Protecting Your Clients: Financial Case Study

A recent survey found 40% of adults in the UK, have less than £500 in savings, and are reliant month to month from their employment. (MAS). With savings alone, a family may quickly face issues.

In the event of death, severe illness or injury, the inability to meet basic household bills and liabilities such a mortgage, adds worry, anxiety and uncertainty into an already stressful time.

There are products available which mitigate these risks, and they fall into three broad categories; Life Assurance, Critical Illness Cover, and Income Protection. This is not an exhaustive list; a wide range of specialist products are available depending on client needs.

Whatever a family’s financial aspirations, the loss of an income, may cause plans to fail, increasing costs at an inconvenient time, with childcare costs etc.

The pyramid below demonstrates the importance of underpinning any financial plan with adequate protection, clearly this is a priority.

Â

Throughout this manual, we will explore the needs of a family (in blue);

Andrew (27) & Amy (24) have their dream home with their daughter, Celeste (4). They have no plans to move, and do not plan on having more children.

Andrew is a self-employed sole-trader, an Electrician, with average net profits; £34,000. During the week Andrew works long hours, but takes weekends off to look after Celeste. Andrew’s drawings are £2,800.

Amy is an assistant manager in a fashion retailer, she has recently returned to full time hours now that Celeste has started private school. Her salary is £21,000 per

annum. As she has been employed by the company for a number of years, she qualifies for 26 weeks’ full sick-pay and is enrolled in the group income protection policy which would pay 50% of her salary each month, after a 26-week deferral period. Amy’s net income is around £1300.

Celeste’s school fees £4000 each term, this is likely to remain until 18. Amy’s store is in a shopping centre, with long opening hours she’s able to work flexibly in order to look after Celeste in the evenings. Andrew drops Celeste off in the mornings to a breakfast club at school. They hope Celeste will go to university, where they expect to help with living costs, in line with their existing costs.

Their £130,000 mortgage has 14 years remaining, and costs them £1100 monthly. They have been able to put some money aside each month and have built up some small savings for emergencies. They have no other debts, and have no existing protection barring Amy’s employment benefits.

They save around £200 each month, and the remainder of the budget is enjoyed through socialising, entertainment, eating out and treating Celeste.

However, recently, Andrew’s stepfather, in his 50’s, who also is an electrician had a heart attack, fortunately he survived, but struggles to do the work he was doing previously. Andrew is concerned at the difficulty his parents have faced in maintaining their lifestyle, and has come to us to discuss protecting his family. He is unsure of what might be right for him, but is happy to spend around £100 each month, protecting his family.

Savings: £4,200Income: £4,100

Outgoings: £3300Disposable budget: £800

Factors to Discuss and Consider

There are a wide range of factors that will impact the necessity, level and term of cover, these include;

Dependents

This not only applies to the clients own children, but could apply to a spouse, elderly relative or grandchild. The number of dependents, and how long will their need last, i.e. until 18. And whether any expenses, beyond normal upkeep, such as school or university fees would increase needs.

Remaining Income

In a family where both halves work, the loss of a partner, or their income is likely impact the family income. Often one partner earns a higher salary, losing the “breadwinner’s”, income, strains finances. This is equally true if the other partner’s income was lost. In ensuring a family can maintain their lifestyle, after the loss of a partner or their income, it is important to consider what income is likely to remain, or be available to them afterwards.

Benefits

A number of state benefits are available to boost the remaining income, or help towards replacing a lost income- i.e. a critical illness prompting payment of personal independence payments or statutory sick pay. These won’t replace an income, and critically, the payments, criteria and timescales are set by the government, and aren’t certain.

Employer Benefits

Many employers offer employees some protection as part of their employment. Some are dependent on the length of service, or seniority. Including; sick pay, paying full salary for a time, or death in service; usually paying a lump sum- usually a multiple of their salary.

Much like government benefits, employer benefits are discretionary. It is also a consideration, that an employee changes employer, with differing benefits.

Savings

Savings, beyond an emergency fund, are likely to be towards a future need, such as retirement, care, or a large purchase. Currently, savings are unlikely to have any significant growth (Thisismoney.co.uk), if relied upon as income, the funds will exhaust eventually. It would be unwise to rely on savings beyond the short term. Savings can however, reduce the need for an income if they can reduce or eliminate liabilities i.e. credit-cards.

Liabilities

After considering the needs of the family and dependents, ensuring these are adequately protected, it is important to also consider any liabilities that could then impact the family. These often take the form of debts, but also commitments like school fees.

Included here are secured liabilities, such as the home. Often, with the loss of one income, there will be difficulties in sustaining the family’s lifestyle, potentially, meeting mortgage costs. Repaying the mortgage is a priority for those seeking life assurance, as it guarantees security of the family home.

Life Assurance

Life assurance, pays the sum assured, when the insured dies- assuming the policy remains in force. Policies usually take the form; “Whole-of-Life”, or “Term Assurance”.

Whole-of-Life

Covering an individual’s entire life, the sum assured is paid, when the policyholder dies. As death is inevitable, the cost is the most expensive.

Premiums

The premiums are either payable until death, or can be set to last until a certain age or for a limited term. The latter options allow for premiums to be paid up until retirement, yet allow cover to continue. When a limited term of payments is chosen, they’re naturally higher than the alternative.

Investment

Policies can be arranged with investment elements. This can be Unit-linked, with-profit, non-profit, or universal, potentially combining all three. A non-profit policy provides a fixed sum. With-profit policies allow the insurers underlying investments to generate growth, with bonuses that may increase the sum assured, although inflation beating growth in the long-term, is unlikely. Unit linked policies allow greater growth potential, above inflation, but the underlying capital is risked, jeopardising the sum assured, less risky funds should be a priority.

As whole-of-life policies can contain investment elements, some providers offer surrender values, although it’s unlikely to be suitable as an investment vehicle.

Whole-of-Life policies will not be suitable for every client. Care must be taken that there is an ongoing and permanent need, and the sum assured fits this.

It may be suitable for a client wishing to protect their family from funeral costs or legal expenses. And can mitigate inheritance tax liability, providing a lump sum to cover the liability due on their assets.

Couples can make use of this through a “joint life – second death” policy, since ordinarily, the estate will pass between the couple, and tax only falls due on the second death. Although more appropriate on larger estates where a significant inheritance tax liability arises, compared to those estates that slightly exceed the nil rate bracket, as the ongoing costs of the life assurance may exceed the eventual liability.

A whole-of-life policy can also be used to provide an income for dependents. While in later life it is unusual to have child dependents, an income may be required for dependents with life-long care needs.

Term Assurance

Unlike a whole-of-life policy, term assurance provides cover for a set period, often against a specific protection need, with an expected maturity. It’s useful against mortgages, or child dependents, because the time the protection is required for can be estimated.

Compared to whole-of-life policies, term assurance is cheaper. As the risk of death is lower over a given timescale, compared to a whole-of-life policy. Once the policy expires the cover ends, unlike whole-of-life policies, there is no surrender value. Term assurance can take a number of forms; decreasing, level or increasing term assurance.

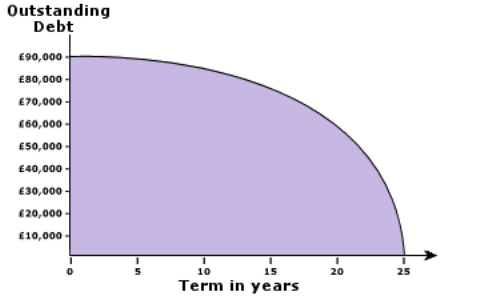

Decreasing (Family Benefit, Mortgage Protection) – Here, the sum assured decreases over time. It’s useful against protecting a repayment mortgage. As the term of the mortgage reduces the balance falls, consequently the level of protection needed reduces.

This is also useful for dependents, as provision needs decrease over time. Reductions in the sum assured can be fixed each period, or in line with the interest charged on a mortgage.

Decreasing term insurance is also cheaper than other term assurance, as the risk to the provider reduces over time.

With a family benefits policy, the benefits are paid as a monthly figure, protecting against the loss of an income until the end of the policy, meaning that the shorter the term remaining, the lower the overall benefit.

Gift inter vivos policy– This is a special case of decreasing term assurance, protecting against inheritance tax liability from a potentially exempt transfer (PET). In line with the tax liability, the sum assured falls over seven years.

Level– The sum assured remains constant. It can be useful in order to repay a set liability, i.e. an interest only mortgage, with a constant balance. They also provide peace of mind to the policyholder’s family, through the certainty of a lump-sum. It can leave people over protected, paying higher premiums for a need that reduces over time.

Increasing- The most expensive form of term assurance. Once arranged, the sum assured, increases over time. At the policies end, the sum assured can be considerably higher than originally. This provides a lump-sum protected against inflation, which over a time, erodes buying.

Convertible & Renewable- special forms of term assurance, allowing the above policies to be converted into whole-of-life policies, or simply renewed without further underwriting, sometimes allowing the sum assured to increase, in what would be a renewable, increasable term assurance policy. Allowing more flexibility for the insured.

Rider Benefits- these are applicable to any of the above policies, they are additional benefits which can be added, or included already. These include; Waiver of Premium, prevents the policy lapsing when the insured is unable to pay premiums through sickness or injury. Terminal illness or total & permanent disability cover, providing an accelerated payment when the insured has a very short life expectancy, or is totally disabled, although the criteria for this varies. Accidental death benefit can also be included. Guaranteed insurability options allow for flexibility within the policy for the sum assured to be increased at key events in the insured’s life, without the requirement for additional medical underwriting. All options and additional benefits will increase premiums.

Summary

Life assurance, ensures that financial needs can be met, often at an affordable cost, regardless of the need, as there are many forms. It does however have restrictions, medical underwriting means that lifestyles increasing the risk of death can impact the cost of the cover, i.e. smoking. While most claims are paid, there are often significant exclusions, including death from; alcohol, drugs, self harm, terrorism, war, or recklessness.

If the policyholder is the insured, on their death, the pay-out from these funds will be added back into their estate, where there is potential for an inheritance tax liability.

Â

Â

Neither have life assurance, in the event of a death, the remaining family would not be able to maintain their lifestyle. Protecting the mortgage on the family home is a priority. A joint policy allows the home to be protected in the event of either death. As the balance on the mortgage is naturally decreasing as repayments are made, a mortgage protection policy, with an initial sum assured of £130,000, and term of 14 years would provide the most cost-effective cover.

Approximately £15 monthly.

In the event of a death now, the mortgage would be repaid, and the monthly outgoings would fall by around £1100. However, other costs could increase, childcare may be required, and Celeste’s education costs would also continue.

The approximate cost of her education over the next 17 years will be; 3 Terms x £4000 x 17= £204,000.

Due to Amy’s employment, she would need childcare for the weekends and mornings. Andrew would require childcare for weekday evenings. Approximately this is 20 hours a week, and expect she would be mature enough to look after herself for a few hours once in secondary school, aged 12. In addition to term-time childcare there would be around around 16 weeks annually, where fulltime care is needed, 40 hours weekly. Average childcare costs in their area are £7 hourly.

20 hours’ x 36 (term-time) x 8 years, 40 hours’ x 16 (holidays) x 8 years

A Total of 10880 hours of childcare would be needed till age 12, at £7, would cost £76,160.

With a total cost in the region of £280,160, It’s clear it’d be difficult for either parent to cover these costs. However, each month, the requirements would reduce. Again, a decreasing term assurance policy would fit their needs, as these are ongoing costs, it would make sense for this policy to be written as a family income benefit policy, providing the average of Celeste’s care and education costs each month. £1000 for her education, and £793 (based on 1360 hours of care each year, divided by 12 months, at £7 an hour), written on a joint basis over a 17-year term. The approximate cost is £23 monthly.

Income Protection Insurance

This provides the insured with an income when, due to; illness, disability or injury, they are unable to work. A provider cannot cancel this policy due to repeated claims, and as long as premiums are maintained, the cover continues.

The benefits are paid monthly, and are used to cover normal expenditure. To incentivise the insured’s return to work, ensuring claims only last as long as necessary, the level of cover is generally between 50-75% of the insured’s salary.

Should a condition make it impossible for the insured to return to their work, and instead they return on a lower salary, a proportionate benefit clause found in many policies, allows a portion of the benefit to be paid, to “top-up” their income.

While the cover is permanent, to a normal retirement age, many insurers have a reviewable premium, similar to critical illness cover. To lower premiums, a deferral period, between 4 & 104 weeks, effectively eliminates short illness, reducing the risk for the insurer. Aligning the deferral period against existing provisions such as an accident, sickness & unemployment cover, or employee sick pay further helps reduce premiums.

Income protection is important for the self-employed, injury or illness will impact their income earlier. Their deferral period tends to be shorter, as they need the income sooner than someone who receives sick-pay.

Amy is fortunate to have employer provided sick-pay and income protection. If she were ill or unable to work, the impact of this would not be felt for 6 months, and then the reduction in her wage by £650 would allow the family to meet their outgoings, albeit with little left.

Andrew, has no protection. If Andrew were unable to work, his income would stop immediately, savings would then be relied upon, the loss of his income means a shortfall of £2,000 each month (Outgoings; £3,300, less Amy’s income of £1,300). Savings could sustain them for around 2 months (Savings/Shortfall, £4200/£2000= 2.1 Months.)

Protecting his income with an income protection policy, until his state retirement age of 68, as regardless of his dependents, there will always be household bills (gov.uk), an 8-week deferral, with benefits of £2100, cost around £49 monthly, extending the deferral to 52 weeks, reduces costs to around £33 monthly. (Drewberry Insurance) Intermediate months could be covered by an accident & sickness policy, by excluding short illness, Andrew may save money on future premiums on review.

Other Protection available

There are a wide range of more specialised protection & insurance policies available, while they may not offer financial security, they can provide peace of mind.

Accident Sickness & Unemployment Insurance

Offering similar benefits to income protection, with important differences. It’s impermanent; the insurer can decline to renew the policy. Benefits are generally provided up to 24-months. “Unemployment” cover’s redundancy, and only when the insurer believes that the insured had no foreknowledge, naturally excluding the self-employed.

Covering Andrew’s income using an accident & sickness policy here, with a deferral period of 2 months, allowing for their savings would cost them in the region of £14 monthly (gocompare.com), a small saving compared to the single product.

Payment Protection Insurance

If the insured is unable to work, through sickness, injury or redundancy, this cover will maintain payments for the liability (credit card, mortgage or loan, etc.) for a period of generally up to 24 months.

Health Insurance & Dental Plans

Private health insurance may provide high quality care, fast diagnosis and short wait times or flexibility for treatment and surgery etc., without the high costs involved in paying for this treatment in a standalone manner. Dental plans are offered in a similar way. There are often exclusions for elective or cosmetic surgeries.

Critical Illness Cover

Providing a lump sum to the insured on the diagnosis of a critical illness, including but not limited to; most Cancers, Heart Attack, and Stroke. Unlike term assurance, the insured need not die, should they recover, funds won’t need to be repaid, as the policy ends on a successful claim.

Beyond major conditions, cover can be provided for other conditions; major organ transplant, paralysis, coma, blindness or loss of limbs. Each provider may apply a different definition to a condition. The Association of British Insurers provides definitions as a guide to best practice, which is the minimum definition an ABI insurer can use. For instance;

The ABI’s blindness definition reads;

“Permanent and irreversible loss of sight to the extent that even when tested with the use of visual aids, vision is measured at 3/60 or worse in the better eye using a Snellen eye chart.” (ABI,2016)

L&G’s definition follows;

“…the use of visual aids, vision is measured at 6/60 or worse in the better….” (L&G, 2016)

Two similar definitions, with L&G’s definition benefiting the insured, with a less restrictive definition. The cost of more generous cover may be higher than stricter insurers.

Compared to term assurance, the cost is much higher, the risk of dying, is far lower than being diagnosed with a critical illness or condition, this extra risk increases costs. Furthermore, a wide range of underwriting factors are used to tailor premiums to the insured’s risk.

Adverse family history increase costs, and previous diagnosis makes securing cover difficult, or impossible, at best, an exclusion is imposed (L&G, 2016). It is expected that all material facts are disclosed, so a full and informed decision is made, withholding a condition can void cover. (Guardian,2013)

With any critical condition, family life becomes pandemonium. The insured may be unable to work, travel to and from medical appointments may be necessary, if provided by a partner, they too may be unable to work. Child care may increase, care may be required, alterations may be required, and of course the usual household expenses will still occur.

Critical Illness Cover, when considering these requirements can provide peace of mind, by funding medical or care costs, covering liabilities, and providing funds to cover the cost of equipment, adaptations or general improvements to the insured’s quality of life with their new condition.

Policies can be arranged in numerous ways, a standalone plan, which works similarly to term assurance, paying out on diagnosis on an insured condition. However, it is commonplace that the insured must survive at least 28 days in order for a valid claim.

Alternatively, it can be arranged in addition to a term assurance policy with death benefits. In addition to being covered against death, the policy would cover critical illness. This additional cover can either be arranged so that following a critical illness, or death, the cover will cease, so a single payment is only possible, or, a payment can be made against both illness and death. It can be incorporated into an endowment or into a whole-of-life plan as an option in a similar fashion.

Like life assurance, the proceeds can be written into trust, this is not usually needed though, if the protection is to cover existing liabilities. However, if the cover is combined with life assurance, potential exists for an inheritance tax liability; if a critical illness is claimed for, the proceeds will go tax free to the insured, if however, a death claim is required, this becomes part of their estate, creating the liability. It is possible to use a “split-benefit” trust, which will pay the proceeds of the critical illness payment to the policyholder, and the death benefit to the beneficiaries in the trust deed.

Critical illness cover premiums are organised similarly to term assurance, with historically fixed payments. Due to advances in medicine and technology, claims have risen with early diagnosis, more providers are now switching to reviewable premiums, which offer stability of fixed payments for a period, before being reviewed, at which point they may rise or fall. Just like term assurance, a similar set of exclusions apply, and medical underwriting may result in additional restrictions or exclusions, and potentially higher costs overall.

Cancelling a policy to take out a new policy is generally not recommended, as comparing cover, benefits and restrictions can be difficult or time consuming.

Although Andrew & Amy are healthy, after recent events they are keen to have some protection that would allow them to deal with an unforeseen critical illness. As you have seen, Amy is well protected through her employment against her income, Andrew would be well covered by the Accident & Sickness Policy, and through an income protection policy. However, they are worried about potential adaptations to their home or care costs being needed. The Money Advice Service suggests that 2 hours each day of care would cost in the region of £11,000 annually. As the mortgage costs a little more than this, a lump sum to cover this, and provide a buffer to allow for some adaptations if necessary, around £150,000 of cover over 17 years, each. Written as stand-alone policies, means each is protected in the event of a critical illness. Together, the cost of these policies is in the region of £65 monthly.

Â

Andrew & Amy’s monthly protections costs exceed the budget they wanted to spend. Coming to a total of around £150 monthly. Although the protection would ensure that whatever happens to either of them, they would have financial security until retirement. Full protection is expensive, and unless they are willing to spend the money to cover themselves adequately, they will need to adjust the level of cover they can afford, or prioritise the policies available to them.

Business Protection

The death or illness of a partner, key person or sole trader can have significant consequences to a business. While these issues can be as wide and varied as the business that have them, the type of cover detailed in this manual can be tailored to provide effective protection.

In Conclusion

As can be seen, it is important to take a view of the bigger picture, and use a holistic approach in shaping protection around a client’s needs. While the hope is that these policies are not used before their time, they provide the firm foundation for clients to achieve their financial aspirations.

A Adviser.

References

ABI Policy Definitions- (2016)

Drewberry Insurance, Income Protection

(2016)

Gocompare.com Accident & Sickness cover quote system (2017)

Gov.uk, State Retirement Age

, (2017)

The Guardian, Critical illness insurance: The neglected cover that could be crucial (2013)

Legal & General Policy Booklet- (2016)

L&G Underwriting Quick Reference Guide, (2010)

Money Advice Service, Care Costs

(2017)

Money Advice Service, Press Release.

(2015)

This is Money.co.uk, What next for savers.

(2017)