WRSX Strategy Experience

WRSX strategy experience

Date of Submission: 11/03/2015

Word count: 1472

Contents

Question 1………………………………………………………………………………..3

Question 2……………………………………………………………………………….7

References……………………………………………………………………………….9

APPENDICES

Appendix A…………………………………………………………………………………..10

Appendix B…………………………………………………………………………………..15

Appendix C…………………………………………………………………………………..17

- Imagine you are presenting to WRSX investors. Referring to data from the performance log and your notes on the decisions that were made, assess a specific decision (or group of related decisions) which explains the performance outcome. Include a discussion of the underpinning theoretical frameworks you either used, or could have used, to assist your decision making. Did the theory support the decision, or mislead you, and why?

The performance of the WRSX and its current state it requires the attention of the board of Directors to relook given that the strategic management of the company needs realignment based on proper application of relevant strategy. Relevant strategy is a key to evaluation of the company as well as brings about value on stakeholders. Reflecting to the data from the performance log, we realise that there is a need for WRSX to function as a complete integrated entity due to the availability of different business units, which are the channels to success as far as the business of WRSX is concerned. The performance of WRSX outcomes depends of the availed strategy and the stakeholders’ perspective to prevent any sort of conflicts as well as allow alignment across all levels in the business. My decision on the aspect of business within WRSX is based on the two factors, which bring about coherence as well as value predetermined from the clientele. The two factors includes innovation and creativity that underlines the aspect of marketing tools through advertisement and which necessitates the level WRSX will outshine other competitors.

Given that WRSX group is an entity well known globally for its business in the four distinctive countries, issues based on the environmental factors needs to be taken into consideration. The entire performance outcome is independent to these environmental factors. This piece of work will advance and make use of PESTEL framework to analyse and give facts on decisions based on the performance outcome of WRSX. To start with, we have political and legal factors. In Western Europe and US, there are stringent laws that protect employees and therefore most of manufacturing and service centres in these countries prefers to do their work away from their homes. It is predetermined that close to 60 % of global advertising revenues comes from this two areas and this is one of the critical issue that WRSX needs to reflect on and tackle it strategically to enhance their revenue market (McKinsey&Company 2011). In relation to the political and legality aspects, the performance outcome of WRSX an issuance of multi-national companies especially in US where there is a changing world economy and prediction is way downturn, the workforce becomes an aspect to the WRSX market (Appendix A).

PESTEL theory however, reflects on the forecasted world economy, which is at bleak due to the instability of economic rates, currency exchange rates and interest rates (Johnson and Whittington, Kevan Scholes  2011). WRSX needs to take into account the growing urgency to be able to satisfy its existing clients and cut the cost arising from the advertisement and communication aspects due to the bleak future. The performance outcome in WRSX Company should be administered based on the economic aspect through which aspects such as manufacturing of overcapacity or differentiation needs that stand out among the competitors. Another decisive aspect is social and cultural articulation. Due to the changing demographics, as well as values of consumers, an aspect of branding strategies needs to be acknowledged especially during advertising and marketing communications services (Appendix A).

For instance, higher buying power is determined by the aging populations who are willing to spend as they have access to their retirement funds. Such scenario enables us to articulate that for the performance outcomes as far as WRSX company business is concerned, social and cultural aspect plays a bigger role and therefore both new-age digital media forms of advertisement and conventional forms of advertisement which necessitate traditional advertising tool should be combined to enhance and capture competition aspect from other competitors at large.

WRSX has more opportunities given that they have high population both in Africa and Asia with more affluence to their products. In generally, a social-cultural form of PESTEL framework enables clients to communicate internally and communication services allows internal alignment within an organisation. More so, the decision-making as far as the performance outcome of WRSX Company is concerned is reflected on the acquisition of current technology aspect of PESTEL framework. The growth and introduction of technology has brought about reliance aspect, which correlates with digital media as a form of advertisement. This has triggered and shaped the forms under which targeted markets can be reached. Internet is widely used for advertisement and marketing of the products and therefore WRSX company needs to articulate and use the current technology in advertising their product since this enable them to reach high population hence increasing the level of performance outcomes.

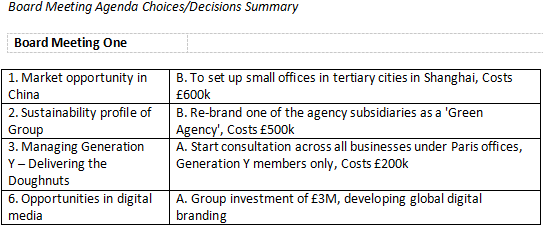

Based on Porters five framework, it shows China has the right level of competitive rivalry, and the barriers to entry is adequate for WRSX to enter the Chinese market. Based on the business analysis provided in period 1, 2 and the initial review before the 3 year period, we can see that it has been noted of long term attractiveness and growth particularly in the Chinese market. Using the directional policy matrix we can gauge the decision to move into the Chinese based on the long term attractiveness and strength of our strategic business unit. The theoretical frameworks proved to be invaluable we can see evidence in period 5 of the Asian economies increasing at triple the rate of the western markets.

For instance, China has an attractive market for any companies in search of global expansion and therefore WRSX should consider china as an option due to the forces they have over the market though the value they have as an option for advertising and marketing communication entities. PESTEL as a framework and theory supports the decision of WRSX performance outcome since the six aspects when combined can lead to high profit margin realisation as far as the financial outcomes of WRSX is concerned.

- Consider your original analysis of the strategic position and strategic choices. To what extent did your assessment of the strategic position and strategic choices change or evolve over the three year period? Did key changes occur, or new information emerges, that changed your original summary and did this lead to a change in strategy?

Taking into account the financial trends from the New York agency, there is poor performance as compared to the other three WRSX agencies. From the analysis we realise that New York Agency spends too much time on level of reporting which affects decision making hence losing their customers. Based on the strategic position and choices change, WRSX Agencies such as New York Agency have had changes in terms of profit maximisation and therefore a need for corporate performance is required given that reporting system needs proper execution. For this change to be delivered positively contribution based on the creativity, innovation and customer-focused company strategy should be executed well.

From the other aspect, there is evolution of strategic position and strategic choices change in WRSX in that practices such as failure to keep top and talented staff as administered by the Lloyd Silberstein practice, has weakened WRSX innovation and creativities capabilities hence a need for strategy is necessary. Meanwhile, the strategic position and strategic choices based on the WRSX’s scope and resource commitment should consider taking into account the use of medium to large scale advertising and marketing service since the market segment is of outstanding nature. WRSX which manages specialised business units such as public relations, research, media buying and insight, branding, direct marketing, film production, brand identity, sports marketing and digital media has an extensive breath and range of services which requires strategy to run (Appendix B).

The business of WRSX is based on the research and insight unit which addresses changes arising within the industry and this is an aspect that makes WRSX not to lag behind in terms of competition. More so, WRSX works on the basis that information within the management is passed to the production team for the purpose of effective advertisement to the target market demographic. The aspect of creativity is what defines the production team in that they are required to add value to the advertisement to add effectiveness within the business. Nevertheless, leverage on the leadership is a vital aspect since the sense of creativity and innovation is predetermined by the leadership skills availability.

WRSX and its agencies however, have merger leaders with unique resources something that brings about strategic position and strategic choices aspect at a glance. These are viewed as dynamic assets and capacities as they are continually advancing with the rate of the business. This empowers WRSX to replenish and reproduce its techniques to handle the progressions and new advancement in the business. Albeit each of the four orgs of WRSX fit in with the same WRSX corporate strategy, such that every one of the four offices work independently without much coordination from the corporate office.

Based through the analysis provided by the Strategic position and choices, it is evident that the external environment strategic formula coincided with the realistic perspective and outcome. Final performance registers optimal performance with both the share price and non financial performance increasing over threefold over the three year period. This brings conclusion that the evolution of our original strategic position and choice, complimented with the overall flow of the moving real time market and can be describe prescriptive in design.

References

Johnson, G. and Whittington, R., Kevan Scholes ; with the assistance of Steve Pyle. (2011)Exploring Strategy Text & Cases Plus MyStrategyLab and The Strategy Experience Simulation. 9th edn. United Kingdom: Financial Times Prentice Hall.

McKinsey&Company (2011) Manufacturing the future: The next era of global growth and innovation. Available at: http://www.mckinsey.com/insights/manufacturing/the_future_of_manufacturing/ (Accessed: 04 March 2015)

APPENDICES

Appendix A

Company Performance and results

Share Price = £6.30

Gross Profit = 294

Appendix B

Relevant models and frameworks:

Helpful models and frameworks might be:

1. Ansoff / market development / product development

2. Market segmentation

3. Resource deployment.

Appendix C