

- BBox

- Balanced Bites

We wanted something that sounded nice and delivered the message of a balanced snack so we agreed on Balanced Bites.

9.Packaging – Labelling

For this product we needed to find a box with four compartments, food grade, not costly and environmentally friendly. We visited the following packaging supplier to discuss solutions.

- Down to Earth packaging , 17/18, City Link Park, Forge Hill, Kinsale Rd, Cork

We reviewed the following two options and decided at initial launch to run with the compostable packaging.

- Compostable packaging

- Sealing equipment

The compostable option fits in with our environmentally friendly, natural alternative to processed snacks. Compostable packaging unlike biodegradable packaging will biodegrade within 12 weeks so the packaging can be put in the compostable bin. Biodegradable packaging on the other hand could take years to biodegrade. The packaging is made from plants.

Compostable packaging :

- Compostable packaging & food waste is recycled into compost here in Ireland,supporting Irish jobs versus dry recycling ending up abroad (more carbon wasted) or in landfills across Ireland (if contaminated).

- Composting food packaging is much easier to recycle than it would be to recycle conventional packaging.

- There is no need to clean the packaging as you would for high quality conventional recycling. All compostable products go into one bin together with the food waste, making it simple.

- In organics recycling, Down2Earth products canturn into nutrient rich compost within 8-12 weeks. The compost can be used to grow more plants, creating a closed loop cycle.

- Recycling food waste and packaging together eliminates consumer confusion of which bin to use – it can all go into the same bin

- It will also reduce waste to landfill and incineration, both of which are more expensive per tonne than food waste recycling.

|

If we scale-up the production we may have to consider purchasing the heat sealing system for our packaging solution. It would however be plastic. This could be done in the CIK unit as outlined earlier, or through the purchase of The Enterpack system from Southern Tapes & Packaging. They offer a range of economical manual machines, high speed automatic machines, and even inline machines that are capable of modifying the atmosphere to give enhanced shelf life and presentation. The peel seal option would suit our product, as it can already be seen in retailers for fresh fruit combinations. The cost for mid range spec of this equipment is approx  €5,000.

|

Compostable        Peel seal box

Label :

The label has been designed by hand and is compliant with all current legislation. A graphically designed, printed label will have to be considered.

Other than product contents the requirements are : Shelf life, Weight, Company name & address, Storage instructions, Usage instructions, Ingredients, Allergens in Bold, Nutritional Info per serving and per 100g.

Top of box

Side of box

Bottom of box

<img src=”https://aai