Sainsburys European Expansion into the Czech Republic

Â

Contents

1.0 Introduction

2.0 Macro Analysis

2.1 Political

2.2 Economic

2.3 Social

2.4 Technological

2.5 Environmental

2.6 Legal

3.0 Market-Specific Data

3.1 Competition within the Market

3.2 Consumer Spending

3.3 Success of current FDI

4.0 Mode of Entry

5.0 Conclusion

6.0 Reference List

1.0 Introduction

Gaining an advantage over its competitors is a top priority for firms. In a highly competitive and relatively mature industry, in the presence of a potentially saturated domestic market, a way in which they can do this is by taking advantage of resources yet to be exploited by other players in the market. This can involve the expansion into new markets overseas; many of such firms do so through Foreign Direct Investment (FDI). FDI is commonly defined as an investment involving the instilment of foreign funds into a firm that operates in a country not that of the country of origin of the investor (Kinda, 2010). There has been a burst of retail FDI, propelled predominantly by the consolidation of Western retail markets, as well as the materialisation of frontrunner firms within these mature, competitive markets, for example, the UK and France. These firms succeeded in leveraging their growing core-market scale for expansionary investment in potentially higher growth emerging markets (Durand & Wrigley, 2008). This is something firms are now looking to exploit within Eastern Europe as part of a new corporate strategy. The aim of this report, as the Head of New Market Development at J.Sainsbury PLC, is to analyse the suitability of particular Eastern European countries for market entry by the company. Explicitly, Czech Republic has been chosen as the country that will be entered into as part of the organisation’s corporate strategy of European expansion; the reasons for this choice will be analysed throughout this report. A formal macro and micro screening process on the country will be coordinated to ascertain its relative appeal for supermarket retail FDI and consideration will be given to PESTEL macro-environment variables as well as market-specific data. Reasons for the selection over other Eastern European countries, will be clearly communicated, and recommendations to the board of directors will be given as to the specific mode of entry for this endeavour.

2.0 Macro Analysis

When examining the suitability of potential foreign markets to enter, it is essential that consideration is given to PESTEL macro-environment variables, as it is these variables that are the reason for, if not considered correctly, failure to effectively invest into foreign markets (Ilmanen et al, 2014). A firm has a lack of control around these factors, and have minimal impact when it comes to changing them, meaning that the composition of the macroeconomic variables of a country, for example, government influence and the strength of the economy is vital when it comes to selecting suitable nations to operate in (Goodwin et al, 2015). It is apparent that, through a thorough analysis of these elements, Czech Republic are a very attractive nation to operate in.

2.1 Political

The Czech Republic is a member of the Multilateral Investment Guarantee Agency (MIGA), an international organisation for protection of investments, which is part of the World Bank-IMF group (CzechInvest, 2017). This involves several bilateral treaties between themselves and other nations, for example, the United States, Germany, and the United Kingdom, which support and protect foreign investments. Czech Republic have undertaken various administrative adjustments since 1998 that makes it an attractive venture for Sainsbury’s. This, coupled with the accession of the Czech Republic to the European Union in 2004 and the amendments to the investment-incentives legislation, investment into the country has been boosted even further. According to the Czech Republic Ministry of Industry and Trade, these measures include: the protection of investment and the avoidance of double taxation, the protection of property rights and the export of profits and advanced activity abroad and improved service for foreign investors (Santander, 2017). Sainsbury’s will therefore function under the same rules and regulations as Czech’s domestic supermarkets, meaning that they will not be operating under any sort of disadvantage. The introduction of these incentives has made it simpler for organisations functioning overseas to operate within their borders, and shows a positive attitude from the government towards supporting foreign investors looking to invest into the country. Other CEE countries however have not had the same attitude in enhancing the capability of FDI into the nation. Changes to the labour code and slow dispute resolution in countries, for example, Slovakia are the biggest elements that undermine the attractiveness of these and general positive outlook towards FDI. Despite a high amount of FDI these countries (Dow, 2010), a bureaucratic approach to decision making has manufactured the red tape experienced by large organisations (Foy, 2014). Therefore, the constant imputes from the Czech government of urging FDI makes expansion there a strong proposition.

2.2 Economic

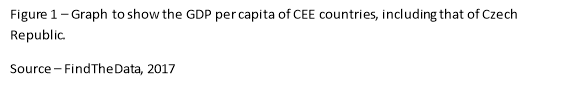

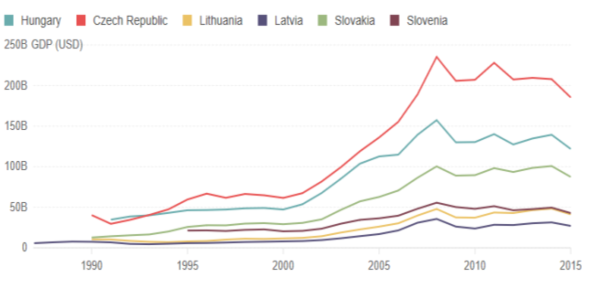

Coupled with central these administrative measures, Czech Republic has a stable and prosperous market economy that is tightly amalgamated with the EU, particularly since their accession from the EU in 2004 (CIA, 2017). It is one of the most prosperous Central and Eastern European (CEE) countries in terms of attracting FDI. It is significant that 173,000 Czech businesses across all sectors are supported by FDI and $77.8 billion worth of FDI has been documented since 1993 (Czech National Bank, 2012). As seen in, Figure 1 Czech Republic has a substantially higher amount of GDP than other CEE nations, providing Sainsbury’s with an environment that supplies the means for long term growth. It is also apparent that Czech Republic offers one of the lowest unemployment rates in Eastern Europe as seen in Figure 2, again, highlighting the stability of the nation. In 2016 the Czech Republic had an unemployment rate of 3.6%, and when compared to other CEE countries such as Latvia with an unemployment rate of 9.8% and Poland at 6.2%,

this sense of economic stability is clear. However, it must be noted by Sainsbury’s that whilst the Czech Republic have a relatively stable and export driven Czech economy, it remains sensitive to the changes in economic performance of its export markets; Germany in particular. In 2008, this breed plenty of problems when Germany and much of Western Europe fell into recession, as the demand for Czech goods and fell, and thus, so did their GDP. Nevertheless, with Germany now having one of the strongest economies in the world, although this idea of economic sensitivity will always be the risk the probability that this will reoccur is minimal. In fact, with the German economy being so strong, this matter of economic sensitivity can only be a benefit to Sainsbury’s. This is a stark contrast to the state of the economy in other CEE nations such as Latvia and Slovakia, as even with economic reform and reasonable tax rates, recent increases in corporate tax in these regions will put a burden on the profit Sainsbury’s would fashion there. Besides, the consistent traction FDI in Czech Republic confirms the country’s appeal for Sainsbury’s.

2.3 Social

It has come to the attention of business analysts that Czech Republic must now be regarded as transitional economy due to a shift in their economic and cultural climate from a state controlled centrally planned economy to more Anglo style capitalist model (Semerak, 2010). Not only will Sainsbury’s be exposed to a much more flexible and fluid labour market from this; the processes, procedures and practices they employ in their home nation can easily be transferred and implemented within Czech Republic (Gooderham and Nordhaug, 2010), denoting a standardisation of work practices.

2.4 Technological

Furthermore, the Czech Republic have been proved to have exceptional research and development capabilities, whilst spending more capital on research and development than many competing countries (Treadwell, 2017). According to Treadwell (2017), This level of spending on R&D has increased from 0.95% of GDP to 2% over the last 20 years. This means that the technological advancements experienced in the UK will also be able to be exploited in Czech Republic. Not only will the technology used create new products to be sold by retail companies, these instruments are all imperative for a retail supermarket with the stature Sainsbury’s possesses, further enhancing to the company’s ability to standardise their practises in a different region.

2.5 Environmental

Due to the increasing scarcity of raw materials, another macroeconomic variable imperative in examining a nations suitability for FDI is its ecological and environmental strategy (Srdjevic,2012). The Czech Republic are abiding by the strategy formulated by the EU for sustainable development that bids for a “Smarter and Cleaner Europe” (CzechInvest, 2017). Under this plan, a range of benefits can be drawn such as the effective use of resources as well as utilisation of the ecological and innovation potential on which economic prosperity rely (Zokaei, 2013). These policies adopted by Czech Republic look to create opportunities for businesses in all industries and are endorsed by the EU; this is advantageous to Sainsbury’s who can profit from the elimination of an overuse of resources, and thus, enhancing their competitiveness within the market.

2.6 Legal

Legal restrictions are elements that can disturb the market actions and management decisions of a company functioning in a particular country, so need to be evaluated when considering FDI (Durnev and Kim, 2005). In the Czech Republic, foreign legal entities from the EU and other countries can obtain real estate under the same conditions as its domestic legal entities, without any restrictions (CzechInvest, 2017). International transfers related to an investment can also be completed out without delay. Hence, FDI in Czech Republic will not come with any restrictions to business, allowing Sainsbury’s to operate freely. A lack of law enforcement would be a pivotal barrier in foreign firms operating effectively within Czech Republic, but safeguards have been put in place within the law to ensure the effectual functioning of these firms (Czech Business Alliance, 2013). With the legal recompenses present in the Czech Republic, it is clear where Sainsbury’s would minimise the risk of ineffective FDI.

3.0 Market-specific data

An integrated approach to the study of the suitability of FDI is essential in making an informed decision as to the most appropriate foreign nation to invest in (Alfaro, 2016). A nation that fails to account for key elements of microeconomic policy will constrain the beneficial impacts of macroeconomic reforms (World Bank, 1999). As we have already examined the Czech Republic at a macro-level to assess its stages of development and institutional capacity, we now look to firm-level data to understand the apparatuses that convey substance to the projected benefits.

3.1 Competition within the market

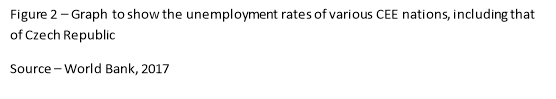

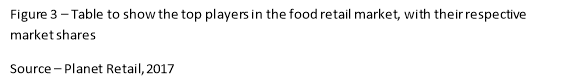

The Czech grocery market is dominated predominately by Western European companies who occupied the country after the fall of Communism in the 1990s (Planet Retail, 2017). Currently, no domestic player has ascertained a notable presence in the market, with the top five players capturing 60.6% of all food retail formats. Figure 3 presents these players and their relative market shares, highlighting Schwarz Group to be the market leader with a market share of 18.6%, closely followed by Rewe Group and Ahold Delhaize with market shares of 11% and 8.24% respectively. This signifies an Oligopolistic market within Czech Republic; a market that is dominated by a small number of entity’s. The benefits drawn by Sainsbury’s from entering an Oligopolistic

The Czech grocery market is dominated predominately by Western European companies who occupied the country after the fall of Communism in the 1990s (Planet Retail, 2017). Currently, no domestic player has ascertained a notable presence in the market, with the top five players capturing 60.6% of all food retail formats. Figure 3 presents these players and their relative market shares, highlighting Schwarz Group to be the market leader with a market share of 18.6%, closely followed by Rewe Group and Ahold Delhaize with market shares of 11% and 8.24% respectively. This signifies an Oligopolistic market within Czech Republic; a market that is dominated by a small number of entity’s. The benefits drawn by Sainsbury’s from entering an Oligopolistic

market derives from the fewer barriers to entry than if they were to enter a monopolistic market. There is no outright leader, providing Sainsbury’s the possibility of dominating the market themselves in the long term. Furthermore, large firms with a strong grip of the market have the ability to yield a vast amount of profit with only a few dominant players in the market. Not only this, but Sainsbury’s will be exposed to economies of scale and scope and private access to resources by entering the Czech market (Piteli, 2009). Furthermore, the likelihood that Sainsbury’s can successfully compete in the Czech market, when compared to other CEE nations is considerable according to Lalinsky (2008). In a survey assumed by 200 companies with the most influence on the development of the Slovak economy, there was unanimity on the subject of new entrants being able to compete in the market; feeling that a new entrant wouldn’t be able to compete with the current competition. This is underlined with the statistic that 15% of respondents thought there was a high probability of the entrance of a new competitor into the Slovakian market. This sense of questionability is not present when discussing the entering of the Czech market, underlining its evident attractiveness.

3.2 Consumer Spending

Regardless of the characteristics that a market possesses, an organisation cannot thrive within it without a high amount of consumer spending driving the market. Stout demand plays a pivotal role in enticing foreign firms to transfer their target markets, as seen in China with consumer spending rising by 15.4% to $555.56 billion, and FDI rising by 12.92% to US$36.93 billion over the same period (Ministry of Commence, 2017). Without a willingness from consumers to spend, a firm cannot reap the benefits of operating in a market irrespective of its other features. Accordingly, Czech Republic has the highest total consumer spend output of all CEE countries, and within this, sales from food retail entities account for 52% of the total consumer spend per capita (Planet Retail, 2017). This willingness of Czech consumers to spend looks to improve further, with the purchasing power of Czech households increasing the performance in the Czech Republic (Smith, 2017). This represents a strong target market for Sainsbury’s to exploit, as coupled with the oligopolistic nature of the Czech market, this provides the potential for them to dominate a fruitful market. Not only this, but these same

Regardless of the characteristics that a market possesses, an organisation cannot thrive within it without a high amount of consumer spending driving the market. Stout demand plays a pivotal role in enticing foreign firms to transfer their target markets, as seen in China with consumer spending rising by 15.4% to $555.56 billion, and FDI rising by 12.92% to US$36.93 billion over the same period (Ministry of Commence, 2017). Without a willingness from consumers to spend, a firm cannot reap the benefits of operating in a market irrespective of its other features. Accordingly, Czech Republic has the highest total consumer spend output of all CEE countries, and within this, sales from food retail entities account for 52% of the total consumer spend per capita (Planet Retail, 2017). This willingness of Czech consumers to spend looks to improve further, with the purchasing power of Czech households increasing the performance in the Czech Republic (Smith, 2017). This represents a strong target market for Sainsbury’s to exploit, as coupled with the oligopolistic nature of the Czech market, this provides the potential for them to dominate a fruitful market. Not only this, but these same

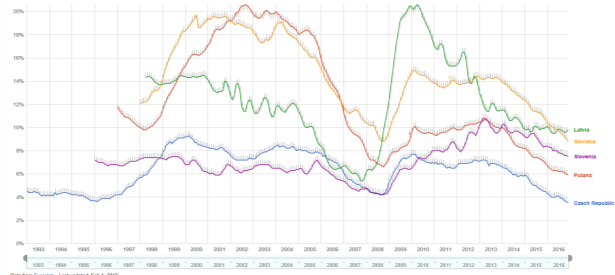

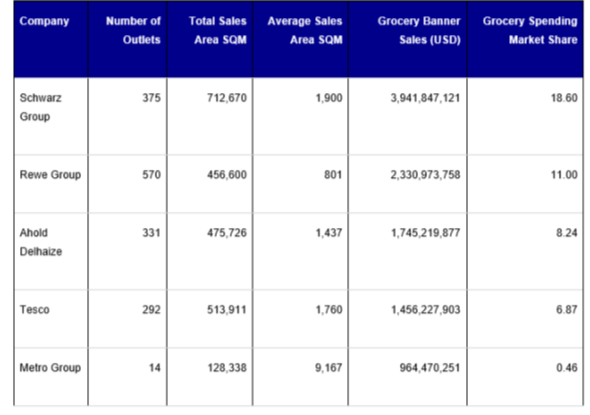

consumers demand high-quality groceries, with there being grocery retailers outperforming non-grocery specialists in 2016. According to Smith (2017) this has been put down to the development of a healthy lifestyle trend amongst Czech consumers, who are now looking towards healthier food options. This provides a considerable amount of opportunity for Sainsbury’s with there being a reduced need for discount stores and other retail stores. Figure 4 shows the main shopping points for Czech consumers in 2014, highlighting discount stores driving 25% of Czech consumers to their stores. Based off of the analysis of Smith (2017), this is something Sainsbury’s could look to exploit, with the need of these stores decreasing in the future, consumers will look to a retailer that offers higher quality goods. Moreover, with Schwarz Group, the current market leader in terms of market share being a discount store themselves, Sainsbury’s could look to overtake them as the market leader with this trend in consumer behaviour.

consumers demand high-quality groceries, with there being grocery retailers outperforming non-grocery specialists in 2016. According to Smith (2017) this has been put down to the development of a healthy lifestyle trend amongst Czech consumers, who are now looking towards healthier food options. This provides a considerable amount of opportunity for Sainsbury’s with there being a reduced need for discount stores and other retail stores. Figure 4 shows the main shopping points for Czech consumers in 2014, highlighting discount stores driving 25% of Czech consumers to their stores. Based off of the analysis of Smith (2017), this is something Sainsbury’s could look to exploit, with the need of these stores decreasing in the future, consumers will look to a retailer that offers higher quality goods. Moreover, with Schwarz Group, the current market leader in terms of market share being a discount store themselves, Sainsbury’s could look to overtake them as the market leader with this trend in consumer behaviour.

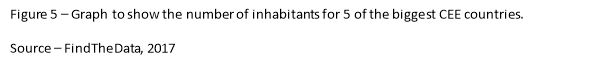

From a plainer standpoint, as seen in Figure 5, out of all of the CEE nations the Czech Republic have one of the highest number of inhabitants at 9.84 million. This provides Sainsbury’s with one of the largest target markets in Eastern Europe for them to exploit, and coupled with the increasing need for higher quality goods in the country, there is a lot of potential to capture the needs of such a vast market.

3.3 Success of current FDI

Although the scrutiny of the current Czech market is important in judging whether or not a country is suitable for a foreign firm to enter into, the success of current foreign firms functioning within Czech Republic will be a gauge as to whether Sainsbury’s can do the same. So far, it is clear that the Czech market looks to be prosperous and can be exploited by Sainsbury’s, however, understanding the success of foreign countries already operating in the Czech Republic will be of additional benefit. Within the Czech retail market the total share of foreign supermarkets has exceeded two thirds; the highest figure of all CEE countries (Frankova, 2016). Foreign firms looking to invest non-domestically have found Czech Republic as a strong place to do so, and have been successful in penetrating the market they enter into; so much that domestic retailers are closing down in the country. This provides Sainsbury’s with the evidence that, if entered into correctly, the Czech market has the means for foreign firms thrive in.

4.0 Mode of Entry

Now that it has been illustrated European expansion into Czech Republic is a robust means of new corporate strategy, it is of vital importance to determine the mode of entry into this foray. For Sainsbury’s, entering the market as a Wholly Owned Affiliate (WOA) is the recommended method. A WOA method is associated with a commitment to a large amount of investment from the company, a high asset intensity in the country and a good industrial location (Wei et al, 2004). According to Wei et al (2004) an investment of such magnitude requires the ability of the organisation to secure a high amount of financial resources, and is often associated with a high level of risk and return. Thus, a WOA will be the most effective mode of entry due to the high degree of control that will be provided for Sainsbury’s. Moreover, as it has already been ascertained that Czech Republic gains a large amount of FDI, the nation will have gained experience in working with foreign investors, thus, learning how to develop a stable and attractive environment for investment (Zhan, 1993). This level of experience will be beneficial to Sainsbury’s, who will have the confidence that the environment Czech Republic has is stable enough for them to enter the market as a standalone entity. Another potential mode Sainsbury’s could use to enter the Czech market is Equity Joint Ventures (EJV), however the sharing of ownership of the affiliate will bring about various costs such as coordination and transaction costs, control rights concerns and difficulties in making decisions (Grossman and Hart, 1986). Coupling this with the macro environment and market-specific data, it is clear that Sainsbury’s has the means to take all of the control of the venture, regardless of the risk associated to it.

5.0 Conclusion

Throughout this report, it has been established that Sainsbury’s should indeed look to foray into overseas markets as part of European expansion, and the country where they would achieve the most success is the Czech Republic. The Czech Republic encompasses an ever-increasing core-market scale for expansionary investment; with non-domestic firms already taking advantage of the composition of the nation by penetrating their market, providing evidence that there is an ability for foreign firms to compete within these markets. From a macroeconomic standpoint, the incentives from the government that accelerate FDI, as well as the strength of the economy and technological capabilities ensure that Sainsbury’s will have the environment to operate under the same constraints as the nation’s domestic firms and provides them with the platform to compete in the market. Not only this, but the level of development of these variables will enable Sainsbury’s to standardise their practises with their domestic practises, reducing the need to adapt. The makeup of the Czech market in terms of its structure and consumer behaviour will allow Sainsbury’s to exploit the apparatuses provided by the macro-economic variables, potentially leading to an enormous amount of success. Moreover, when comparing these variables with other CEE nations, it is clear that the Czech Republic is the most attractive proposition; making expansion into this particular country effective corporate strategy.

6.0 Reference List

Alfaro, L (2016). Gains from Foreign Direct Investment: Macro and Micro Approaches. World Bank Econ Rev. Volume 30 Issue 1.

Central Intelligence Agency (2017). The World Factbook. The Economy of Czech Republic. https://www.cia.gov/library/publications/the-world-factbook/geos/ez.html

Czech Invest (2017). Czech Republic – Land of Investment. Investment Climate in the Czech Republic. http://www.czechinvest.org/data/files/investment-climate-web-53-en.pdf

Czech National Bank (2012). https://www.cnb.cz/en/

Dow, D; Ferencikovab, S (2010). More than just national cultural distance: Testing new distance scales on FDI in Slovakia. International Business Review. Volume 19, Issue 1, February 2010, Pages 46-58

Durnev, A., & Kim, E. (2005). To steal or not to steal: Firm attributes, legal environment, and valuation. The Journal of Finance, 60(3), 1461-1493.

Durand, C. & Wrigley, N. (2009) Institutional and economic determinants of transnational retailer expansion and performance: a comparative analysis of Wal-Mart and Carrefour, Environment and Planning A, volume 41, pps.1534-1555.

Frankov, F (2016). Share of foreign supermarket chains on Czech retail market exceeds two thirds. http://www.radio.cz/en/section/business/share-of-foreign-supermarket-chains-on-czech-retail-market-exceeds-two-thirds

Gooderham, P., Nordhaug, O (2010) One European model of HRM? Cranet empirical contributions, Human Resource Management Review, Volume 21.

Goodwin, N; Harris, J; Nelson, J; Roach, B; Torras, M (2015). Macroeconomics in Context. 2nd edition. Business and Economics

Ilmanen, A; Maloney T; Ross, A (2014). Exploring Macroeconomic Sensitivities: How Investments Respond to Different Economic Environments. The Journal of Portfolio Management Spring 2014, Vol. 40, No. 3: pp. 87-99

Inomica Research (2014). http://www.ditp.go.th/contents_attach/89710/89710.pdf

Lalinskt, T (2008). Competitiveness Factors of Slovak Companies. Working Paper. Naronda Banka Slovenska.

Kinda, T (2010). Investment Climate and FDI in Developing Countries: Firm-Level Evidence. World Development. Volume 38, Issue 4, April 2010, Pages 498-513

Piteli, E (2009). Foreign Direct Investment in Developed Economies: A Comparison between European and non – European Countries. University of Cambridge

Planet Retail (2017). Country Report Czech Republic Market Profile

Planet Retail (2017). Country Report Slovakia Market Profile

Santander (2017). Trade Portal. https://en.portal.santandertrade.com/establish-overseas/czech-republic/foreign-investment

Semerak, V (2010). Regional input-output analysis: application on rural regions in Germany, the Czech Republic and Greece. European Association of Agricultural Economists

Smith, P (2017) Retailing in the Czech Republic.

Srdjevic, Z; Bajcetic, R; Srdjevic, B (2012). Identifying the Criteria Set for Multicriteria Decision Making Based on swot/pestle Analysis: A Case Study of Reconstructing A Water Intake Structure. Water Resources Management Volume 26, Issue 12, pp 3379-3393

Wei Y; Liu, B; Liu, X (2004) Entry Modes of Foreign Direct Investment in China: A Multinomial Logit Approach. International Business Research Group, Department of Economics

World Bank, (1999) Czech Republic: Towards EU Accession: Summary Report. A World Bank Country Study. The World Bank Washington D.C.

World Bank, (2017). http://www.worldbank.org/

Zhan, X (1993) The role of foreign direct investment in market-oriented reforms and economic development: The case of China. Transnational Corporations 121-148

Zokaei, K (2013). Environmentally-friendly business is profitable business. The Guardian.