Risks of Forex Investment

Currency market

Introduction

The foreign exchange market is a very liquid market; everyone can trade and sell, everyone has access to it 24/7. Unlike the stock exchange, where it’s centralised at a particular area, such as the New York Stock Exchange. But the currency market is an over the counter market; it can be traded in any geographic location. There is no broker fee, only a low-cost transaction fee, which makes it more accessible for people to invest in. To answer the assignment question, we will need to look at the risks associated with currency market, the potential returns and finally how to manage these factors.

Risks

When an organisation makes the decision to engage in international financing activities, the company also take on additional risk as well as opportunities. The most common risks are associated with businesses engaging in international finance which includes foreign exchange risk and political risk, such as Trump being elected the new president of United States of America. The dollar increased, and will continue to increase, depending on what political decision he makes, as Donald Trump plays a huge part of influencing the value of the dollar. These political risks may make it difficult to maintain constant and reliable revenue for the firm or could be a potential to make a profit.

An investor could also invest in Forex, but there is always a risk that occurs when the value of investment vacillates. This is due to changes in a currency’s conversion rate. When a native currency appreciates against a foreign exchange, profit or returns earned in the foreign country will decline after being exchanged back to the native currency.

Numerous points of investment risks are inherent in overseas investing: political risk, local tax inferences and exchange rate risk. Exchange rate risk is particularly significant since the earnings associated with a foreign stock must then be transformed into U.S. dollars before an investor can spend the profits. Breaking down risks:

The political environment of overseas countries generates portfolio risks because governments and political systems are continuously in change. Naturally this has a very direct influence on economic and business divisions. Political risk is considered a type of disorganised risk linked with specific countries, which can be spread away by capitalising in a broad range of countries, effectively accomplished with broad-based overseas mutual assets or exchange-traded assets.

Foreign taxation poses another problem. Just as overseas investors with U.S. securities are subject to U.S. government taxes, foreign investors are also taxed on foreign-based securities. Taxes on overseas investments are typically withheld at the source country before an investor can understand any advantages. Returns are then taxed again once the stockholder exiles the funds.

Finally, there’s currency risk. Variations in the value of currencies can directly influence foreign investments, and these fluctuations interrupt the risks of investing in non-U.S. assets. Occasionally these risks work in the firm’s favour, other times they do not. For example, “In the wake of Donald Trump winning the US election, the real 10-year Treasury yield climbed to a 2016 high of 0.74 per cent by mid-December. It has subsequently retreated since to about 0.4 per cent, and weighed on the dollar.” (Khan, 2017). As Donald Trump won the election, the price of the dollar improved, this generates opportunities for investors, so they can make a profit.

Figure 1 Trump victory. (Cox, 2017)

By looking at figure 1, since the Trump election victory, the dollar has increased by 4.46%, from 97.06 to 101.39 over a period of 55 days. “The last time it happened, in January 1987, the Dow dropped 11 percent over the next year as the market endured one of its worst crashes. The previous occurrence in March 1964 saw the index climb 9.3 percent over 12 months.” (Ciolli and Wang, 2017). This political event was one of the crucial days for investors in the currency market, but history suggests that the market might endure a bad crash.

That’s one example, the Brexit event is another political example: If Britain stops sending money to the EU budget, they lose access to the single market. But they save £350m every week, and they can easily renegotiate a trade deal with the EU for goods, as Britain already complies with the current regulations and there are no tariffs currently. (Cadman and Tetlow, 2016)

After the decision to leave the EU, there have been several initial effects caused by “Brexit”. The FTSE 100 shrugged off a brief post-referendum dip and is now at levels that haven’t been seen since August 2015. The FTSE 250 suffered an 11.4 per cent fall just after the vote. (Belam, 2016)

Figure 2 FTSE 250

The other effects of the Brexit vote were on the pound, on 23 June, it was worth $1.50. It is now trading around $1.30, down about 13%. This is the lowest it has been since the mid-1980’s. (Belam, 2016) As the pound weakens, international companies with businesses both domestically and outside of the UK make profits this is due to the foreign currency being converted back into sterling.

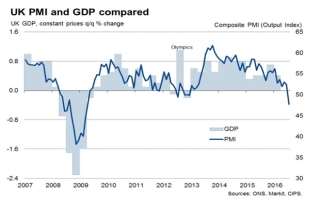

An additional effect of the Brexit was the PMI report submitted by Markit’s, and it shows that the UK economy is shrinking at a quarterly rate of 0.4%. (Belam, 2016)

Services output and new business both fall at the fastest rates since march 2009, and the month-on-month decline in the index in the latest period, at 4.9 points, was the largest observed since the survey began in July 1996. (Martin, 2016)  (Belam, 2016)

(Belam, 2016)

By looking at the initial effects, we can undoubtedly see that the UK economy is suffering cause of the Brexit decision, and is shrinking its economy by a quarterly rate of 0.4%.

Potential Returns

The long-term returns of the currency market are engrossed in a few days. “Javier Estrada of the IESE Business School showed that over a period of 40 years, missing only the best 10 days would have cost investors about half their capital gains, while avoiding the 10 worst days would have led to 2½ times the capital gains.” (Authers, 2017). This tells the importance of being active and decisive in the currency market, missing a few crucial days can cost dearly. The clue behind this process is making fewer transactions that yield larger individual gains.

That’s the long-term returns, the short term return however, is decided in seconds and minutes, quick thinkers and experienced stock investors make the quick decision, deciding whether it is worth investing or not. Looking at political opportunities that can benefit both long term and short term returns, the example of Donald Trump winning the presidential election and Britain invoking article 50 are good examples that explain the impact the political decisions shaped on the currency market. Missing an event like that can cause the investor to lose a lot of capital. In a real scenario that should not happen, as the economists working for the investment firm should’ve predicted a jump in the dollar matrix due to the election and a drop in sterling after Brexit.

“Looking ahead to 2017, our experts argue a new investment phase has begun as the yield curve finally turns upwards. Flattened by years of ultra-low interest rates and monetary stimulus, world economies are gradually being weaned off quantitative easing.” (Barret, 2017)

Recommendations for investors

Managing the risks of investing can be hard, but not if you take certain precautions before the investor makes the investment, such as carefully considering his investment objectives, the level of experience, and risk appetite. If the investor makes a loss, the investor/firm needs to have enough capital to invest in something else, rather than spending all the assets in one investment.

A different way to manage risk is diversification and it is the most important component in helping the investor reach a long-range economic goal while diminishing the investor’s risk. At the same time, diversification is not a bulletproof assurance against a loss. No matter how much diversification you employ, investing includes taking on some risk.

An additional way to manage the risk is hedging, but it’s not free, and if the investor isn’t experienced enough about investing then it could have a really bad input to the investment, but it does reduce the risk of the investment.

A question that often confuses investors is how many stocks should be bought in order to reach ideal diversification. According to portfolio theorists, adding about 20 securities to the investor’s portfolio reduces almost all of the individual security risk involved. This assumes that the investor buys stocks of different proportions from numerous industries.

Conclusion

The conclusion of this essay tells that, investing in forex is full of risk, but there are several ways of limiting the risks. But limiting risks can also create more risks, such as using hedging to reduce the risk.

References:

Authers, J. (2017). Timing the US market a big challenge for passive investors. [online] Ft.com. Available at: https://www.ft.com/content/090e22ec-fa56-11e6-bd4e-68d53499ed71 [Accessed 26 Feb. 2017].

Cox, J. (2017). What is going to happen to the dollar under Trump, according to experts and investors. [online] The Independent. Available at: http://www.independent.co.uk/news/business/news/donald-trump-dollar-pound-value-what-will-happen-rise-fall-currency-exchange-experts-economists-a7537041.html [Accessed 26 Feb. 2017].

Belam, M. (2016). One month on, what has been the impact of the Brexit vote so far?. [online] the Guardian. Available at: https://www.theguardian.com/politics/2016/jul/22/one-month-on-what-is-the-impact-of-the-brexit-vote-so-far [Accessed 20 Feb. 2017].

Martin, W. (2016). Every part of the UK economy is suddenly shrinking. [online] Business Insider Australia. Available at: http://www.businessinsider.com.au/markit-services-pmi-for-the-uk-in-july-2016-8 [Accessed 20 Feb. 2016].

Cadman, E. and Tetlow, G. (2016). The EU single market: How it works and the benefits it offers. [online] Financial Times. Available at: https://www.ft.com/content/1688d0e4-15ef-11e6-b197-a4af20d5575e [Accessed 22 Oct. 2016].

Cadman, E. and Tetlow, G. (2016). The EU single market: How it works and the benefits it offers. [online] Financial Times. Available at: https://www.ft.com/content/1688d0e4-15ef-11e6-b197-a4af20d5575e [Accessed 22 Oct. 2016].

Ciolli, M. and Wang, M. (2017). Trump Is on the Verge of His Own Bull Market. [online] Bloomberg.com. Available at: https://www.bloomberg.com/news/articles/2017-02-24/trump-at-brink-of-his-own-bull-market-as-dow-flirts-with-history [Accessed 28 Feb. 2017].

Khan, M. (2017). US 10-year treasury yields enjoy biggest monthly jump since 2009. [online] Ft.com. Available at: https://www.ft.com/content/157e9c79-c708-3527-963d-58d918165261 [Accessed 28 Feb. 2017].

Barret, C. (2017). Where should I invest in 2017?. [online] Ft.com. Available at: https://www.ft.com/content/df00d4da-c117-11e6-9bca-2b93a6856354 [Accessed 28 Feb. 2017].